Radio Shack 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

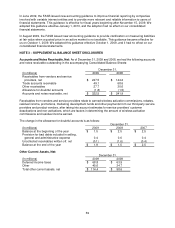

58

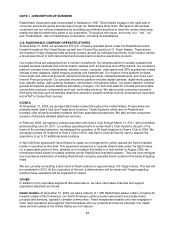

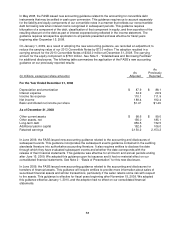

In May 2008, the FASB issued new accounting guidance related to the accounting for convertible debt

instruments that may be settled in cash upon conversion. This guidance requires us to account separately

for the liability and equity components of our convertible notes in a manner that reflects our nonconvertible

debt borrowing rate when interest cost is recognized in subsequent periods. This guidance requires

bifurcation of a component of the debt, classification of that component in equity, and then accretion of the

resulting discount on the debt as part of interest expense being reflected in the income statement. The

guidance requires retrospective application to all periods presented and was effective for fiscal years

beginning after December 15, 2008.

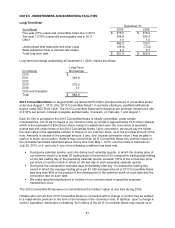

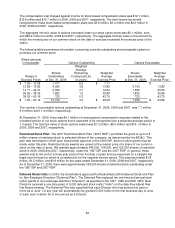

On January 1, 2009, as a result of adopting the new accounting guidance, we recorded an adjustment to

reduce the carrying value of our 2013 Convertible Notes by $73.0 million. The adoption resulted in a

carrying amount for the 2013 Convertible Notes of $302.0 million at December 31, 2008. The carrying

amount for the equity component is $78.0 million. See Note 5 - "Indebtedness and Borrowing Facilities"

for additional disclosures. The following table summarizes the application of the FASB’s new accounting

guidance on our previously reported results:

(In millions, except per share amounts)

As

Adjusted

As

Previously

Reported

For the Year Ended December 31, 2008

Depreciation and amortization $ 87.9 $ 88.1

Interest expense 34.9 29.9

Income tax expense 110.1 111.9

Net income 189.4 192.4

Basic and diluted net income per share $1.47 $1.49

As of December 31, 2008

Other current assets $ 98.6 $ 99.0

Other assets, net 156.0 185.1

Long-term debt 659.5 732.5

Additional paid-in capital 152.5 106.0

Retained earnings 2,150.2 2,153.2

In June 2009, the FASB issued new accounting guidance related to the accounting and disclosures of

subsequent events. This guidance incorporates the subsequent events guidance contained in the auditing

standards literature into authoritative accounting literature. It also requires entities to disclose the date

through which they have evaluated subsequent events and whether the date corresponds with the

release of their financial statements. This guidance was effective for all interim and annual periods ending

after June 15, 2009. We adopted this guidance upon its issuance and it had no material effect on our

consolidated financial statements. See Note 2 - “Basis of Presentation” for this new disclosure.

In June 2009, the FASB issued new accounting guidance related to the accounting and disclosures for

transfers of financial assets. This guidance will require entities to provide more information about sales of

securitized financial assets and similar transactions, particularly if the seller retains some risk with respect

to the assets. This guidance is effective for fiscal years beginning after November 15, 2009. We adopted

this guidance effective January 1, 2010, and the adoption had no effect on our consolidated financial

statements.