Porsche 2008 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2008 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

To our shareholders The Company

216

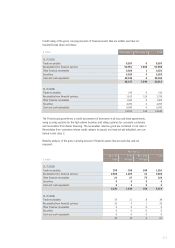

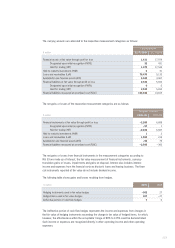

The Porsche group uses two different methods to present market risk from primary and derivative

financial instruments in accordance with IFRS 7. The currency and interest rate risks in financial

services are valued using the value-at-risk model, while market price risks in the automotive seg-

ment for interest rate, currency hedges and the investment risks associated with asset manage-

ment largely are calculated using a sensitivity analysis, and a value-at-risk model is used for share

price risks. In the value-at-risk calculation, a historical simulation is used to determine the potential

change in market price. The sensitivity analysis calculates the effect on equity and profit by modi-

fying risk variables within the respective market risk. The value at risk shows the potential future

loss of a certain portfolio over a predefined period of time (retention period) with certain probabili-

ties which are not likely to be exceeded. The degree of risk does not, however, say anything about

the distribution and anticipated loss, if it is actually exceeded.

4.2 Porsche subgroup

4.2.1 Market risk in the automotive division

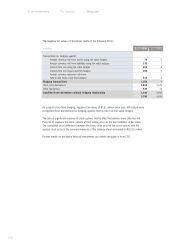

4.2.1.1 Foreign currency risk

Currency risks from current receivables and liabilities as well as from highly probable forecast

transactions are, hedged with forward exchange contracts, currency options or combined options

where this makes economic sense. Hedges for value fluctuations in future cash flows from highly

probable forecast transactions mainly relate to planned revenues in foreign currency. As of 31 July

2009, currency hedges are in place in particular for the major currencies US dollar, pound sterling

and Japanese yen.

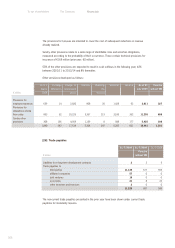

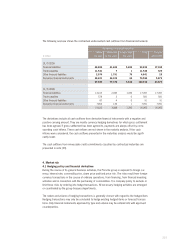

For the sensitivity analyses within the meaning of IFRS 7, all non-functional currencies in which the

Porsche subgroup enters into financial instruments are considered as relevant risk variables. If the

functional currencies concerned had appreciated by 10% higher compared to the other currencies

as of 31 July 2009, the hedge reserve in equity would have been €688 million higher (prior year:

€967 million). If the functional currencies concerned had depreciated 10% compared to the other

currencies as of 31 July 2009, the hedge reserve in equity would have been €555 million lower

(prior year: €777 million). If the functional currencies concerned had appreciated by 10% higher

compared to the other currencies as of 31 July 2009, profit would have been €33 million higher

(prior year: €117 million lower). If the functional currencies concerned had depreciated by 10%

compared to the other currencies as of 31 July 2009, profit would have been €80 million lower

(prior year: €23 million higher).

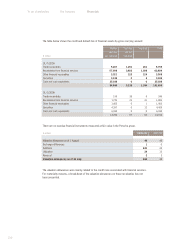

4.2.1.2 Interest rate risk

The interest rate risk for the automotive division results from changes in market interest rates.

This particularly affects the current interest result for call money and medium- and long-term vari-

able-interest receivables and liabilities, but can equally also impact on the market value recognized

for fixed-interest receivables and liabilities. Interest rate swaps and interest contracts are used as

hedges depending on the market situation.

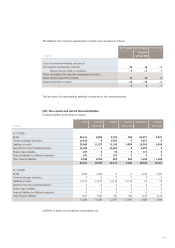

Interest rate risk within the meaning of IFRS 7 is calculated for the automotive division using sensitiv-

ity analyses. The effects of the risk variables in the form of market rates of interest on the financial

result and on equity are presented. If market interest rate had been 100 base points higher as of

31 July 2009, the reserve in equity would have been €9 million lower (prior year: €3 million). If

market interest rate had been valued 100 base points lower as of 31 July 2009, the reserve in

equity would have been €0 million higher (prior year: €3 million). If market interest rate had been

valued 100 base points higher as of 31 July 2009, the profit would have been €60 million lower