Radio Shack 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

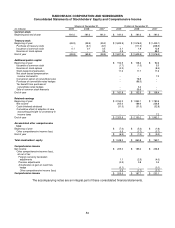

60

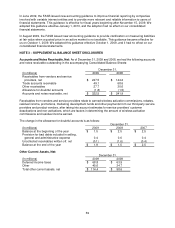

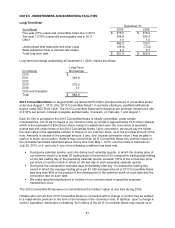

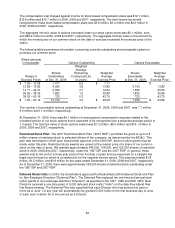

Property, Plant and Equipment, Net:

December 31,

(In millions) 2009 2008

Land $ 2.4 $ 2.7

Buildings 55.2 55.0

Furniture, fixtures, equipment and

software

663.2

679.6

Leasehold improvements 360.9 358.6

Total PP&E 1,081.7 1,095.9

Less accumulated depreciation

and amortization

(799.4)

(789.5)

Property, plant and equipment, net $ 282.3 $ 306.4

Other Assets, Net:

December 31,

(In millions) 2009 2008

Notes receivable $ 10.0 $ 10.3

Deferred income taxes 53.1 66.8

Other 29.3 42.2

Total other assets, net $ 92.4 $ 119.3

Accrued Expenses and Other Current Liabilities:

December 31,

(In millions) 2009 2008

Payroll and bonuses $ 67.0 $ 50.3

Insurance 75.9 84.2

Sales and payroll taxes 41.9 41.5

Rent 36.8 41.0

Advertising 31.4 31.7

Gift card deferred revenue 19.4 20.5

Other 86.6 98.1

Total accrued expenses and other

current liabilities

$ 359.0

$ 367.3

Other Non-Current Liabilities:

December 31,

(In millions) 2009 2008

Deferred compensation $ 33.1 $ 35.2

Liability for unrecognized tax benefits 35.1 46.1

Other 30.5 15.2

Total other non-current liabilities $ 98.7 $ 96.5

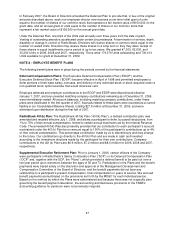

NOTE 4 – ACQUISITIONS

RadioShack de Mexico: In December 2008, we acquired the remaining interest (slightly more than 50%) of

our Mexican joint venture - RadioShack de Mexico, S.A. de C.V. - with Grupo Gigante, S.A.B. de C.V. We

now own 100% of this subsidiary, which consisted of 200 RadioShack-branded stores and 14 dealers

throughout Mexico at the time of acquisition. The purchase price was $44.9 million which consisted of $42.2

million in cash paid and transaction costs, net of cash acquired, plus $2.7 million in assumed debt. The

acquisition was accounted for using the purchase method of accounting in accordance with the FASB’s

accounting guidance for business combinations. The purchase price allocation resulted in an excess of

purchase price over net tangible assets acquired of $35.5 million, all of which was attributed to goodwill. The

goodwill will not be subject to amortization for book purposes but rather an annual test for impairment. The

premium we paid in excess of the fair value of the net assets acquired was based on the established

business in Mexico and our ability to expand our business in Mexico and possibly other countries. The

goodwill will not be deductible for tax purposes. Results of the acquired business have been included in our

operations from December 1, 2008.