Pizza Hut 2004 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and 107 and a rescission of FASB Interpretation No.34”

(“FIN45”).FIN45elaboratesonthedisclosurestobemade

byaguarantorinitsinterimandannualfinancialstatements

aboutitsobligationsunderguaranteesissued.FIN45also

clarifiesthataguarantorisrequiredtorecognize,atinception

ofaguarantee,aliabilityforthefairvalueofcertainobliga-

tionsundertaken.Theinitialrecognitionandmeasurement

provisionswereapplicabletocertainguaranteesissuedor

modifiedafterDecember31,2002.Whilethenatureofour

businessresultsintheissuanceofcertainguaranteesfrom

timetotime,theadoptionofFIN45didnothaveamaterial

impact on our Consolidated Financial Statements for the

yearsendedDecember25,2004orDecember27,2003.

Wehavealsoissuedguaranteesasaresultofassigning

our interest in obligations under operating leases as a

condition to the refranchising of certain Company restau-

rants.Suchguaranteesaresubjecttotherequirementsof

SFASNo.145,“Rescission of FASBStatements No.4,44,

and64,AmendmentofFASBStatementNo.13,andTechnical

Corrections”(“SFAS145”).Werecognizea liabilityforthe

fairvalueofsuchleaseguaranteesunderSFAS145attheir

inception,withtherelatedexpensebeingincludedinrefran-

chisinggains(losses).

Cash and Cash Equivalents Cash equivalents represent

fundswehavetemporarilyinvested(withoriginalmaturities

notexceedingthreemonths)aspartofmanagingourday-to-

dayoperatingcashreceiptsanddisbursements.

Inventories Wevalueourinventoriesatthelowerofcost

(computedonthefirst-in,first-outmethod)ornetrealizable

value.

Property,PlantandEquipment Westateproperty,plantand

equipmentatcostlessaccumulateddepreciationandamor-

tization,impairment writedownsandvaluationallowances.

Wecalculatedepreciationandamortizationonastraight-line

basisovertheestimatedusefullivesoftheassetsasfollows:

5to25yearsforbuildingsandimprovements,3to20years

formachineryandequipmentand3to7yearsforcapitalized

softwarecosts.Asdiscussedabove,wesuspenddeprecia-

tionandamortizationonassetsrelatedtorestaurantsthat

areheldforsale.

Leases and Leasehold Improvements We account for

our leases in accordance with SFASNo.13, “Accounting

for Leases” (“SFAS13”), and other related authoritative

guidance.Whendeterminingtheleaseterm,weofteninclude

optionperiodsforwhichfailuretorenewtheleaseimposes

apenaltyontheCompanyinsuchanamountthatarenewal

appears, at the inception of the lease, to be reasonably

assured.Theprimarypenaltytowhichwearesubjectisthe

economicdetrimentassociatedwiththeexistenceoflease-

holdimprovementswhichmightbeimpairedifwechoosenot

tocontinuetheuseoftheleasedproperty.

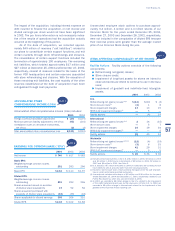

In 2004, we recorded an adjustment, similar to that

recorded by many other companies within our industry,

suchthatallofourleaseholdimprovementsarenowbeing

depreciated over the shorter of their useful lives or the

underlying lease term. The cumulative adjustment neces-

sary,primarilythroughincreasedU.S.depreciationexpense,

totaled$11.5million($7millionaftertax).Theportionofthis

adjustmentthatrelatedtothecurrentyearwasapproximately

$3million.Asthe portion oftheadjustmentrecordedthat

wasacorrectionoferrorsinourpriorperiodfinancialstate-

mentswasnotmaterialtoanyofthosepriorperiodfinancial

statements,werecordedtheentireadjustmentinour2004

ConsolidatedFinancialStatementsasincreasedoccupancy

andotheroperatingexpenses.

Werecordrentexpenseforleasesthatcontainscheduled

rentincreasesonastraight-linebasisovertheleaseterm,

includinganyoptionperiodsconsideredinthedetermination

ofthatleaseterm.Contingentrentalsaregenerallybasedon

saleslevelsinexcessofstipulatedamounts,andthusare

notconsideredminimumleasepaymentsandareincluded

inrentexpenseastheyaccrue.Wecapitalizerentassoci-

atedwithlandthatweareleasingwhileweareconstructing

arestaurant.Suchcapitalizedrentisthenexpensed ona

straight-linebasisovertheremainingtermoftheleaseupon

openingoftherestaurant.Wegenerallydonotreceiverent

holidays,rentconcessionsorleaseholdimprovementincen-

tivesuponopeningastorethatissubjecttoalease.

InternalDevelopmentCostsandAbandonedSiteCosts We

capitalizedirectcostsassociatedwiththesiteacquisitionand

constructionofaCompanyunitonthatsite,includingdirect

internal payroll and payroll-related costs. Only those site-

specificcostsincurredsubsequenttothetimethatthesite

acquisitionisconsideredprobablearecapitalized.Ifwesubse-

quentlymakeadeterminationthatasiteforwhichinternal

developmentcostshavebeencapitalizedwillnotbeacquired

ordeveloped,anypreviouslycapitalizedinternaldevelopment

costsareexpensedandincludedinG&Aexpenses.

Goodwill and Intangible Assets The Company accounts

foracquisitionsofrestaurantsfromfranchiseesandother

acquisitionsofbusinessthatmayoccurfromtimetotime

inaccordancewithSFASNo.141,“BusinessCombinations”

(“SFAS141”).Goodwillinsuchacquisitionsrepresentsthe

excessofthecostofabusinessacquiredoverthenetof

theamountsassignedtoassetsacquired,includingidenti-

fiableintangibleassets,andliabilitiesassumed.SFAS141

specifiescriteriatobeusedindeterminingwhetherintan-

gibleassetsacquiredinabusinesscombinationmustbe

recognizedandreportedseparatelyfromgoodwill.Webase

amountsassignedtogoodwillandotheridentifiableintangible

assetsonindependentappraisalsorinternalestimates.

TheCompanyaccountsforrecordedgoodwillandother

intangibleassetsinaccordancewithSFASNo.142,“Goodwill

andOtherIntangibleAssets”(“SFAS142”).Inaccordance

withSFAS142,wedonotamortizegoodwillandindefinite-

livedintangibleassets.Weevaluatetheremaininguseful

lifeofanintangibleassetthatisnotbeingamortizedeach

reporting period todeterminewhethereventsand circum-

stancescontinuetosupportanindefiniteusefullife.Ifan

intangibleassetthatisnotbeingamortizedissubsequently

54