Pizza Hut 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

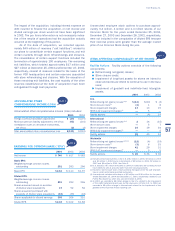

FRANCHISEANDLICENSEFEES

NOTE9

2004 2003 2002

Initialfees,includingrenewalfees $ 43 $ 36 $ 33

Initialfranchisefeesincludedin

refranchisinggains (10) (5) (6)

33 31 27

Continuingfees 986 908 839

$1,019 $939 $866

OTHER(INCOME)EXPENSE

NOTE10

2004 2003 2002

Equityincomefrominvestmentsin

unconsolidatedaffiliates $(54) $(39) $(29)

Foreignexchangenet(gain)loss (1) (2) (1)

$(55) $(41) $(30)

PROPERTY,PLANTANDEQUIPMENT,NET

NOTE11

2004 2003

Land $ 617 $ 662

Buildingsandimprovements 2,957 2,861

Capitalleases,primarilybuildings 146 119

Machineryandequipment 2,337 1,964

6,057 5,606

Accumulateddepreciationandamortization (2,618) (2,326)

$3,439 $3,280

Depreciationandamortizationexpenserelatedtoproperty,

plant and equipment was $434million, $388million and

$357millionin2004,2003and2002,respectively.

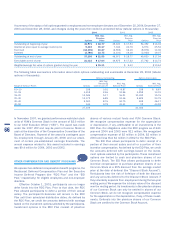

GOODWILLANDINTANGIBLEASSETS

NOTE12

The changes in the carrying amount of goodwill are as

follows:

Inter-

U.S. national Worldwide

BalanceasofDecember28,2002 $372 $113 $485

Acquisitions 21 15 36

Disposalsandother,net(a) (7) 7 —

BalanceasofDecember27,2003 $386 $135 $521

Acquisitions 19 14 33

Disposalsandother,net(a) (10) 9 (1)

BalanceasofDecember25,2004 $395 $158 $553

(a)Disposalsandother,netforInternationalprimarilyreflectstheimpactofforeign

currencytranslationonexistingbalances.

Intangibleassets,netfortheyearsended2004and2003

areasfollows:

2004 2003

Gross Gross

Carrying Accumulated Carrying Accumulated

Amount Amortization Amount Amortization

Amortizedintangibleassets

Franchisecontractrights $146 $(55) $141 $(49)

Trademarks/brands 67 (3) 67 (1)

Favorableoperatingleases 22 (16) 27 (18)

Pension-relatedintangible 11 — 14 —

Other 5 (1) 5 —

$251 $(75) $254 $(68)

Unamortizedintangibleassets

Trademarks/brands $171 $171

The most significant recorded trademark/brand assets

resulted when we acquired YGR in 2002. At the date of

acquisition, we assigned value to both the LJS and A&W

trademark/brand assets and determined both had indefi-

nitelives.Thefairvalueofatrademark/brandisdetermined

baseduponthevaluederivedfromtheroyaltyweavoid,inthe

caseofCompanystores,orreceive,inthecaseoffranchise

andlicenseestores,fortheuseofthetrademark/brand.This

fairvaluedeterminationisthuslargelydependentuponour

estimationofsalesattributabletothetrademark/brand.

The fair valueofthe LJStrademark/brand was deter-

minedtobeinexcessofitscarryingvalueduringour2004

and2003annualimpairmenttests.Theestimatesofsales

attributabletotheLJStrademark/brandatthedatesofthese

testsreflecttheopportunitieswebelieveexistwithregardto

increasedpenetrationofLJS,forbothstand-aloneunitsand

asamultibrandpartner.

Asaresultofthedecisionin2003tofocusshort-term

development largely on increased penetration of LJS and

ourdiscretionarycapitalspendinglimits,lessdevelopment

ofA&Wwasassumedintheneartermthanforecastedat

thedateofacquisition.Additionally,whilewecontinuedto

view A&W as a viable multibrand partner, subsequent to

acquisitionwedecidedtocloseorrefranchisesubstantially

allCompany-ownedA&Wrestaurantsthatwehadacquired.

These restaurants werelow-volume,mall-basedunitsthat

wereinconsistentwiththeremainderofourCompany-owned

portfolio.BoththedecisiontoclosetheseCompany-owned

A&Wunitsandthedecisiontofocusonshort-termdevelop-

mentopportunitiesatLJSnegativelyimpactedthefairvalue

of the A&W trademark/brand. Accordingly, we recorded a

$5millionchargein2003tofacilityactionstowritethevalue

oftheA&Wtrademark/branddowntoitsfairvalue.

Historically, we have considered the assets acquired

representingtrademark/brandtohaveindefiniteusefullives

duetoourexpecteduseoftheassetandthelackoflegal,

regulatory,contractual,competitive,economicorotherfactors

thatmaylimittheirusefullives.AsrequiredbySFAS142,we

reconsidertheremainingusefullifeofindefinite-lifeintangible

59

Yum!Brands,Inc.