Radio Shack 2009 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2009 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

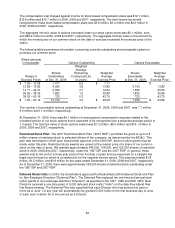

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

Basis of Fair Value Measurements

Quoted Prices Significant

In Active Other Significant

Fair Value Markets for Observable Unobservable

of Assets Identical Items Inputs Inputs

(In millions)

(Liabilities) (Level 1) (Level 2) (Level 3)

Year Ended December 31, 2009

Long-lived assets held and used $ 1.0 -- -- $ 1.0

In 2009, long-lived assets held and used in our U.S. RadioShack company-operated stores and kiosks with

a carrying value of $2.5 million were written down to their fair value of $1.0 million, resulting in an

impairment charge of $1.5 million, which was included in earnings for the period. The inputs used to

calculate the fair value of these long-lived assets included the projected cash flows and a risk-adjusted rate

of return that we estimated would be used by a market participant in valuing these assets. In 2008, we

recorded $2.8 million in impairment charges for long-lived assets held and used in our U.S. RadioShack

company-operated stores and kiosks.

NOTE 13 - COMMITMENTS AND CONTINGENCIES

Lease Commitments: We lease rather than own most of our facilities. Our lease agreements expire at

various dates through 2024. Some of these leases are subject to renewal options and provide for the

payment of taxes, insurance and maintenance. Our retail locations comprise the largest portion of our

leased facilities. These locations are primarily in major shopping malls and shopping centers owned by other

companies. Some leases are based on a minimum rental plus a percentage of the store's sales in excess of

a stipulated base figure (contingent rent). Certain leases contain escalation clauses. We also lease a

distribution center and our corporate campus. Additionally, we lease automobiles and information systems

equipment.

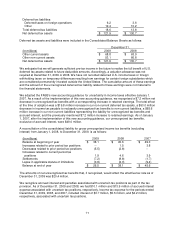

Future minimum rent commitments at December 31, 2009, under non-cancelable operating leases (net of

immaterial amounts of sublease rent income), are included in the following table.

(In millions)

Operating

Leases

2010 $ 200.1

2011 146.1

2012 96.7

2013 58.8

2014 31.7

2015 and thereafter 40.0

Total minimum lease payments $ 573.4

On June 25, 2008, Tarrant County College District (“TCC”) announced that it had purchased from Kan Am

Grund Kapitalanlagegesellschaft mbH (“Kan Am”) the buildings and real property comprising our corporate

headquarters in Fort Worth, Texas, which we had previously sold to Kan Am and then leased for a period of

20 years in a sale and lease-back transaction in December 2005.

In connection with the above sale to TCC, we entered into an agreement with TCC to convey certain

personal property located in the corporate headquarters and certain real property located in close proximity

to the corporate headquarters in exchange for an amended and restated lease to occupy a reduced portion