Radio Shack 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.31

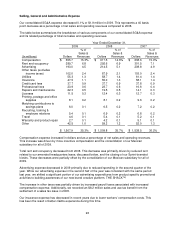

The 2007 effective tax rate was affected by the net reversal in June 2007 of approximately $10.0 million

in unrecognized tax benefits, deferred tax assets and accrued interest. This $10.0 million reversal

lowered our effective tax rate 2.7 percentage points for the year ended December 31, 2007.

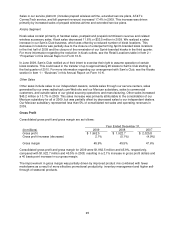

Acquisition of RadioShack de Mexico

In December 2008, we acquired the remaining interest (slightly more than 50%) of our Mexican joint venture

- RadioShack de Mexico, S.A. de C.V. - with Grupo Gigante, S.A.B. de C.V. We now own 100% of this

subsidiary, which consisted of 200 RadioShack-branded stores and 14 dealers throughout Mexico at the

time of acquisition. The purchase price was $44.9 million which consisted of $42.2 million in cash paid and

transaction costs, net of cash acquired, plus $2.7 million in assumed debt. The acquisition was accounted

for using the purchase method of accounting in accordance with the FASB’s accounting guidance for

business combinations. The purchase price allocation resulted in an excess of purchase price over net

tangible assets acquired of $35.5 million, all of which was attributed to goodwill. The goodwill will not be

subject to amortization for book purposes but rather an annual test for impairment. The premium we paid in

excess of the fair value of the net assets acquired was based on the established business in Mexico and our

ability to expand our business in Mexico and possibly other countries. The goodwill will not be deductible for

tax purposes. Results of the acquired business have been included in our operations from December 1,

2008, and were immaterial for 2008. If we had owned 100% of RadioShack de Mexico for all of 2008, we

would have recognized approximately $100 million in additional net sales and operating revenues for the

year.

RECENTLY ISSUED ACCOUNTING PRONOUNCEMENTS

Refer to Note 2 – “Summary of Significant Accounting Policies” under the section titled “New Accounting

Standards” in the Notes to Consolidated Financial Statements.

LIQUIDITY AND CAPITAL RESOURCES

Cash Flow Overview

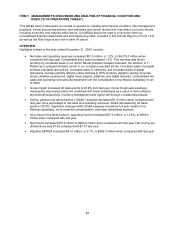

Operating Activities: Cash provided by operating activities in 2009 was $245.8 million, compared with

$274.6 million in 2008. This decrease was primarily driven by less cash received from customers, dealers

and service providers than in 2008. This decrease in cash receipts was attributable to higher outstanding

accounts receivable balances at December 31, 2009, related to our increased commissions on wireless

sales. We collected a significant portion of these receivables in early 2010. The decrease in cash

received from customers, dealers and service providers was partially offset by less cash paid to suppliers

and employees than in 2008; this was primarily attributable to our continued focus on managing our

inventory and accounts payable balances. We also received less interest on our cash balance and paid

more interest on our long-term debt than in 2008.

Investing Activities: Cash used in investing activities was $80.8 million and $124.3 million in 2009 and

2008, respectively. The decrease from 2008 was primarily the result of $42.0 million in cash paid in 2008

for our acquisition of RadioShack de Mexico. Capital expenditures of $81.0 million in 2009 were

consistent with last year. Capital expenditures primarily relate to our U.S. RadioShack company-operated

stores and information system projects.

Financing Activities: Net cash used in financing activities was $71.6 million in 2009 compared with net

cash provided by financing activities of $154.8 million in 2008. This change was partially driven by the

repurchase of $43.2 million of our 2011 Notes in 2009. The change was also driven by the issuance of

our 2013 convertible notes and associated hedge and warrant transactions in 2008. We also repurchased

$111.3 million of our common stock in 2008 under our share repurchase program, compared with no

repurchases in 2009.

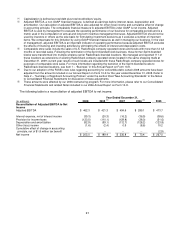

Free Cash Flow: Our free cash flow, defined as cash flows from operating activities less dividends paid

and additions to property, plant and equipment, was $133.5 million in 2009, $157.7 million in 2008, and

$300.9 million in 2007. The decrease in free cash flow for 2009 was attributable to decreased cash flow

from operating activities as described above.