Radio Shack 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

In June and August 2003, we entered into interest rate swap agreements with underlying notional amounts

of debt of $100 million and $50 million, respectively, and both with maturities in May 2011. Our counterparty

for these swaps is Citigroup. These swaps effectively convert a portion of our long-term fixed rate debt to a

variable rate. For more information regarding our interest rate swaps, refer to Note 11 – “Derivative Financial

Instruments.”

In September 2009, we completed a tender offer to purchase for cash any and all of these notes. Upon

expiration of the offer, $43.2 million of the aggregate outstanding principal amount of the notes was validly

tendered and accepted. We paid a total of $46.6 million, which consisted of the purchase price of $45.4

million for the tendered notes plus $1.2 million in accrued and unpaid interest, to the holders of the tendered

notes.

Operating Leases: We use operating leases, primarily for our retail locations and our corporate campus, to

lower our capital requirements.

Continuing Lease Obligations: We have obligations under retail leases for locations that we assigned to

other businesses. The majority of these lease obligations arose from leases for which CompUSA Inc.

(“CompUSA”) assumed responsibility as part of its purchase of our Computer City, Inc. subsidiary in

August 1998. Because the company that assumed responsibility for these leases has ceased operations,

we may be responsible for rent due under the leases.

Following an announcement by CompUSA in February 2007 of its intention to close as many as 126

stores and an announcement in December 2007 that it had been acquired by Gordon Brothers Group,

CompUSA’s stores ceased operations in January 2008. We may be responsible for rent due on a portion

of the leases that relate to the closed stores. As of February 8, 2010, we had been named as a defendant

in a total of 12 lawsuits from lessors seeking payment from us, six of which had been resolved.

Based on all available information pertaining to the status of these lawsuits, and after applying the

FASB’s accounting guidance on accounting for contingencies, the balance of our accrual for these

obligations was $6.2 million and $9.0 million at December 31, 2009 and 2008, respectively. We have

continued to monitor this situation and will update our accrual to reflect new information on outstanding

litigation and settlements as more information becomes available.

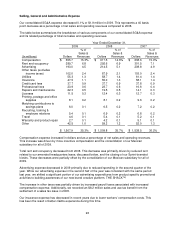

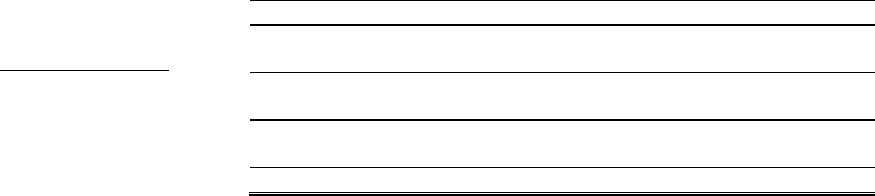

Capitalization

The following table sets forth information about our capitalization on the dates indicated.

December 31,

2009 2008

(Dollars in millions)

Dollars

% of Total

Capitalization

Dollars

% of Total

Capitalization

Short-term debt $ 41.6 2.4% $ 39.3 2.5%

Long-term debt 627.8 36.6 659.5 42.3

Total debt 669.4 39.0 698.8 44.8

Stockholders’ equity 1,048.3 61.0 860.8 55.2

Total capitalization $ 1,717.7 100.0% $ 1,559.6 100.0%

Our debt-to-total capitalization ratio decreased in 2009 from 2008, due to the repurchase of $43.2 million

of our 2011 Notes and an increase in stockholders’ equity primarily due to 2009 net income.

Dividends: We have paid common stock cash dividends for 23 consecutive years. On November 9,

2009, our Board of Directors declared an annual dividend of $0.25 per share. The dividend was paid on

December 16, 2009, to stockholders of record on November 27, 2009. The dividend payment of $31.3

million was funded from cash on hand.