Pizza Hut 2004 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

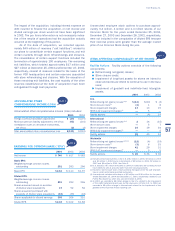

Thefollowingtablesummarizesthe2004and2003activity

relatedtoreservesforremainingleaseobligationsforstores

closedorstoresweintendtoclose.

Estimate/

Beginning Amounts New Decision Ending

Balance Used Decisions Changes Other)(a) Balance

2003Activity $41 (13) 6 2 4 $40

2004Activity $40 (17) 8 (1) 13 $43

(a)Primarilyreservesestablisheduponacquisitionsoffranchiseerestaurants.

Thefollowingtablesummarizesthecarryingvaluesofthe

majorclassesofassetsheldforsaleatDecember25,2004

andDecember27,2003.U.S.amountsprimarilyrepresent

landonwhichwepreviouslyoperatedrestaurantsandarenet

ofimpairmentchargesof$2millionatbothDecember25,

2004 and December27, 2003. International amounts in

2003relateprimarilytoourPuertoRicobusiness.ThePuerto

RicobusinesswassoldonOctober4,2004foranamount

approximatingitsthencarryingvalue.

2004

Inter-

U.S. national Worldwide

Property,plantandequipment,net $ 7 $ — $ 7

Goodwill — — —

Otherassets — — —

Assetsclassifiedasheldforsale $ 7 $ — $ 7

2003

Inter-

U.S. national Worldwide

Property,plantandequipment,net $ 9 $ 73 $82

Goodwill — 12 12

Otherassets — 2 2

Assetsclassifiedasheldforsale $ 9 $ 87 $96

WrenchLitigation Incomeof$14millionwasrecordedfor

2004reflectingsettlementsassociatedwiththeWrenchliti-

gationforamountslessthanpreviouslyaccruedaswellas

relatedinsurance recoveries. Expenseof $42million was

recordedasWrenchlitigationfor2003reflectingtheamounts

awardedtotheplaintiffandinterestthereon.SeeNote24for

adiscussionofWrenchlitigation.

AmeriServeandOtherCharges(Credits) AmeriServeFood

DistributionInc.(“AmeriServe”)wastheprimarydistributorof

foodandpapersuppliestoourU.S.storeswhenitfiledfor

protectionunderChapter11oftheU.S.BankruptcyCodeon

January31,2000.AplanofreorganizationforAmeriServe(the

“POR”)wasapprovedonNovember28,2000,whichresultedin,

amongotherthings,theassumptionofourdistributionagree-

ment,subjecttocertainamendments,byMcLaneCompany,

Inc.DuringtheAmeriServebankruptcyreorganizationprocess,

wetookanumberofactionstoensurecontinuedsupplytoour

system.Thoseactionsresultedinsignificantexpenseforthe

Company,primarilyrecordedin2000.UnderthePOR,weare

entitledtoproceedsfromcertainresidualassets,preference

claimsandotherlegalrecoveriesoftheestate.

We classify expenses and recoveries related to

AmeriServe,aswellasintegrationcostsrelatedtoouracqui-

sitionofYGR,coststodefendcertainwageandhourlitigation

andcertainotheritems,asAmeriServeandothercharges

(credits).Theseamountswereclassifiedasunusualitems

in2002.

Income of $16million and $26million was recorded

as AmeriServe and other charges (credits) for 2004 and

2003,respectively.Theseamountsprimarilyresultedfrom

cashrecoveriesrelatedtotheAmeriServebankruptcyreor-

ganizationprocess.Incomeof$27millionwasrecordedas

AmeriServeandothercharges(credits)for2002,primarily

resultingfrom recoveries related totheAmeriServe bank-

ruptcyreorganizationprocess,partiallyoffsetbyintegration

costsrelatedtoouracquisitionofYGRandcoststodefend

certainwageandhourlitigation.

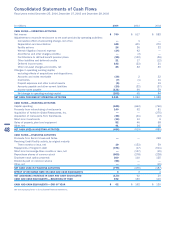

SUPPLEMENTALCASHFLOWDATA

NOTE8

2004 2003 2002

CashPaidfor:

Interest $146 $178 $153

Incometaxes 276 196 200

SignificantNon-CashInvestingand

FinancingActivities:

Assumptionofdebtandcapitalleases

relatedtotheacquisitionofYGR $ — $ — $227

Assumptionofcapitalleasesrelated

totheacquisitionofrestaurants

fromfranchisees 8 — —

Capitalleaseobligationsincurredto

acquireassets 13 9 23

Debtreductionduetoamendment

ofsale-leasebackagreements

(seeNote14) — 88 —

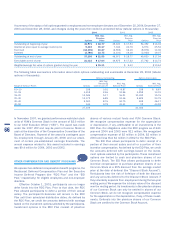

OnNovember10,2003,ourunconsolidatedaffiliateinCanada

was dissolved. Upon dissolution, the Company assumed

operationofcertainunitsthatwerepreviouslyoperatedbythe

unconsolidatedaffiliate.TheCompanyalsoassumedowner-

shipoftheassetsrelatedtotheunitsthatitnowoperates,

aswellastherealestateassociatedwithcertainunitsprevi-

ouslyownedandoperatedbytheunconsolidatedaffiliatethat

arenowoperatedbyfranchisees(eitherourformerpartnerin

theunconsolidatedaffiliateorapublicly-heldIncomeTrustin

Canada).Theacquiredrealestateassociatedwiththeunits

thatarenotoperatedbytheCompanyisbeingleasedtothe

franchisees.Theresultingreductioninourinvestmentsinuncon-

solidatedaffiliates($56millionatNovember10,2003)was

primarilyoffsetbyincreasesinproperty,plantandequipment,

netandcapitalleasereceivables(includedinotherassets).

TheCompanyrealizedaninsignificantgainuponthedissolu-

tionoftheunconsolidatedaffiliate.Thisgainwasrealizedas

thefairvalueofourincreasedownershipintheassetsreceived

wasgreaterthanourcarryingvalueinthoseassets,andwas

netofexpensesassociatedwiththedissolution.

58