Radio Shack 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

We believe free cash flow is a relevant indicator of our ability to repay maturing debt, change dividend

payments or fund other uses of capital that management believes will enhance shareholder value. The

comparable financial measure to free cash flow under generally accepted accounting principles is cash

flows from operating activities, which was $245.8 million in 2009, $274.6 million in 2008, and $379.0

million in 2007. We do not intend for the presentation of free cash flow, a non-GAAP financial measure, to

be considered in isolation or as a substitute for measures prepared in accordance with GAAP, nor do we

intend to imply that free cash flow represents cash flow available for discretionary expenditures.

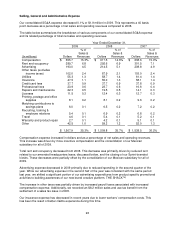

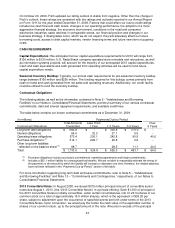

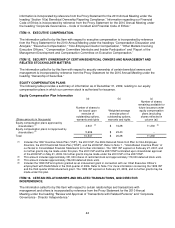

The following table is a reconciliation of cash flows from operating activities to free cash flow.

Year Ended December 31,

(In millions) 2009 2008

2007

Net cash provided by operating activities $ 245.8 $ 274.6 $ 379.0

Less:

Additions to property, plant and equipment 81.0 85.6 45.3

Dividends paid 31.3 31.3 32.8

Free cash flow $ 133.5 $ 157.7 $ 300.9

SOURCES OF LIQUIDITY

As of December 31, 2009, we had $908.2 million in cash and cash equivalents. Additionally, we have a

credit facility of $325 million. As of December 31, 2009, we had $291.3 million available under this credit

facility due to the issuance of standby letters of credit. We have not borrowed from this facility. We believe

that our cash flows from operations and available cash and cash equivalents will adequately fund our

operations, our capital expenditures, and our maturing debt obligations. Additionally, our credit facility is

available for additional working capital needs or investment opportunities.

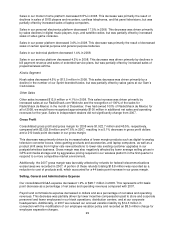

The table below lists our credit commitments from various financial institutions.

(In millions) Commitment Expiration per Period

Credit Commitments

Total Amounts

Committed

Less Than

1 Year

1-3 Years

3-5 Years

Over

5 Years

Lines of credit $ 325.0 $ -- $ 325.0 $ -- $ --

Standby letters of credit -- -- -- -- --

Total commercial commitments $ 325.0 $ -- $ 325.0 $ -- $ --

Available Financing: As of December 31, 2009, we had $291.3 million in borrowing capacity available

under our existing credit facility due to the issuance of standby letters of credit. We incurred no

borrowings from this facility during 2009. This facility expires in May of 2011.

Our $325 million credit facility provides us a source of liquidity. This facility is provided by a syndicate of

lenders with a majority of the facility provided by Wells Fargo, Citigroup, and Bank of America. We

incurred no borrowings from this facility in 2009. Interest charges under this facility are derived using a

base LIBOR rate plus a margin which changes based on our credit ratings. Our credit facility has

customary terms and covenants, and we were in compliance with these covenants at December 31,

2009.

Credit Ratings: Below are the agencies’ ratings by category, as well as their respective current outlook

for the ratings, as of February 8, 2010.

Rating Agency Rating Outlook

Standard and Poor’s BB Stable

Moody's Ba1 Stable

Fitch BB Stable