Pizza Hut 2004 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

therecognitionin2004ofvaluationallowancesforcertain

deferredtaxassetswhoserealizationisnolongerconsidered

morelikelythannot.

The2003effectivetaxratedecreased1.9percentage

pointsto30.2%.Thedecreaseintheeffectivetaxratewas

primarilyduetoa4.1percentagepointbenefitofamending

certainpriorU.S.incometaxreturnstoclaimcreditforforeign

taxespaidinprioryears.Thereturnswereamendedupon

ourdeterminationthatitwasmorebeneficialtoclaimcredit

forsuchtaxesthantodeductsuchtaxes,ashadbeendone

whenthereturnswereoriginallyfiled.Infutureyears,weantic-

ipatecontinuingtoclaimcreditforforeigntaxespaidinthe

thencurrentyear,aswehavedonein2004,2003and2002.

However,theamendedreturnbenefitrecognizedin2003was

non-recurring.Thedecreaseinthe2003effectivetaxrate

waspartiallyoffsetbytherecognitionofvaluationallowances

forcertaindeferredtaxassetswhoserealizationisnolonger

consideredmorelikelythannot.SeeNote22foradiscussion

ofvaluationallowances.

Adjustments to reserves and prior years include the

effectsofthereconciliationofincometaxamountsrecorded

in our Consolidated Statements of Income to amounts

reflectedonourtaxreturns,includinganyadjustmentstothe

ConsolidatedBalanceSheets.Adjustmentstoreservesand

prioryearsalsoincludeschangesintaxreservesestablished

forpotentialexposurewemayincurifataxingauthoritytakes

apositiononamattercontrarytoourposition.Weevaluate

thesereserves,including interest thereon,onaquarterly

basistoinsurethattheyhavebeenappropriatelyadjusted

forevents,includingauditsettlements,thatwebelievemay

impactourexposure.

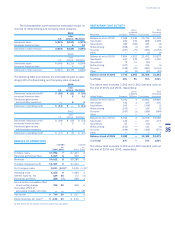

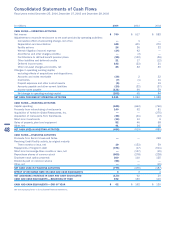

CONSOLIDATEDCASHFLOWS

Netcashprovidedbyoperatingactivitieswas$1,131million

compared to $1,053million in 2003. The increase was

primarilydrivenbyanincreaseinnetincomeandadecrease

intheamountofvoluntarycontributionstoourfundedpension

plancomparedto2003,partiallyoffsetbyhigherincometax

paymentsin2004.

In2003,netcashprovidedbyoperatingactivitieswas

$1,053million compared to $1,088million in 2002. The

decreasewasprimarilydrivenby$130millioninvoluntary

contributionstoourfundedpensionplanin2003,partially

offsetbyhighernetincome.

Netcashusedininvestingactivitieswas$486million

versus$519million in 2003.Thedecrease wasprimarily

drivenbyhigherproceedsfromrefranchisingofrestaurants

andlowercapitalspendingcomparedto2003,partiallyoffset

bytheimpactofthetimingofpurchasesandsalesofshort-

terminvestments.

In 2003, net cash used in investing activities was

$519millionversus$885millionin2002.Thedecreasein

cashusedwasprimarilydrivenbythe$275millionacquisi-

tionofYGRin2002andlowercapitalspendingin2003.

Netcashusedinfinancingactivitieswas$779million

versus $475million in 2003. The increase in 2004 was

primarilydrivenbyhighersharerepurchases,highernetdebt

repaymentsandthepaymentoftwoquarterlydividends,partially

offsetbyhigherproceedsfromstockoptionexercises.

In 2003, net cash used in financing activities was

$475million versus $187million in 2002. The increase

wasprimarilydrivenbyhighernetdebtrepaymentsandhigher

sharesrepurchasedin2003.

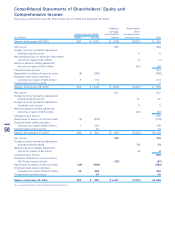

CONSOLIDATEDFINANCIALCONDITION

Assetsincreased$76millionor1%to$5.7billionprimarily

duetoanincreaseinproperty,plantandequipmentdrivenby

capitalexpendituresinexcessofdepreciation.Theincrease

wasalsopartiallydrivenbytheexistenceofafederalincome

tax receivable at December25,2004 recordedinprepaid

expensesandothercurrentassetsandthetimingofthecollec-

tionofcertainaccountsreceivable.Theincreasewaspartially

offsetbytheimpactofhigherspendingforfinancingactivities

comparedto2003,asdescribedabove,andadecreasein

otherassetsasaresultoftheutilizationofdeferredincome

taxassetsin2004.

Liabilitiesdecreased$399millionor9%to$4.1billion

primarily due to lower long-term debt as a result of the

early redemptionof our 2005 Senior Unsecured Notes of

$350millionin2004andlowerincometaxespayabledue

totheexcessofcurrentyeartaxpaymentsmadeoverthe

currentyearprovision.

LIQUIDITYANDCAPITALRESOURCES

OperatingintheQSRindustryallowsustogeneratesubstan-

tialcashflowsfromtheoperationsofourcompanystores

andfromourfranchiseoperations,whichrequirealimited

YUMinvestment.Ineachofthelastthreefiscalyears,net

cashprovidedbyoperatingactivitieshasexceeded$1billion.

Thesecashflowshaveallowedustofundourdiscretionary

spending, while at the same time reducing our long-term

debtbalances.Weexpecttheselevelsofnetcashprovided

byoperatingactivitiestocontinueintheforeseeablefuture.

Ourdiscretionaryspendingincludescapitalspendingfornew

restaurants,acquisitions of restaurants fromfranchisees,

repurchasesofsharesofourcommonstockanddividends

paidtoourshareholders.Thoughadeclineinrevenuescould

adverselyimpactourcashflowsfromoperations,webelieve

ouroperatingcashflows,ourabilitytoreducediscretionary

spending,andourborrowingcapacitywillallowustomeetour

cashrequirementsin2005andbeyond.

We initiated the payment of quarterly dividends in

2004withtwoquarterlydividendspaidtotaling$58million.

Additionally,onNovember12,2004ourBoardofDirectors

approveda cash dividend of $0.10 pershareofcommon

stocktobedistributedonFebruary4,2005toshareholders

ofrecordatthecloseofbusinessonJanuary14,2005.On

40