Pizza Hut 2004 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

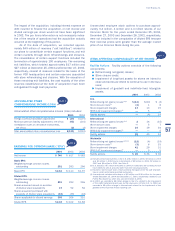

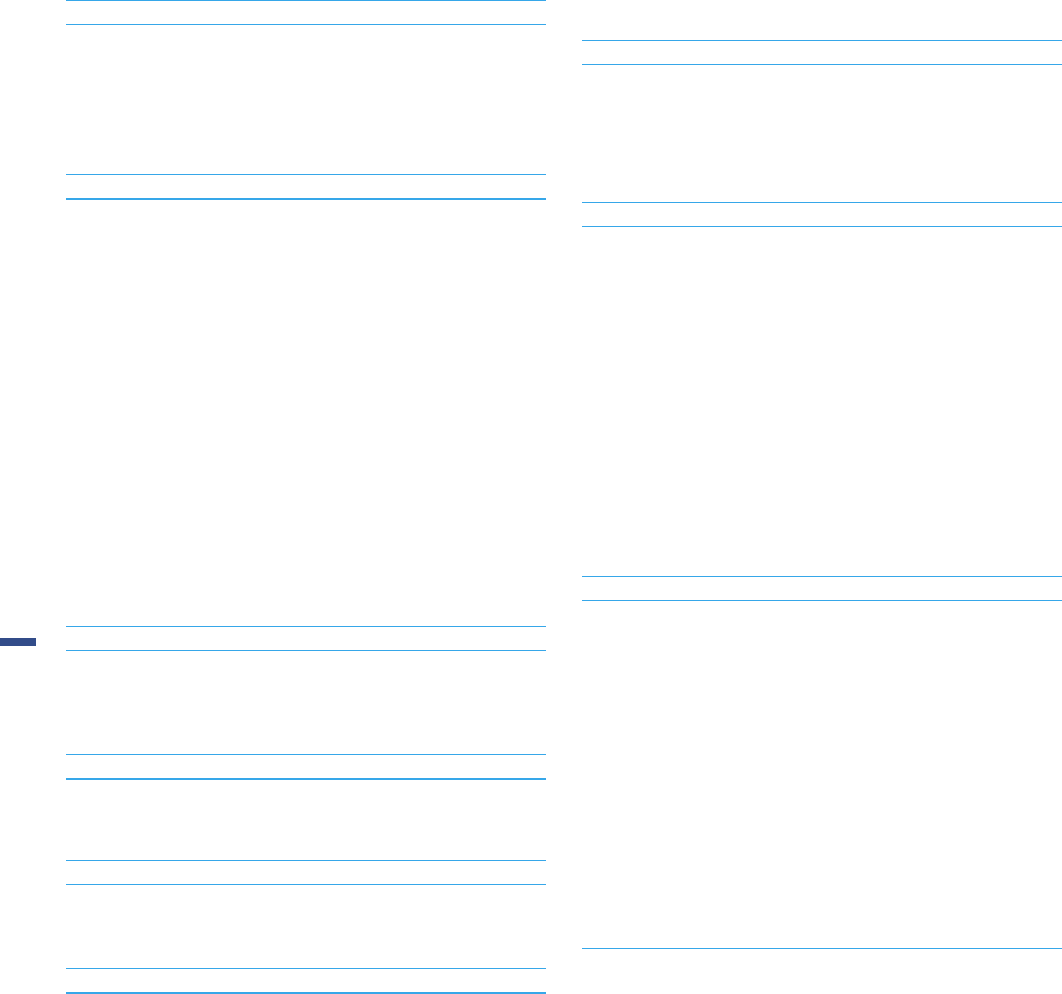

Postretirement

PensionBenefits MedicalBenefits

2004 2003 2004 2003

Amountsrecognizedinthe

statementoffinancial

positionconsistof:

Accruedbenefitliability $(111) $(125) $(58) $(53)

Intangibleasset 11 14 — —

Accumulatedother

comprehensiveloss 153 162 — —

$ 53 $ 51 $(58) $(53)

Additionalinformation

Othercomprehensive

(income)lossattributableto

changeinadditional

minimumliabilityrecognition $ (9) $ 48

Additionalyear-endinformation

forpensionplanswith

accumulatedbenefitobligations

inexcessofplanassets

Projectedbenefitobligation $ 700 $ 629

Accumulatedbenefitobligation 629 563

Fairvalueofplanassets 518 438

WhilewearenotrequiredtomakecontributionstothePlanin

2005,wemaymakediscretionarycontributionsduringtheyear

basedonourestimateofthePlan’sexpectedSeptember30,

2005fundedstatus.

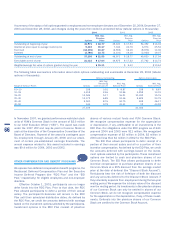

ComponentsofNetPeriodicBenefitCost

PensionBenefits

2004 2003 2002

Servicecost $ 32 $ 26 $ 22

Interestcost 39 34 31

Amortizationofpriorservicecost 3 4 1

Expectedreturnonplanassets (40) (30) (28)

Recognizedactuarialloss 19 6 1

Netperiodicbenefitcost $ 53 $ 40 $ 27

Additionallossrecognizeddueto:

Curtailment $ — $ — $ 1

PostretirementMedicalBenefits

2004 2003 2002

Servicecost $ 2 $ 2 $ 2

Interestcost 5 5 4

Amortizationofpriorservicecost — — —

Recognizedactuarialloss 1 1 1

Netperiodicbenefitcost $ 8 $ 8 $ 7

Priorservicecostsareamortizedonastraight-linebasisover

theaverageremainingserviceperiodofemployeesexpected

toreceivebenefits.Curtailmentgainsandlosseshavebeen

recognizedinfacilityactionsastheyhaveresultedprimarily

fromrefranchisingandclosureactivities.

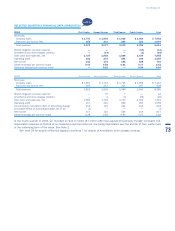

Weighted-AverageAssumptionsUsedtoDetermineBenefit

ObligationsatSeptember30:

Postretirement

PensionBenefits MedicalBenefits

2004 2003 2004 2003

Discountrate 6.15% 6.25% 6.15% 6.25%

Rateofcompensationincrease 3.75% 3.75% 3.75% 3.75%

Weighted-AverageAssumptionsUsedtoDeterminetheNet

PeriodicBenefitCostforFiscalYears:

Postretirement

PensionBenefits MedicalBenefits

2004 2003 2002 2004 2003 2002

Discountrate 6.25% 6.85% 7.60% 6.25% 6.85% 7.58%

Long-termrate

ofreturnon

planassets 8.50% 8.50%10.00% — — —

Rateofcompen-

sationincrease 3.75% 3.85% 4.60% 3.75% 3.85% 4.60%

Ourestimatedlong-termrateofreturnonplanassetsrepre-

sentstheweightedaverageofexpectedfuturereturnson

theassetcategoriesincludedinourtargetinvestmentalloca-

tionbasedprimarilyonthehistoricalreturnsforeachasset

category, adjusted for an assessment of current market

conditions.

AssumedHealthCareCostTrendRatesatSeptember30:

Postretirement

MedicalBenefits

2004 2003

Healthcarecosttrendrateassumedfornextyear 11% 12%

Ratetowhichthecosttrendrateisassumedto

decline(theultimatetrendrate) 5.5% 5.5%

Yearthattheratereachestheultimatetrendrate 2012 2012

Thereisacaponourmedicalliabilityforcertainretirees.

ThecapforMedicareeligibleretireeswasreachedin2000

andthecapfornon-Medicareeligibleretireesisexpectedto

bereachedbetweentheyears2007-2008;oncethecapis

reached,ourannualcostperretireewillnotincrease.

Assumedhealthcarecosttrendrateshaveasignificant

effectontheamountsreportedforourpostretirementhealth

careplans.Aone-percentage-pointchangeinassumedhealth

carecosttrendrateswouldhavethefollowingeffects:

1-Percentage- 1-Percentage-

Point Point

Increase Decrease

Effectontotalofserviceandinterestcost $— $—

Effectonpostretirementbenefitobligation $ 2 $ (2)

64