Radio Shack 2009 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2009 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22

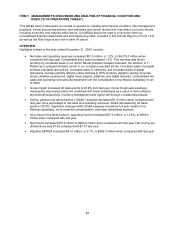

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS (“MD&A”).

This MD&A section discusses our results of operations, liquidity and financial condition, risk management

practices, critical accounting policies, and estimates and certain factors that may affect our future results,

including economic and industry-wide factors. Our MD&A should be read in conjunction with our

consolidated financial statements and accompanying notes, included in this Annual Report on Form 10-K,

as well as the Risk Factors set forth in Item 1A above.

OVERVIEW

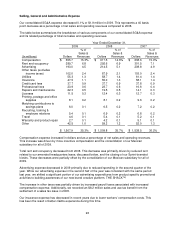

Highlights related to the year ended December 31, 2009, include:

• Net sales and operating revenues increased $51.5 million, or 1.2%, to $4,276.0 million when

compared with last year. Comparable store sales increased 1.3%. This increase was driven

primarily by increased sales in our Sprint Nextel postpaid wireless business, the addition of T-

Mobile as a postpaid wireless carrier in our company-operated stores, increased sales of prepaid

wireless handsets and airtime, increased sales of netbooks, and increased sales of digital

televisions, but was partially offset by sales declines in GPS products, digital-to-analog converter

boxes, wireless accessories, digital music players, batteries, and digital cameras. Consolidated net

sales and operating revenues also benefited from the consolidation of our Mexico subsidiary for all

of 2009.

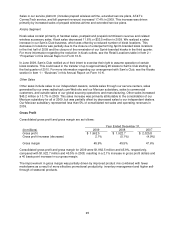

• Gross margin increased 40 basis points to 45.9% from last year. Gross margin was positively

impacted by improved product mix combined with fewer markdowns as a result of more effective

promotional productivity, inventory management and higher sell-through of seasonal products.

• Selling, general and administrative (“SG&A”) expense decreased $1.9 million when compared with

last year. As a percentage of net sales and operating revenues, SG&A decreased by 40 basis

points to 35.3%. Significant changes within SG&A expense include the full year results of our

Mexican subsidiary, more incentive compensation, and lower advertising expense.

• As a result of the factors above, operating income increased $47.2 million, or 14.6%, to $369.4

million when compared with last year.

• Net income increased $15.6 million to $205.0 million when compared with last year. Net income per

diluted share was $1.63 compared with $1.47 last year.

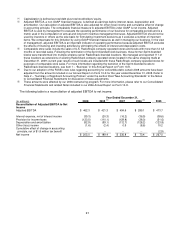

• Adjusted EBITDA increased $41.0 million, or 9.7%, to $462.3 million when compared with last year.