Radio Shack 2009 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2009 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.64

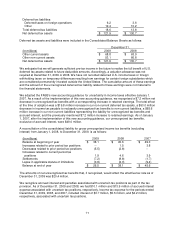

Also concurrent with the issuance of the 2013 Convertible Notes, we sold warrants (the “Warrants”)

permitting the purchasers to acquire shares of our common stock. The Warrants are currently exercisable

for 15.5 million shares of RadioShack common stock at a current exercise price of $36.60 per share. We

received $39.9 million in proceeds for the sale of the Warrants. The Warrants may be settled at various

dates beginning in November 2013 and ending in March 2014. The Warrants provide for net share

settlement. In no event will we be required to deliver a number of shares in connection with the transaction

in excess of twice the aggregate number of Warrants.

We determined that the Convertible Note Hedges and Warrants meet the requirements of the FASB’s

accounting guidance for accounting for derivative financial instruments indexed to, and potentially settled in,

a company's own stock and other relevant guidance and, therefore, are classified as equity transactions. As

a result, we recorded the purchase of the Convertible Note Hedges as a reduction in additional paid-in

capital and the proceeds of the Warrants as an increase to additional paid-in capital in the Consolidated

Balance Sheets, and we will not recognize subsequent changes in the fair value of the agreements in the

financial statements.

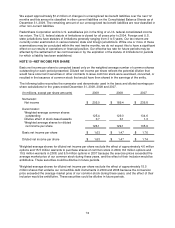

In accordance with the FASB’s accounting guidance in calculating earnings per share, the Warrants will

have no effect on diluted net income per share until our common stock price exceeds the per share strike

price of $36.60 for the Warrants. We will include the effect of additional shares that may be issued upon

exercise of the Warrants using the treasury stock method. The Convertible Note Hedges are antidilutive

and, therefore, will have no effect on diluted net income per share.

NOTE 7 – STOCK-BASED INCENTIVE PLANS

We have implemented several plans to award employees with stock-based compensation, which are

described below.

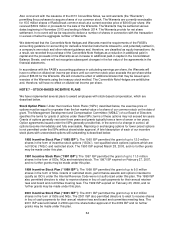

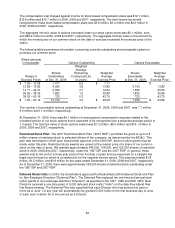

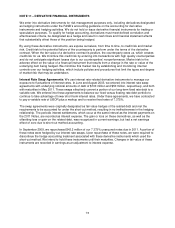

Stock Option Plans: Under the Incentive Stock Plans (“ISPs”) described below, the exercise price of

options must be equal to or greater than the fair market value of a share of our common stock on the date of

grant. The Management Development and Compensation Committee (“MD&C”) of our Board of Directors

specifies the terms for grants of options under these ISPs; terms of these options may not exceed ten years.

Grants of options generally vest over three years and grants typically have a term of seven or ten years.

Option agreements issued under the ISPs generally provide that, in the event of a change in control, all

options become immediately and fully exercisable. Repricing or exchanging options for lower priced options

is not permitted under the ISPs without shareholder approval. A brief description of each of our incentive

stock plans with unexercised options still outstanding is described below:

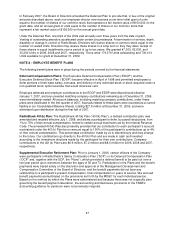

1993 Incentive Stock Plan (“1993 ISP”): The 1993 ISP permitted the grant of up to 12.0 million

shares in the form of incentive stock options (“ISOs”), non-qualified stock options (options which are

not ISOs) (“NQs”) and restricted stock. The 1993 ISP expired March 28, 2003, and no further grants

may be made under this plan.

1997 Incentive Stock Plan (“1997 ISP”): The 1997 ISP permitted the grant of up to 11.0 million

shares in the form of ISOs, NQs and restricted stock. The 1997 ISP expired on February 27, 2007,

and no further grants may be made under this plan.

1999 Incentive Stock Plan (“1999 ISP”): The 1999 ISP permitted the grant of up to 9.5 million

shares in the form of NQs. Grants of restricted stock, performance awards and options intended to

qualify as ISO’s under the Internal Revenue Code were not authorized under this plan. The 1999 ISP

also permitted directors to elect to receive shares in lieu of cash payments for their annual retainer

fees and board and committee meeting fees. The 1999 ISP expired on February 23, 2009, and no

further grants may be made under this plan.

2001 Incentive Stock Plan (“2001 ISP”): The 2001 ISP permitted the grant of up to 9.2 million

shares in the form of ISOs and NQs. The 2001 ISP also permitted directors to elect to receive shares

in lieu of cash payments for their annual retainer fees and board and committee meeting fees. The

2001 ISP was terminated in 2009 upon the shareholder approval of the 2009 ISP and no further

grants may be made under this plan.