Pizza Hut 2004 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’sDiscussionandAnalysis

ofFinancialConditionandResultsofOperations

INTRODUCTIONANDOVERVIEW

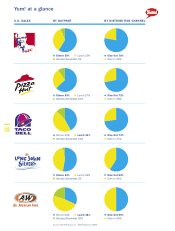

YUM! Brands, Inc. and Subsidiaries (collectively referred

toas “YUM” orthe“Company”) comprises the worldwide

operationsofKFC,PizzaHut,TacoBell,LongJohnSilver’s

(“LJS”) and A&W All-American Food Restaurants (“A&W”)

(collectively“theConcepts”)andistheworld’slargestquick

servicerestaurant(“QSR”)companybasedonthenumberof

systemunits.LJSandA&WwereaddedwhenYUMacquired

YorkshireGlobalRestaurants,Inc.(“YGR”)onMay7,2002.

With12,998internationalunits,YUMisthesecondlargest

QSRcompanyoutsidetheU.S.YUMbecameanindependent,

publicly-ownedcompanyonOctober6,1997(the“Spin-off

Date”)viaatax-freedistributionofourCommonStock(the

“Distribution”or“Spin-off”)totheshareholdersofourformer

parent,PepsiCo,Inc.(“PepsiCo”).

ThroughitsConcepts,YUMdevelops,operates,franchises

andlicensesasystemofbothtraditionalandnon-traditional

QSRrestaurants.Traditionalunitsfeaturedine-in,carryout

and,insomeinstances,drive-thruordeliveryservices.Non-

traditionalunits,whicharetypicallylicensedoutlets,include

expressunitsandkioskswhichhaveamorelimitedmenu

andoperateinnon-traditionallocationslikemalls,airports,

gasoline service stations, convenience stores, stadiums,

amusementparksandcolleges,whereafull-scaletraditional

outletwouldnotbepracticalorefficient.

Theretailfoodindustry,inwhichtheCompanycompetes,

ismadeupofsupermarkets,supercenters,warehousestores,

conveniencestores,coffeeshops,snackbars,delicatessens

andrestaurants(includingtheQSRsegment),andisintensely

competitivewithrespecttofoodquality,price,service,conve-

nience,locationandconcept.Theindustryisoftenaffected

bychanges inconsumertastes;national,regionalorlocal

economic conditions; currency fluctuations; demographic

trends; traffic patterns; the type, number and location of

competing food retailers and products; and disposable

purchasingpower.EachoftheConceptscompeteswithinter-

national,nationalandregionalrestaurantchainsaswellas

locally-ownedrestaurants,notonlyforcustomers,butalsofor

managementandhourlypersonnel,suitablerealestatesites

andqualifiedfranchisees.

TheCompany’skeystrategiesare:

BuildingdominantrestaurantbrandsinChina

Drivingprofitableinternationalexpansion

Improvingrestaurantoperations

Multibrandingcategory-leadingbrands

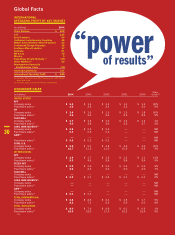

The Company is focused on five long-term measures

identifiedasessential to ourgrowthand progress.These

fivemeasuresandrelatedkeyperformanceindicatorsareas

follows:

Internationalexpansion

•Internationalsystem-salesgrowth(localcurrency)

•Numberofnewinternationalrestaurantopenings

•Netinternationalunitgrowth

Multibrandinnovationandexpansion

•Numberofmultibrandrestaurantlocations

•Numberofmultibrandunitsadded

•Numberoffranchisemultibrandunitsadded

Portfolioofcategory-leadingU.S.brands

•U.S.blendedsamestoresalesgrowth

•U.S.systemsalesgrowth

Globalfranchisefees

•Newrestaurantopeningsbyfranchisees

•Franchisefeegrowth

Strongcashgenerationandreturns

•Cashgeneratedfromallsources

•Cashgeneratedfromallsourcesaftercapital

spending

•Restaurantmargins

Our progress against these measures is discussed

throughout the Management’s Discussion and Analysis

(“MD&A”).

Throughout the MD&A, the Company provides the

percentagechangeexcludingtheimpactofforeigncurrency

translation.Theseamountsarederivedbytranslatingcurrent

yearresultsatprioryearaverageexchangerates.Webelieve

the elimination of the foreign currency translation impact

providesbetteryear-to-yearcomparabilitywithoutthedistor-

tionofforeigncurrencyfluctuations.

This MD&A should be read in conjunction with our

ConsolidatedFinancialStatementsonpages47through50

andtheCautionaryStatementsonpage46.AllNoterefer-

enceshereinrefertotheNotestotheConsolidatedFinancial

Statementsonpages51through73.Tabularamountsare

displayedinmillionsexceptpershareandunitcountamounts,

orasotherwisespecificallyidentified.

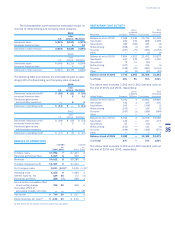

FACTORSAFFECTINGCOMPARABILITYOF2004RESULTS

TO2003RESULTSAND2003RESULTSTO2002RESULTS

Lease Accounting Adjustments In late 2004 and early

2005, a number of companies within the QSR industry

announcedadjustmentstotheiraccountingforleasesand

thedepreciationofleaseholdimprovements.Inconsultation

withourexternalauditors,wealsodeterminedthatanadjust-

mentwasnecessarytomodifyouraccountingintheseareas.

Accordingly,inthefourthquarterof 2004,we recordedan

adjustmentsuchthatallofourleaseholdimprovementsare

nowbeingdepreciatedovertheshorteroftheirusefullives

orthetermofthelease,includingoptionsinsomeinstances,

overwhichwearerecordingrentexpense,includingescala-

tions,onastraight-linebasis.

Thecumulativeadjustment,primarilythroughincreased

U.S.depreciationexpense,totaled$11.5million($7million

after tax). Theportions of this adjustment that related to

2004fullyearand2004fourthquarterwereapproximately

$3million and $1million, respectively. As the portion of

ouradjustmentrecordedthatwasacorrectionoferrorsof

amountsreportedinourpriorperiodfinancialstatementswas

notmaterialtoanyofthosepriorperiodfinancialstatements,

theentireadjustmentwasrecordedinthe2004Consolidated

FinancialStatementsandnoadjustmentwasmadetoany

prior period financial statements. We anticipate that the

impact of this accounting change will result in additional

expenseof$3millionin2005.

33

Yum!Brands,Inc.