Pizza Hut 2004 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

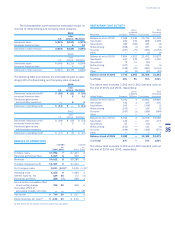

areself-insured.Themajorityofourrecordedliabilityforself-

insuredemployeehealthandpropertyandcasualtylosses

representsestimatedreservesforincurredclaimsthathave

yettobefiledorsettled.

OFF-BALANCESHEETARRANGEMENTS

Wehadprovidedapproximately$16millionofpartialguar-

antees of two franchisee loan pools related primarily to

theCompany’shistoricalrefranchisingprograms and,to a

lesserextent,franchiseedevelopmentofnewrestaurants,

atDecember25,2004.Insupportoftheseguarantees,we

posted$4millionoflettersofcreditatDecember25,2004.

Wealsoprovidedastandbyletterofcreditof$18millionat

December25, 2004,under which we could potentially be

requiredtofundaportionofoneofthefranchiseeloanpools.

The total loans outstanding under these loan pools were

approximately$90millionatDecember25,2004.

Any funding under the guarantees or letters of credit

wouldbesecuredbythefranchiseeloansandanyrelated

collateral.Webelievethatwehaveappropriatelyprovidedfor

ourestimatedprobableexposuresunderthesecontingent

liabilities. These provisions were primarily charged to net

refranchisingloss(gain).Newloansarenotcurrentlybeing

addedtoeitherloanpool.

Wehaveguaranteedcertainlinesofcreditandloansof

unconsolidatedaffiliatestotaling$34millionatDecember25,

2004.Ourunconsolidatedaffiliateshadtotal revenuesof

over $1.7billion for the year ended December25, 2004

and assets and debt of approximately $884million and

$49million,respectively,atDecember25,2004.

OTHERSIGNIFICANTKNOWNEVENTS,TRENDS

ORUNCERTAINTIESEXPECTEDTOIMPACT2005

OPERATINGPROFITCOMPARISONSWITH2004

NewAccountingPronouncementsNotYetAdopted Upon

theadoptionofStatementofFinancialAccountingStandards

No. 123 (Revised 2004), “Share-Based Payment” (“SFAS

123R”)in2005,wewillberequiredtorecognizecompen-

sationcostinthefinancialstatementsforallshare-based

paymentstoouremployees,includinggrantsofstockoptions,

basedonthefairvalue oftheshare-basedawardsonthe

dateofgrant.Thefairvalueoftheshare-basedawardswillbe

determinedusingoptionpricingmodelsandassumptionsthat

appropriatelyreflectthespecificcircumstancesoftheawards.

Compensationcostwillberecognizedoverthevestingperiod

basedonthefairvalueofawardsthatactuallyvest.

SFAS 123R is effective at the beginning of the first

interimorannualperiodbeginningafterJune15,2005(the

quarterendingDecember31,2005forthe Company)and

earlyadoptionisencouraged.Weareintheprocessofevalu-

atingtheuseofcertainoption-pricingmodelsaswellasthe

assumptionstobeusedinsuchmodels.Whensuchevalua-

tioniscomplete,wewilldeterminethetransitionmethodto

useandthetimingofadoption.Wecurrentlydonotanticipate

thatthe impact on netincomeona full year basisofthe

adoptionofSFAS123Rwillbesignificantlydifferentfromthe

historicalproformaimpactsaspreviouslydisclosed.

SeeNote2.

SaleofPuertoRicoBusiness Asaresultofthesaleofour

PuertoRicobusinessonOctober4,2004,Companysales,

restaurantprofitandgeneralandadministrativeexpenses

willdecrease by$159million,$29millionand$8million,

respectively,andweestimatefranchisefeeswillincreaseby

$10millionfortheyearendedDecember31,2005compared

totheyearendedDecember25,2004.

ExtraWeekin2005 Ourfiscalcalendarresultsinafifty-

thirdweekeveryfiveorsixyears.Fiscalyear2005willinclude

afifty-thirdweekinthefourthquarterforthemajorityofour

U.S.businessesaswellasourinternationalbusinessesthat

reportonaperiod,asopposedtoamonthly,basis.IntheU.S.,

weanticipatepermanentlyacceleratingthetimingoftheKFC

businessclosingbyoneweekinDecember2005,andthus,

therewillbenofifty-thirdweekbenefitforthisbusinessin

2005.Weestimatethefifty-thirdweekwillincreaserevenues

andoperatingprofitin2005byapproximately$80millionand

$15million,respectively.Whiletheimpactofthefifty-third

weekaddsapotentialincrementalbenefitof$0.04todiluted

earningspershare,webelievethisbenefitwillbeoffsetby

expenseassociatedwithstrategicassetactionsandrefran-

chisingKFCrestaurantsintheU.S.

International Reporting Changes In the first quarter of

2005wewillbeginreportinginformationforourinternational

businessesintwoseparateoperatingsegmentsasaresult

of changes to our management reporting structure. The

ChinaDivisionwillincludeMainlandChina(“China”),Thailand

andKFCTaiwan,andtheInternationalDivisionwillinclude

theremainderofourinternationaloperations.Thisreporting

changewillnotimpactourconsolidatedresults.

In the first quarter of 2005 we will also change the

Chinabusinessreportingcalendartomorecloselyalignthe

timingofthereportingofitsresultsofoperationswithour

U.S.business.PreviouslyourChinabusiness,liketherest

ofourinternationalbusinesses,closedonemonth(orone

periodforcertainofourinternationalbusinesses)earlierthan

YUM’speriodenddatetofacilitateconsolidatedreporting.

Asaresult,theoperationsoftheChinabusinessfortheone

monthperiodendingDecember31,2004willberecognized

asanadjustmenttoconsolidatedretainedearningsinthe

firstquarterof2005,asopposedtobeingrecordedinour

ConsolidatedStatementofIncome,tomaintaincomparability

ofourconsolidatedresultsofoperations.Ourconsolidated

resultsofoperationsforthefirstquarterof2005willthus

includetheresultsofoperationsoftheChinabusinessfor

themonthsofJanuaryandFebruaryandthemonthsincluded

ineachquarterlyreportingperiodthereafterwillbeginone

monthlaterin2005thaninpreviousyears.

42