Pizza Hut 2004 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

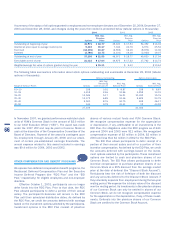

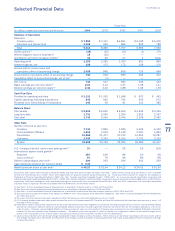

INCOMETAXES

NOTE22

Thedetailsofourincometaxprovision(benefit)aresetforth

below. Amounts do not include the income tax benefit of

approximately$1milliononthe$2millioncumulativeeffect

adjustment recorded on December29, 2002 due to the

adoptionofSFAS143.

2004 2003 2002

Current: Federal $ 78 $181 $137

Foreign 79 114 93

State (13) (4) 24

144 291 254

Deferred:Federal 41 (23) 29

Foreign 67 (16) (6)

State 34 16 (2)

142 (23) 21

$286 $268 $275

Includedinthefederaldeferredtaxprovisionaboveisapproxi-

mately$6millionintaxprovidedonundistributedearningsin

oneofourforeigninvestmentswhichweintendtorepatriate

totheU.S.Wehavemadethedeterminationtorepatriate

suchearningsastheresultofTheAmericanJobsCreation

Actof2004which became lawonOctober22,2004 (the

“Act”). The Act allows a dividends received deduction of

85%ofrepatriatedqualifiedforeignearningsinfiscalyear

2005.The$6millionintaxisbeingprovidedasaresultof

ourdeterminationtorepatriateapproximately$110millionat

December25,2004.InaccordancewithFASBStaffPosition

109-2,“AccountingandDisclosureGuidancefortheForeign

EarningsRepatriation Provisions withintheAmericanJobs

CreationActof2004,”wecontinuetoevaluatewhetherwe

willnowrepatriateotherundistributedearningsfromforeign

investmentsasaresultoftheAct.Therangeofadditional

amountsthatwemightrepatriatethroughtheAct’seffective

dateis$0toapproximately$400million.Theassociatedtax

ifsuchamountswererepatriatedinaccordancewiththeAct

wouldrangefrom$0to$20million.Wewill completethe

evaluationofwhichoftheseearningswewillrepatriate,ifany,

during2005.

Taxespayablewerereducedby$102million,$26million

and$49millionin2004,2003and2002,respectively,asa

resultofstockoptionexercises.

Valuationallowancesrelatedtodeferredtaxassetsin

foreigncountriesincreasedby$45million,$19millionand

$6millionin2004,2003and2002,respectively.Valuation

allowances in cer tain states increased by $6million

($4million, net of federal tax) and $1million ($1million,

netoffederaltax)in2003 and2002,respectively. These

increaseswereasaresultofdeterminingthatitismorelikely

thannotthatcertainlosscarryforwardswillnotbeutilized

priortoexpiration.

In2004,thedeferredforeigntaxprovisionincludeda

$1millioncredittoreflecttheimpactofchangesinstatu-

torytaxratesinvariouscountries.Thedeferredforeigntax

provisionfor2002includeda$2millioncredittoreflectthe

impactofchangesinstatutorytaxratesinvariouscountries.

U.S.and foreignincomebeforeincometaxes areset

forthbelow:

2004 2003 2002

U.S. $ 704 $669 $665

Foreign 322 217 193

$1,026 $886 $858

Thereconciliationofincometaxescalculatedat the U.S.

federaltaxstatutoryratetooureffectivetaxrateissetforth

below:

2004 2003 2002

U.S.federalstatutoryrate 35.0% 35.0% 35.0%

Stateincometax,

netoffederaltaxbenefit 1.3 1.8 2.0

ForeignandU.S.taxeffects

attributabletoforeignoperations (5.8) (3.6) (2.8)

Adjustmentstoreserves

andprioryears (6.7) (1.7) (1.8)

Foreigntaxcreditamended

returnbenefit — (4.1) —

Valuationallowanceadditions

(reversals) 4.2 2.8 —

Other,net (0.1) — (0.3)

Effectiveincometaxrate 27.9% 30.2% 32.1%

Theadjustmentstoreservesandprioryearsin2004was

primarilydrivenbythereversalofreservesassociatedwith

auditsthatweresettled.

Weamendedcertainprioryearreturnsin2003uponour

determinationthatitwasmorebeneficialtoclaimcrediton

ourU.S.taxreturnsforforeigntaxespaidthantodeductsuch

taxes,ashadbeendonewhenthereturnswereoriginallyfiled.

Thebenefitforamendingsuchreturnswillbenon-recurring.

The details of 2004 and 2003 deferredtaxliabilities

(assets)aresetforthbelow:

2004 2003

Intangibleassetsandproperty,

plantandequipment $ 153 $ 131

Other 209 126

Grossdeferredtaxliabilities $ 362 $ 257

Netoperatinglossandtaxcreditcarryforwards $(231) $(231)

Employeebenefits (111) (105)

Self-insuredcasualtyclaims (46) (52)

Capitalleasesandfuturerentobligations

relatedtosale-leasebackagreements (25) (20)

Variousliabilitiesandother (479) (362)

Grossdeferredtaxassets (892) (770)

Deferredtaxassetvaluationallowances 351 183

Netdeferredtaxassets (541) (587)

Netdeferredtax(assets)liabilities $(179) $(330)

ReportedinConsolidatedBalanceSheetsas:

Deferredincometaxes $(156) $(165)

Otherassets (89) (178)

Otherliabilitiesanddeferredcredits 52 —

Accountspayableandothercurrentliabilities 14 13

$(179) $(330)

68