Pizza Hut 2004 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

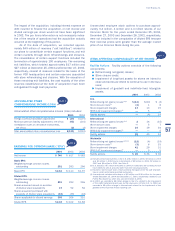

rate swaps with notional amounts of$850million.These

swapshaveresetdatesandfloatingrateindiceswhichmatch

thoseofourunderlyingfixed-ratedebtandhavebeendesig-

natedasfairvaluehedgesofaportionofthatdebt.Asthe

swapsqualifyfortheshort-cutmethodunderSFAS133,no

ineffectiveness has been recorded. The net fair value of

theseswapsasofDecember25,2004wasapproximately

$29million,ofwhich$30millionand$1millionhavebeen

includedin otherassetsandotherliabilitiesand deferred

credits,respectively.Theportionofthisfairvaluewhichhas

notyetbeenrecognizedasareductiontointerestexpense

atDecember25,2004(approximately$21million)hasbeen

includedinlong-termdebt.

Duetoearlyredemptionoftheunderlying7.45%Senior

Unsecured Notes on November 15, 2004 (see Note 14),

pay-variable interest rate swaps with notional amounts

of $350million that qualified for hedge accounting at

December27,2003,nolongerqualifyforhedgeaccounting

atDecember25,2004.Asweelectedtoholdtheseswaps

untiltheirMay2005maturity,weenteredintonewpay-fixed

interest rate swaps with offsetting notional amounts and

terms.Gainsorlossesduetochangesinthefairvalueof

thepay-variableswapswillberecognizedintheresultsof

operationsthroughMay2005butthesegainsorlossesare

expectedtobealmostentirelyoffsetbychangesinfairvalue

ofthepay-fixedswaps.Thefairvalueofbothoftheseswaps

wereinanassetpositionasofDecember25,2004witha

fairvaluetotalingapproximately$9million.Thisfairvaluehas

beenincludedinprepaidexpensesandothercurrentassets.

Thefairvalueoftheswapsthatpreviouslyqualifiedforhedge

accounting was$31millionat December27,2003,which

wasincludedinotherassets.Theportionofthisfairvalue

which had notbeen recognizedasa reduction to interest

expenseatDecember27,2003(approximately$29million)

wasincludedinlong-termdebt.

ForeignExchange DerivativeInstruments We enter into

foreign currency forward contracts with the objective of

reducing our exposure to cash flow volatility arising from

foreigncurrencyfluctuationsassociatedwithcertainforeign

currency denominated financial instruments, the majority

of which are intercompany short-term receivables and

payables.Thenotionalamount,maturitydate,andcurrency

ofthesecontractsmatchthoseoftheunderlyingreceivables

or payables. For those foreign currency exchange forward

contractsthatwehavedesignatedascashflowhedges,we

measureineffectivenessbycomparingthecumulativechange

intheforward contract withthecumulative changein the

hedgeditem. No ineffectivenesswasrecognizedin2004,

2003or2002forthoseforeigncurrencyforwardcontracts

designatedascashflowhedges.

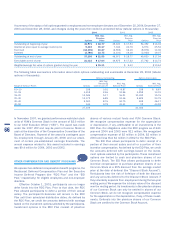

EquityDerivativeInstruments OnDecember3,2004,we

enteredintoanacceleratedsharerepurchaseprogram(the

“Program”).InconnectionwiththeProgram,athird-partyinvest-

mentbankborrowedapproximately5.4millionsharesofour

commonstockfromshareholders.Wethenrepurchasedthose

sharesattheirthenmarketvalue($46.58)fromtheinvest-

mentbankforapproximately$250million.Therepurchaseof

the5.4millionshareswasmadepursuanttoa$300million

sharerepurchaseprogramauthorizedbyourBoardofDirectors

inMay2004.

Simultaneously,weenteredintoaforwardcontractwith

the investment bank that was indexed to the number of

sharesrepurchased.Underthetermsoftheforwardcontract

wewillreceiveorberequiredtopayapriceadjustmentbased

onthedifferencebetweentheweightedaveragepriceofour

commonstockoverthedurationoftheProgramandtheinitial

purchasepriceof$46.58pershare.WeexpecttheProgram

tobecompletedbytheendofourfirstfiscalquarterin2005.

Atourelection,anypaymentsweareobligatedtomakewill

eitherbeincashorinsharesofourcommonstock(notto

exceed15millionsharesasspecifiedintheforwardcontract).

Therefore,inaccordance withEITF 00-19,“Accounting for

DerivativeFinancialInstrumentsIndexedto,andPotentially

SettledIn,aCompany’sOwnStock,”anychangesinthefair

valueoftheforwardcontractwillberecognizedasanadjust-

ment to Shareholders’ Equity at the end of the Program.

Through December25, 2004, the difference between the

weightedaveragepriceofourcommonstockandtheinitial

purchasepricewasinsignificant.

Commodity Derivative Instruments Wealsoutilize,on a

limitedbasis,commodity futures andoptionscontractsto

mitigateourexposuretocommoditypricefluctuationsover

thenexttwelvemonths.Thosecontractshavenotbeendesig-

nated as hedges under SFAS133. Commodity future and

optionscontractsdidnotsignificantlyimpacttheConsolidated

FinancialStatementsin2004,2003or2002.

DeferredAmountsinAccumulated OtherComprehensive

Income (Loss) As of December25,2004,we had a net

deferredlossassociatedwithcashflowhedgesofapproxi-

mately$2million,netoftax.Theloss,whichprimarilyarose

fromthesettlementoftreasurylocksenteredintopriorto

theissuanceofcertainamountsofourfixed-ratedebt,willbe

reclassifiedintoearningsfromJanuary1,2005through2012

asanincreasetointerestexpenseonthisdebt.

CreditRisks Creditriskfrominterestrateswapsandforeign

exchange contracts is dependent both on movement in

interestandcurrencyratesandthepossibilityofnon-payment

bycounterparties.Wemitigatecreditriskbyenteringinto

62