Pizza Hut 2004 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

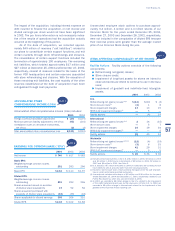

OurcashobligationsundertheEIDPlanasoftheend

of2004and2003were$23millionand$25million,respec-

tively.Werecognizedcompensationexpense of $4million

in2004,$3millionin2003and$2millionin2002forthe

EIDPlan.

Wesponsor acontributoryplan toprovide retirement

benefitsundertheprovisionsofSection401(k)oftheInternal

RevenueCode(the“401(k)Plan”)foreligibleU.S.salaried

andhourlyemployees.During2004,participantswereableto

electtocontributeupto25%ofeligiblecompensationona

pre-taxbasis(themaximumparticipantcontributionincreased

from15% to 25%effective January1,2003). Participants

mayallocatetheircontributionstooneoranycombinationof

10investmentoptionswithinthe401(k)Plan.TheCompany

matches100%oftheparticipant’scontributiontothe401(k)

Planupto3%ofeligiblecompensationand50%ofthepartic-

ipant’scontributiononthenext2%ofeligiblecompensation.

All matching contributionsaremadetothe YUMCommon

StockFund.Werecognizedascompensationexpenseourtotal

matchingcontributionof$11millionin2004,$10millionin

2003and$8millionin2002.

SHAREHOLDERS’RIGHTSPLAN

NOTE20

In July 1998, our Board of Directors declared a dividend

distribution of onerightfor eachshare ofCommonStock

outstandingasofAugust3,1998(the“RecordDate”).As

aresultofthetwo-for-onestocksplitdistributedonJune17,

2002,eachholderofCommonStockisentitledtoonerightfor

everytwosharesofCommonStock(one-halfrightpershare).

Eachrightinitiallyentitlestheregisteredholdertopurchase

aunitconsistingofoneone-thousandthofashare(a“Unit”)

ofSeriesAJuniorParticipatingPreferredStock,withoutpar

value,atapurchasepriceof$130perUnit,subjecttoadjust-

ment.Therights,whichdonothavevotingrights,willbecome

exercisableforourCommonStocktenbusinessdaysfollowing

apublicannouncementthatapersonorgrouphasacquired,

orhascommencedorintendstocommenceatenderoffer

for,15%ormore,or20%ormoreifsuchpersonorgroup

owned10%ormoreontheadoptiondateofthisplan,ofour

CommonStock.Intheeventtherightsbecomeexercisablefor

CommonStock,eachrightwillentitleitsholder(otherthanthe

AcquiringPersonasdefinedintheAgreement)topurchase,

attheright’sthen-currentexerciseprice,YUMCommonStock

havingavalueoftwicetheexercisepriceoftheright.Inthe

eventtherightsbecomeexercisableforCommonStockand

thereafter we are acquired in a mergeror other business

combination,eachrightwillentitleitsholdertopurchase,at

theright’sthen-currentexerciseprice,commonstockofthe

acquiringcompanyhavingavalueoftwicetheexerciseprice

oftheright.

We can redeem the rights in their entirety, prior to

becoming exercisable, at $0.01 per right under certain

specified conditions. The rights expire on July 21, 2008,

unlessweextendthatdateorwehaveearlierredeemedor

exchangedtherightsasprovidedintheAgreement.

Thisdescriptionoftherightsisqualifiedinitsentirety

byreferencetotheoriginalRightsAgreement,datedJuly21,

1998,andtheAgreementofSubstitutionandAmendmentof

CommonShareRightsAgreement,datedAugust28,2003,

betweenYUMandAmericanStockTransferandTrustCompany,

theRightsAgent(bothincludingtheexhibitsthereto).

SHAREREPURCHASEPROGRAM

NOTE21

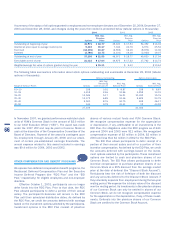

InMay2004,ourBoardofDirectorsauthorizedasharerepur-

chaseprogram.Thisprogramauthorizedustorepurchase,

through November 2005, up to $300million (excluding

applicable transaction fees) of our outstanding Common

Stock.DuringtheyearendedDecember25,2004,werepur-

chasedapproximately5.9millionsharesforapproximately

$275millionatanaveragepricepershareofapproximately

$46underthisprogram. Basedonmarketconditions and

otherfactors,additionalrepurchasesmaybemadefromtime

totimeintheopenmarketorthroughprivatelynegotiated

transactionsatthediscretionoftheCompany.

InNovember 2003,ourBoard ofDirectorsauthorized

asharerepurchaseprogram.Thisprogramauthorizedusto

repurchase,throughMay21,2005,upto$300millionofour

outstandingCommonStock(excluding applicabletransac-

tionfees).Thissharerepurchaseprogramwascompletedin

2004.During2004,werepurchasedapproximately8.1million

sharesforapproximately$294millionatanaverageprice

pershareofapproximately$36underthisprogram.During

2003,werepurchased approximately 169,000 sharesfor

approximately$6millionatanaverage pricepershare of

approximately$34underthisprogram.

InNovember 2002,ourBoard ofDirectorsauthorized

a share repurchase program. This program authorized us

to repurchase up to $300million (excluding applicable

transactionfees) ofouroutstandingCommon Stock.This

sharerepurchaseprogramwascompletedin2003.During

2003,werepurchasedapproximately9.2millionsharesfor

approximately$272millionatanaveragepricepershareof

approximately$30underthisprogram.During2002,werepur-

chasedapproximately1.2millionsharesforapproximately

$28millionatanaveragepricepershareofapproximately

$24underthisprogram.

In February 2001, our Board of Directors authorized

a share repurchase program. This program authorized us

to repurchase up to $300million (excluding applicable

transactionfees) ofouroutstandingCommon Stock.This

sharerepurchaseprogramwascompletedin2002.During

2002,werepurchasedapproximately7.0millionsharesfor

approximately$200millionatanaveragepricepershareof

approximately$29underthisprogram.

67

Yum!Brands,Inc.