Pizza Hut 2004 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

InNovember1997,wegrantedperformance-restrictedstock

unitsofYUM’sCommonStockintheamountof$3.6million

toourChiefExecutiveOfficer(“CEO”).Theawardwasmade

underthe1997LTIPandmaybepaidinCommonStockor

cashatthediscretionoftheCompensationCommitteeofthe

BoardofDirectors.Paymentoftheawardiscontingentupon

hisemploymentthrough January25,2006 andourattain-

ment of certain pre-established earnings thresholds. The

annualexpenserelatedtothisawardincludedinearnings

was$0.4millionfor2004,2003and2002.

OTHERCOMPENSATIONANDBENEFITPROGRAMS

NOTE19

Wesponsortwodeferredcompensationbenefitprograms,the

RestaurantDeferredCompensationPlanandtheExecutive

Income Deferral Program (the “RDC Plan” and the “EID

Plan,”respectively)foreligibleemployeesandnon-employee

directors.

EffectiveOctober1,2001,participantscannolonger

deferfundsintotheRDCPlan.Priortothatdate,theRDC

Planallowedparticipantstodeferaportionoftheirannual

salary. The participant’s balances will remain in the RDC

Planuntiltheirscheduleddistributiondates.Asdefinedby

theRDCPlan,wecredittheamountsdeferredwithearnings

basedontheinvestmentoptionsselectedbytheparticipants.

Investment options in the RDC Plan consist of phantom

sharesofvarious mutual fundsand YUMCommonStock.

Werecognizecompensation expense fortheappreciation

ordepreciation,ifany,attributabletoallinvestmentsinthe

RDCPlan.OurobligationsundertheRDCprogramasofboth

year-end2004and2003were$11million.Werecognized

compensationexpenseof$2millionin2004,$3millionin

2003andlessthan$1millionin2002fortheRDCPlan.

TheEIDPlan allows participantstodeferreceiptofa

portionoftheirannualsalaryandalloraportionoftheir

incentivecompensation.AsdefinedbytheEIDPlan,wecredit

theamountsdeferredwithearnings basedontheinvest-

mentoptionsselectedbytheparticipants.Theseinvestment

options are limited to cash and phantom shares of our

CommonStock. TheEID Planallowsparticipants to defer

incentivecompensationtopurchasephantomsharesofour

CommonStockata25%discountfromtheaveragemarket

priceatthedateofdeferral(the“DiscountStockAccount”).

Participantsbeartheriskofforfeitureofboththediscount

andanyamountsdeferredtotheDiscountStockAccountif

theyvoluntarilyseparatefromemploymentduringthetwo-year

vestingperiod.Weexpensetheintrinsicvalueofthediscount

overthevestingperiod.Asinvestmentsinthephantomshares

ofourCommonStockcanonlybesettledinsharesofour

CommonStock,wedonotrecognizecompensationexpense

fortheappreciationorthedepreciation,ifany,oftheseinvest-

ments.DeferralsintothephantomsharesofourCommon

StockarecreditedtotheCommonStockAccount.

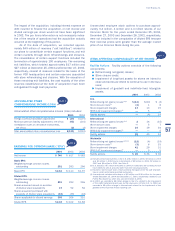

Asummaryofthestatusofalloptionsgrantedtoemployeesandnon-employeedirectorsasofDecember25,2004,December27,

2003andDecember28,2002,andchangesduringtheyearsthenendedispresentedbelow(tabularoptionsinthousands):

2004 2003 2002

Wtd.Avg. Wtd.Avg. Wtd.Avg.

Exercise Exercise Exercise

Options Price Options Price Options Price

Outstandingatbeginningofyear 46,971 $18.77 49,630 $17.54 54,452 $16.04

Grantedatpriceequaltoaveragemarketprice 5,223 35.17 7,344 24.78 6,974 25.52

Exercised (12,306) 16.27 (6,902) 16.18 (8,876) 14.06

Forfeited (2,780) 23.75 (3,101) 19.18 (2,920) 19.07

Outstandingatendofyear 37,108 $21.53 46,971 $18.77 49,630 $17.54

Exercisableatendofyear 21,033 $17.64 19,875 $17.22 17,762 $13.74

Weighted-averagefairvalueofoptionsgrantedduringtheyear $15.11 $ 9.43 $10.44

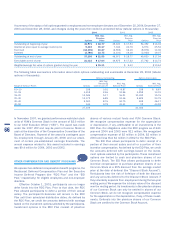

ThefollowingtablesummarizesinformationaboutstockoptionsoutstandingandexercisableatDecember25,2004(tabular

optionsinthousands):

OptionsOutstanding OptionsExercisable

Wtd.Avg.

Remaining Wtd.Avg. Wtd.Avg.

RangeofExercisePrices Options ContractualLife ExercisePrice Options ExercisePrice

$0–10 338 0.51 $ 8.87 338 $ 8.87

10–15 4,418 2.46 12.96 4,258 13.01

15–20 13,536 5.17 16.21 10,392 15.76

20–30 13,172 6.85 24.46 5,625 23.75

30–40 5,500 8.76 34.75 408 36.17

40–50 144 9.79 41.41 12 43.52

37,108 21,033

66