Pizza Hut 2004 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

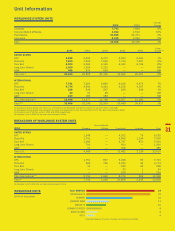

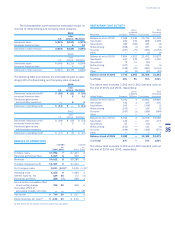

OPERATINGPROFIT

%Increase/

(decrease)

2004 2003 2004 2003

UnitedStates $ 777 $ 812 (4) 1

International 542 441 23 22

Unallocatedandcorporate

expenses (204) (179) (14) —

Unallocatedotherincome

(expense) (2) (3) NM NM

Unallocatedfacilityactions 12 4 NM NM

Wrenchlitigationincome

(expense) 14 (42) NM NM

AmeriServeandother

(charges)credits 16 26 NM NM

Operatingprofit $1,155 $1,059 9 3

In2004,thedecreaseinU.S.operatingprofitwasdrivenby

theimpactonrestaurantprofitofhighercommoditycosts

(primarilycheeseand meat)and theadjustmentrecorded

relatedto our accountingforleases and the depreciation

ofleaseholdimprovements,aswellashighergeneraland

administrativeexpenses.Thedecreasewaspartiallyoffset

bytheimpactofsamestoresalesincreasesonrestaurant

profitandfranchiseandlicensefees.Excludingthefavorable

impactoftheYGRacquisition,U.S.operatingprofitin2003

wasflatcomparedto2002.Decreasesdrivenbylowerrestau-

rantprofitasaresultofincreasedoccupancyexpensesand

theimpactofunfavorablediscountingandproductmixshift

onfoodandpapercostswereoffsetbylowerfranchiseand

licenseandgeneralandadministrativeexpenses.

Excluding the favorable impact from foreign currency

translation,Internationaloperatingprofitincreased17%in

2004.Theincreasewasdrivenbynewunitdevelopment,the

impactofsamestoresalesincreasesonrestaurantprofitand

franchiseandlicensefeesandhigherincomefromourinvest-

mentsinunconsolidatedaffiliates,partiallyoffsetbyhigher

general and administrative costs. Excluding the favorable

impactfromforeigncurrencytranslation,Internationaloper-

atingprofitincreased15%in2003.Theincreasewasdrivenby

newunitdevelopmentandtheimpactofsupplychainsavings

initiativesonthecostoffoodandpaper,partiallyoffsetbythe

impactofsamestoresalesdeclinesonrestaurantprofitand

highergeneralandadministrativeexpenses.

Unallocatedandcorporateexpensescomprisegeneral

andadministrativeexpensesandunallocatedfacilityactions

compriserefranchisinggains(losses),neitherofwhichare

allocatedtotheU.S. orInternationalsegmentsforperfor-

mancereportingpurposes.

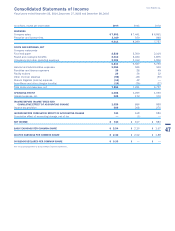

INTERESTEXPENSE,NET

2004 2003 2002

Interestexpense $145 $185 $180

Interestincome (16) (12) (8)

Interestexpense,net $129 $173 $172

Interestexpensedecreased$40millionor22%in2004.The

decreasewasprimarilydrivenbyadecreaseinouraverage

interestratesprimarilyattributabletopay-variableinterest

rateswapsenteredintoduring2004.Alsocontributingtothe

decreasewasareductioninouraveragedebtoutstanding

primarily as a result of the amended YGR sale-leaseback

agreementandlowerInternationalshort-termborrowings.

Interestexpenseincreased$5millionor3%in2003.

ExcludingtheimpactoftheYGRacquisition,interestexpense

decreased6%.Thedecreasewasprimarilyduetoadecrease

inouraveragedebtoutstanding.

INCOMETAXES

2004 2003 2002

Reported

Incometaxes $286 $268 $275

Effectivetaxrate 27.9% 30.2% 32.1%

Thereconciliationofincometaxescalculatedat the U.S.

federaltaxstatutoryratetooureffectivetaxrateissetforth

below:

2004 2003 2002

U.S.federalstatutorytaxrate 35.0% 35.0% 35.0%

Stateincometax,netof

federaltaxbenefit 1.3 1.8 2.0

ForeignandU.S.taxeffects

attributabletoforeignoperations (5.8) (3.6) (2.8)

Adjustmentstoreserves

andprioryears (6.7) (1.7) (1.8)

Foreigntaxcreditamended

returnbenefit — (4.1) —

Valuationallowanceadditions

(reversals) 4.2 2.8 —

Other,net (0.1) — (0.3)

Effectivetaxrate 27.9% 30.2% 32.1%

Income taxes and the effective tax rate as shown above

reflecttaxonallamountsincludedinourresultsofoperations

exceptfortheincometaxbenefitofapproximately$1million

onthe$2millioncumulativeeffectadjustmentrecordedin

theyearendedDecember27,2003duetotheadoptionof

SFAS143.

The2004effectivetaxratedecreased2.3percentage

points to 27.9%. The decrease in the effective tax rate

was driven by a number of factors, including the reversal

ofreservesinthecurrentyearassociatedwithauditsthat

weresettledaswellastheeffectsofcertaininternational

taxplanningstrategiesimplementedin2004.Thedecrease

waspartiallyoffsetbytheimpactoflappingthebenefitin

2003ofamendingcertainpriorU.S.incometaxreturnsto

claimcreditforforeigntaxespaidinprioryearsaswellas

39

Yum!Brands,Inc.