Radio Shack 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

The decrease in other SG&A expense was primarily due to a $12.1 million non-cash charge recorded in

connection with our amended headquarters lease in 2008. See below for further discussion.

Amended Corporate Headquarters Lease: In June 2008, Tarrant County College District (“TCC”)

announced that it had purchased from Kan Am Grund Kapitalanlagegesellschaft mbH (“Kan Am”) the

buildings and real property comprising our corporate headquarters in Fort Worth, Texas, which we had

previously sold to Kan Am and then leased for a period of 20 years in a sale and lease-back transaction

in December 2005.

In connection with the above sale to TCC, we entered into an agreement with TCC to convey certain

personal property located in the corporate headquarters and certain real property located in close

proximity to the corporate headquarters in exchange for an amended and restated lease to occupy a

reduced portion of the corporate headquarters for a shorter time period. The amended and restated lease

agreement provides for us to occupy approximately 40% of the corporate headquarters complex for a

primary term of three years with no rental payments required during the term. The agreement also

provides for one two-year option to renew approximately half of the space at market-based rents.

This agreement resulted in a non-cash net charge to other SG&A expense of $12.1 million for the second

quarter of 2008. This net amount consisted of a net loss of $2.8 million related to the assets conveyed to

TCC and a $9.3 million charge to reduce a receivable for economic development incentives associated

with the corporate headquarters to its net realizable value.

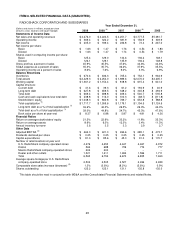

Depreciation and Amortization

The table below gives a summary of our total depreciation and amortization by segment.

Year Ended December 31,

(In millions) 2009 2008

2007

U.S. RadioShack company-operated stores $ 45.8 $ 52.9 $ 53.4

Kiosks 3.2 5.8 6.3

Other 5.8 1.8 1.7

Unallocated 38.1 38.6 51.3

Total depreciation and amortization $ 92.9 $ 99.1 $ 112.7

The table below provides an analysis of total depreciation and amortization.

Year Ended December 31,

(In millions) 2009 2008

2007

Depreciation and amortization expense $ 83.7 $ 87.9 $ 102.7

Depreciation and amortization included in

cost of products sold

9.2

11.2

10.0

Total depreciation and amortization $ 92.9 $ 99.1 $ 112.7

Total depreciation and amortization for 2009 declined $6.2 million or 6.3%. This decrease was primarily

due to reduced capital expenditures in recent years when compared with prior years.

Impairment of Long-Lived Assets

Impairment of long-lived assets was $1.5 million and $2.8 million for 2009 and 2008, respectively. These

amounts were related primarily to underperforming U.S. RadioShack company-operated stores and kiosk

locations.