Pizza Hut 2004 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

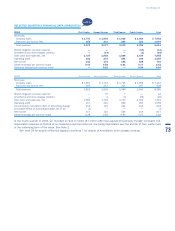

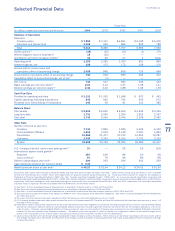

SelectedFinancialData

FiscalYear

(inmillions,exceptpershareandunitamounts) 2004 2003 2002 2001 2000

SummaryofOperations

Revenues

Companysales $7,992 $7,441 $6,891 $6,138 $6,305

Franchiseandlicensefees 1,019 939 866 815 788

Total 9,011 8,380 7,757 6,953 7,093

Facilityactions(a) (26) (36) (32) (1) 176

Wrenchlitigationincome(expense)(b) 14 (42) — — —

AmeriServeandother(charges)credits(c) 16 26 27 3 (204)

Operatingprofit 1,155 1,059 1,030 891 860

Interestexpense,net 129 173 172 158 176

Incomebeforeincometaxesand

cumulativeeffectofaccountingchange 1,026 886 858 733 684

Incomebeforecumulativeeffectofaccountingchange 740 618 583 492 413

Cumulativeeffectofaccountingchange,netoftax(d) — (1) — — —

Netincome 740 617 583 492 413

Basicearningspercommonshare(e) 2.54 2.10 1.97 1.68 1.41

Dilutedearningspercommonshare(e) 2.42 2.02 1.88 1.62 1.39

CashFlowData

Providedbyoperatingactivities $1,131 $1,053 $1,088 $ 832 $ 491

Capitalspending,excludingacquisitions 645 663 760 636 572

Proceedsfromrefranchisingofrestaurants 140 92 81 111 381

BalanceSheet

Totalassets $5,696 $5,620 $5,400 $4,425 $4,149

Long-termdebt 1,731 2,056 2,299 1,552 2,397

Totaldebt 1,742 2,066 2,445 2,248 2,487

OtherData

Numberofstoresatyearend

Company 7,743 7,854 7,526 6,435 6,123

UnconsolidatedAffiliates 1,662 1,512 2,148 2,000 1,844

Franchisees 21,858 21,471 20,724 19,263 19,287

Licensees 2,345 2,362 2,526 2,791 3,163

System 33,608 33,199 32,924 30,489 30,417

U.S.Companyblendedsamestoresalesgrowth(f) 3% — 2% 1% (2)%

Internationalsystemsalesgrowth(g)

Reported 15% 14% 8% 1% 6%

Localcurrency(h) 9% 7% 9% 8% 8%

Sharesoutstandingatyearend(e) 290 292 294 293 293

Cashdividendsdeclaredpercommonshare $ 0.30 — — — —

Marketpricepershareatyearend(e)$46.27 $33.64 $24.12 $24.62 $16.50

Fiscalyears2004,2003,2002and2001include52weeksandfiscalyear2000includes53weeks.FromMay7,2002,resultsincludeLongJohnSilver’s(“LJS”)andA&W

All-AmericanFoodRestaurants(“A&W”),whichwereaddedwhenweacquiredYorkshireGlobalRestaurants,Inc.Fiscalyear2002includestheimpactoftheadoptionof

StatementofFinancialAccountingStandards(“SFAS”)No.142,“GoodwillandOtherIntangibleAssets”(“SFAS142”).Asaresultweceasedamortizationofgoodwilland

indefinite-livedassetsbeginningDecember30,2001.IfSFAS142hadbeeneffectivefor2001and2000,reportednetincomewouldhaveincreased$26millionand$24million,

respectively.Bothbasicearningspershareanddilutedearningspersharewouldhaveincreased$0.09and$0.08in2001and2000,respectively.Theselectedfinancialdata

shouldbereadinconjunctionwiththeConsolidatedFinancialStatementsandtheNotesthereto.

(a)SeeNote7totheConsolidatedFinancialStatementsforadescriptionofFacilityactionsin2004,2003and2002.

(b)SeeNote24totheConsolidatedFinancialStatementsforadescriptionofWrenchlitigationin2004and2003.

(c)SeeNote7totheConsolidatedFinancialStatementsforadescriptionofAmeriServeandothercharges(credits)in2004,2003and2002.

(d)Fiscalyear2003includestheimpactoftheadoptionofSFASNo.143,“AccountingforAssetRetirementObligations.”SeeNote2totheConsolidatedFinancialStatements

forfurtherdiscussion.

(e)Pershareandshareamountshavebeenadjustedtoreflectthetwo-for-onestocksplitdistributedonJune17,2002.

(f)U.S.Companyblendedsame-storesalesgrowthincludestheresultsofCompanyownedKFC,PizzaHutandTacoBellrestaurantsthathavebeenopenoneyearormore.LJS

andA&Warenotincluded.

(g)Internationalsystemsalesgrowthincludestheresultsofallinternationalrestaurantsregardlessofownership,includingCompanyowned,franchise,unconsolidatedaffiliate

andlicenserestaurants.Salesoffranchise,unconsolidatedaffiliateandlicenserestaurantsgeneratefranchiseandlicensefeesfortheCompany(typicallyatarateof4%

to6%ofsales).Franchise,unconsolidatedaffiliateandlicenserestaurantsalesarenotincludedinCompanysaleswepresentontheConsolidatedStatementsofIncome;

however,thefeesareincludedintheCompany’srevenues.Webelievesystemsalesgrowthisusefultoinvestorsasasignificantindicatoroftheoverallstrengthofour

businessasitincorporatesallourrevenuedrivers,Companyandfranchisesamestoresalesaswellasnetunitdevelopment.

(h)Localcurrencyrepresentsthepercentagechangeexcludingtheimpactofforeigncurrencytranslation.Theseamountsarederivedbytranslatingcurrentyearresultsatprior

yearaverageexchangerates.Webelievetheeliminationoftheforeigncurrencytranslationimpactprovidesbetteryear-to-yearcomparabilitywithoutthedistortionofforeign

currencyfluctuations.

77

Yum!Brands,Inc.