Pizza Hut 2004 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

animpaired restauranttoitsestimatedfairmarketvalue,

whichbecomesitsnewcostbasis.Wegenerallymeasure

estimatedfairmarketvaluebydiscountingestimatedfuture

cashflows.Inaddition,whenwedecidetoclosearestau-

rantitisreviewedforimpairmentanddepreciablelivesare

adjustedbasedontheexpecteddisposaldate.Theimpair-

mentevaluationisbasedontheestimatedcashflowsfrom

continuingusethroughtheexpecteddisposaldateplusthe

expectedterminalvalue.

TheCompanyhasadoptedSFASNo.146,“Accountingfor

CostsAssociatedwithExitorDisposalActivities”(“SFAS146”),

effectiveforexitordisposalactivitiesthatwereinitiatedafter

December31,2002.CostsaddressedbySFAS146include

coststoterminateacontractthatisnotacapitallease,costs

ofinvoluntaryemployeeterminationbenefitspursuanttoa

one-time benefit arrangement, costs to consolidate facili-

tiesandcoststorelocate employees.SFAS146changes

thetimingofexpenserecognitionforcertaincostsweincur

whileclosingrestaurantsorundertakingotherexitordisposal

activities;however,thetimingdifferenceisnottypicallysignifi-

cantinlength.AdoptionofSFAS146didnothaveamaterial

impact on our Consolidated Financial Statements for the

yearsendedDecember25,2004orDecember27,2003.

Store closure costs includecosts ofdisposing of the

assetsaswellasotherfacility-relatedexpensesfromprevi-

ouslyclosedstores.Thesestoreclosurecostsaregenerally

expensedasincurred.Additionally,atthedateweceaseusing

apropertyunderanoperatinglease,werecordaliabilityfor

thenetpresentvalueofanyremainingleaseobligations,net

ofestimatedsubleaseincome,ifany.Totheextentwesell

assets,primarilyland,associatedwithaclosedstore,anygain

orlossuponthatsaleisrecordedinstoreclosurecosts.

Refranchisinggains(losses)includesthegainsorlosses

fromthesalesofourrestaurantstonewandexistingfran-

chiseesandtherelated initial franchise fees,reducedby

transactioncosts.Inexecutingourrefranchisinginitiatives,we

mostoftenoffergroupsofrestaurants.Weclassifyrestaurants

asheldforsaleandsuspenddepreciationandamortization

when(a)wemakeadecisiontorefranchise;(b)thestores

canbeimmediatelyremovedfromoperations;(c)wehave

begun anactiveprogramtolocate abuyer;(d)significant

changestotheplanofsalearenotlikely;and(e)thesaleis

probablewithinoneyear.Werecognizeestimatedlosseson

refranchisingswhentherestaurantsareclassifiedasheldfor

sale.Wealsorecognizeasrefranchisinglossesimpairment

associatedwithstoreswehaveofferedtorefranchisefora

pricelessthantheircarryingvalue,butdonotbelievehave

metthecriteriatobeclassifiedasheldforsale.Werecognize

gainsonrestaurantrefranchisingswhen thesale transac-

tioncloses,thefranchiseehasa minimumamountofthe

purchasepriceinat-riskequity,andwearesatisfiedthatthe

franchiseecanmeetitsfinancialobligations.Ifthecriteriafor

gainrecognitionarenotmet,wedeferthegaintotheextent

wehavearemainingfinancialexposureinconnectionwiththe

salestransaction.Deferredgainsarerecognizedwhenthe

gainrecognitioncriteriaaremetorasourfinancialexposure

isreduced.Whenwemakeadecisiontoretainastoreprevi-

ouslyheldforsale,werevaluethestoreatthelowerofits

(a)netbook value atouroriginalsaledecisiondateless

normaldepreciationandamortizationthatwouldhavebeen

recordedduringtheperiodheldforsaleor(b)itscurrentfair

marketvalue.Thisvaluebecomesthestore’snewcostbasis.

Werecordanydifferencebetweenthestore’scarryingamount

anditsnewcostbasistorefranchisinggains(losses).When

wemakeadecisiontocloseastorepreviouslyheldforsale,

wereverseanypreviouslyrecognizedrefranchisinglossand

thenrecordimpairmentandstoreclosurecostsasdescribed

above.Refranchisinggains(losses)alsoincludechargesfor

estimatedexposuresrelatedtothosepartialguaranteesof

franchiseeloanpoolsandcontingentleaseliabilitieswhich

arosefromrefranchisingactivities.Theseexposuresaremore

fullydiscussedinNote24.

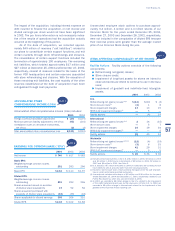

Considerable management judgment is necessary

to estimate future cash flows, including cash flows from

continuinguse,terminalvalue,closurecosts,subleaseincome

andrefranchisingproceeds.Accordingly,actualresultscould

varysignificantlyfromourestimates.

ImpairmentofInvestmentsinUnconsolidatedAffiliates We

recordimpairment chargesrelatedtoaninvestmentin an

unconsolidatedaffiliatewhenevereventsorcircumstances

indicatethatadecreaseinthevalueofaninvestmenthas

occurred which is other than temporary. In addition, we

evaluate our investments in unconsolidated affiliates for

impairment when theyhaveexperiencedtwo consecutive

yearsofoperatinglosses.Ourimpairmentmeasurementtest

foraninvestmentinanunconsolidatedaffiliateissimilarto

thatforourrestaurantsexceptthatweusediscountedcash

flows after interestand taxesinsteadofdiscounted cash

flowsbeforeinterestandtaxesasusedforourrestaurants.

Considerable management judgment is necessary to

estimatefuturecashflows.Accordingly,actualresultscould

varysignificantlyfromourestimates.

Asset Retirement Obligations Effective December29,

2002, the Company adopted SFASNo.143, “Accounting

forAssetRetirementObligations”(“SFAS143”).SFAS143

addressesthefinancialaccountingandreportingforlegal

obligationsassociatedwiththeretirementoftangiblelong-

livedassetsandtheassociatedassetretirementcosts.As

aresultofobligationsundercertainleasesthatarewithin

thescopeofSFAS143,theCompanyrecordedacumulative

effectadjustmentof$2million($1millionaftertax)whichdid

nothaveamaterialeffectondilutedearningspercommon

share.TheadoptionofSFAS143alsodidnothaveamaterial

impact on our Consolidated Financial Statements for the

yearsendedDecember25,2004orDecember27,2003.If

SFAS143hadbeenadoptedasofthebeginningof2002,the

cumulativeeffectadjustmentwouldnothavebeenmaterially

differentfromthatrecordedonDecember29,2002.

Guarantees TheCompanyhasadoptedFASBInterpretation

No.45,“Guarantor’sAccountingandDisclosureRequirements

forGuarantees,IncludingIndirectGuaranteesofIndebtedness

toOthers,an interpretationofFASB StatementsNo.5,57

53

Yum!Brands,Inc.