Porsche 2008 Annual Report Download - page 217

Download and view the complete annual report

Please find page 217 of the 2008 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254

|

|

215

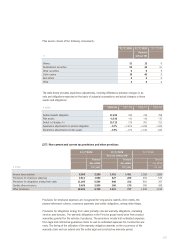

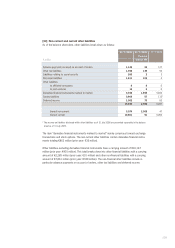

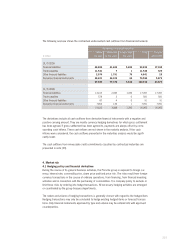

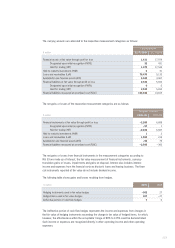

The following overview shows the contractual undiscounted cash outflows from financial instruments:

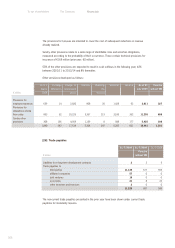

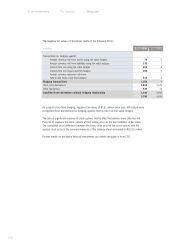

The derivatives include all cash outflows from derivative financial instruments with a negative and

positive carrying amount. They are mostly currency hedging derivatives for which gross settlement

has been agreed. If gross settlement has been agreed to, payments are always offset by corre-

sponding cash inflows. These cash inflows are not shown in the maturity analysis. If the cash

inflows were considered, the cash outflows presented in the maturities analysis would be signifi-

cantly lower.

The cash outflows from irrevocable credit commitments classified by contractual maturities are

presented in note [33].

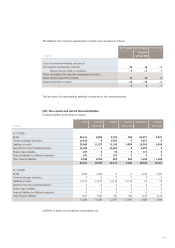

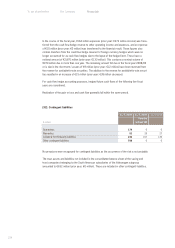

4. Market risk

4.1 Hedging policy and financial derivatives

During the course of its general business activities, the Porsche group is exposed to foreign cur-

rency, interest rate, commodity price, share price and fund price risk. The risks result from foreign

currency transactions in the course of ordinary operations, from financing, from financial investing

activities and in connection with the purchasing of commodities. It is company policy to exclude or

limit these risks by entering into hedge transactions. All necessary hedging activities are arranged

or coordinated by the group treasury departments.

The nature and volume of hedging transactions is generally chosen with regard to the hedged item.

Hedging transactions may only be concluded to hedge existing hedged items or forecast transac-

tions. Only financial instruments approved by type and volume may be entered into with approved

counterparties.

Remaining contractual maturities

€ million

Within

one year

Within one

to five years

In more than

five years

Total Porsche

without VW

31/7/2009

Financial liabilities 46,984 41,469 5,483 93,936 17,048

Trade payables 11,541 71 11,549 720

Other financial liabilities 2,974 1,791 76 4,841 29

Derivative financial instruments 36,421 34,105 64 70,590 5,873

97,920 77,372 5,624 180,916 23,670

31/7/2008

Financial liabilities 13,103 2,945 1,349 17,397 17,397

Trade payables 578 3 0 581 581

Other financial liabilities 87 4 0 91 91

Derivative financial instruments 7,854 136 1 7,991 7,991

21,622 3,088 1,350 26,060 26,060