Pizza Hut 2004 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

toaBusinessCombination”(“EITF04-1”).EITF04-1requires

thatabusinesscombinationbetweentwopartiesthathave

a preexisting relationship be evaluated to determine if a

settlementofapreexistingrelationshipexists.EITF04-1also

requiresthatcertainreacquiredrights(includingtherightsto

theacquirer’stradenameunderafranchiseagreement)be

recognizedasintangibleassetsapartfromgoodwill.However,

ifacontractgivingrisetothereacquiredrightsincludesterms

thatarefavorableorunfavorablewhencomparedtopricing

forcurrentmarkettransactionsforthesameorsimilaritems,

EITF 04-1 requires that a settlement gain or loss should

bemeasuredasthelesserofa)theamountbywhichthe

contractisfavorableorunfavorabletomarkettermsfromthe

perspectiveoftheacquirerorb)thestatedsettlementprovi-

sionsofthecontractavailabletothecounterpartytowhich

thecontractisunfavorable.

EITF04-1iseffectiveprospectivelyforbusinesscombi-

nations consummatedinreportingperiods beginningafter

October13,2004(thefiscalyearbeginningDecember26,

2004 for the Company). When effective, EITF 04-01 will

applytoacquisitionsofrestaurantswemaymakefromour

franchiseesorlicensees.Wecurrentlyattempttohaveour

franchisees or licensees enter into standard franchise or

licenseagreementsfortheapplicableConceptand/ormarket

whenrenewingorenteringintoanewagreement.However,

incertaininstancesfranchiseesorlicenseeshaveexisting

agreementsthatpossessterms,includingroyaltyrates,that

differfromourcurrentstandardagreementsfortheapplicable

Conceptand/ormarket.Ifinthefutureweweretoacquirea

franchiseeorlicenseewithsuchanexistingagreement,we

wouldberequiredtorecordasettlementgainorlossatthe

dateofacquisition.Theamountandtimingofanysuchgainsor

losseswemightrecordisdependentuponwhichfranchisees

orlicenseeswemightacquireandwhentheyareacquired.

Accordingly,anyimpactcannotbecurrentlydetermined.

In December2004, the FASB issued SFASNo.123

(Revised 2004), “Share-Based Payment” (“SFAS123R”),

whichreplacesSFAS123,supersedesAPB25andrelated

interpretations and amends SFASNo.95, “Statement of

Cash Flows.” The provisions of SFAS123R are similar to

thoseofSFAS123,however,SFAS123Rrequiresallshare-

basedpaymentstoemployees,includinggrantsofemployee

stockoptions,toberecognizedinthefinancialstatements

ascompensationcostbasedontheirfairvalueonthedate

ofgrant.Fairvalueofshare-basedawardswillbedetermined

usingoption-pricingmodels(e.g.Black-Scholesorbinomial

models) and assumptions that appropriately reflect the

specificcircumstancesoftheawards.Compensationcostwill

berecognizedoverthevestingperiodbasedonthefairvalue

ofawardsthatactuallyvest.

We will be required to choose between the modified-

prospectiveandmodified-retrospectivetransitionalternativesin

adoptingSFAS123R.Underthemodified-prospective-transition

method,compensationcost will be recognized in financial

statementsissuedsubsequenttothedateofadoptionforall

shared-basedpaymentsgranted,modifiedorsettledafterthe

dateofadoption,aswellasforanyunvestedawardsthatwere

grantedpriortothedateofadoption.Aswepreviouslyadopted

onlytheproformadisclosureprovisionsofSFAS123,wewill

recognizecompensationcostrelatingtotheunvestedportion

ofawardsgrantedpriortothedateofadoptionusingthesame

estimateofthegrant-datefairvalueandthesameattribution

methodusedtodeterminetheproformadisclosuresunder

SFAS123.Underthemodified-retrospective-transitionmethod

compensationcostwillberecognizedinamannerconsistent

withthemodified-prospective-transitionmethod,however,prior

periodfinancialstatementswillalsoberestatedbyrecognizing

compensationcostaspreviouslyreportedintheproforma

disclosuresunderSFAS123.Therestatementprovisionscan

beappliedtoeithera)allperiodspresentedorb)tothebegin-

ningofthefiscalyearinwhichSFAS123Risadopted.

SFAS123R is effective at the beginning of the first

interimorannualperiodbeginningafterJune15,2005(the

quarterendingDecember31,2005forthe Company)and

earlyadoptionisencouraged.TheCompanyisintheprocess

of evaluating the use of certain option-pricing models as

wellastheassumptionstobeusedinsuchmodels.When

suchevaluationiscomplete,wewilldeterminethetransition

methodtouseandthetimingofadoption.Wedonotcurrently

anticipatethattheimpactonnetincomeonafullyearbasis

oftheadoptionofSFAS123Rwillbesignificantlydifferent

fromthehistoricalproformaimpactsasdisclosedinaccor-

dancewithSFAS123.

TWO-FOR-ONECOMMONSTOCKSPLIT

NOTE3

On May 7, 2002, the Company announced that its Board

ofDirectorsapprovedatwo-for-onesplitoftheCompany’s

outstandingsharesofCommonStock.Thestocksplitwas

effectedintheformofastockdividendandentitledeach

shareholderofrecordatthecloseofbusinessonJune6,

2002toreceiveoneadditionalshareforeveryoutstanding

shareofCommonStockheldontherecorddate.Thestock

dividendwasdistributedonJune17,2002,withapproximately

149million shares of common stock distributed. All per

shareandshareamountsintheaccompanyingConsolidated

FinancialStatementsandNotestotheFinancialStatements

havebeenadjustedtoreflectthestocksplit.

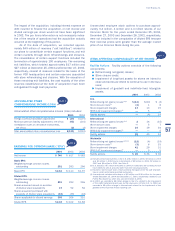

YGRACQUISITION

NOTE4

OnMay 7,2002,YUM completedtheacquisition of YGR.

TheresultsofoperationsforYGRhavebeenincludedinour

Consolidated Financial Statementssince thatdate.Ifthe

acquisitionhadbeencompletedasofthebeginningofthe

yearendedDecember28,2002,proformaCompanysales

andfranchiseandlicensefeeswouldhavebeenasfollows:

2002

Companysales $7,139

Franchiseandlicensefees 877

56