Pizza Hut 2004 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

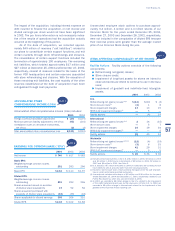

PlanAssets Ourpensionplanweighted-averageassetallo-

cations at September 30,byasset category areset forth

below:

AssetCategory2004 2003

Equitysecurities 70% 65%

Debtsecurities 28% 30%

Cash 2% 5%

Total 100% 100%

Ourprimaryobjectivesregardingthepensionassetsareto

optimizereturnonassetssubjecttoacceptableriskandto

maintainliquidity,meetminimumfundingrequirementsand

minimizeplanexpenses.Toachievetheseobjectives,wehave

adoptedapassiveinvestmentstrategyinwhichtheasset

performanceisdrivenprimarilybytheinvestmentallocation.

Ourtargetinvestmentallocationis70%equitysecuritiesand

30%debtsecurities,consistingprimarilyoflowcostindex

mutual funds that track several sub-categories of equity

anddebtsecurityperformance.Theinvestmentstrategyis

primarilydrivenbyourPlan’sparticipants’agesandreflectsa

long-terminvestmenthorizonfavoringahigherequitycompo-

nentintheinvestmentallocation.

A mutual fund held as an investment by the Plan

includesYUMstockintheamount of$0.2millionatboth

September30,2004and2003(lessthan1%oftotalplan

assetsineachinstance).

BenefitPayments Thebenefitsexpectedtobepaidineach

ofthenextfiveyearsandintheaggregateforthefiveyears

thereafteraresetforthbelow:

Pension Postretirement

Yearended: Benefits MedicalBenefits

2005 $ 17 $ 5

2006 22 5

2007 25 6

2008 28 6

2009 32 6

2010–2014 242 35

Expected benefits are estimated based on the same

assumptions used to measure our benefit obligation on

ourmeasurementdateofSeptember30,2004andinclude

benefitsattributabletoestimatedfurtheremployeeservice.

STOCK-BASEDEMPLOYEECOMPENSATION

NOTE18

Atyear-end2004,wehadfourstockoptionplansineffect:

theYUM!Brands,Inc.Long-TermIncentivePlan(“1999LTIP”),

the1997Long-TermIncentivePlan(“1997LTIP”),theYUM!

Brands,Inc.RestaurantGeneralManagerStockOptionPlan

(“RGMPlan”)andtheYUM!Brands,Inc. SharePowerPlan

(“SharePower”).During2003,the1999LTIPwasamended,

subsequenttoshareholderapproval,to increase thetotal

numberofsharesavailableforissuanceandtomakecertain

othertechnicalandclarifyingchanges.

We may grant awards of up to 29.8million shares

and 45.0million shares of stockunder the 1999 LTIP,as

amended,and1997LTIP,respectively. Potentialawardsto

employeesandnon-employeedirectorsunderthe1999LTIP

includestockoptions,incentivestockoptions,stockapprecia-

tionrights,restrictedstock,stockunits,restrictedstockunits,

performancesharesandperformanceunits.Potentialawards

toemployeesandnon-employeedirectorsunderthe1997

LTIPincludestockappreciationrights,restrictedstockand

performance-restrictedstockunits.PriortoJanuary1,2002,

wealsocouldgrantstockoptionsandincentivestockoptions

underthe1997LTIP.Wehaveissuedonlystockoptionsand

performance-restrictedstockunitsunderthe1997LTIPand

haveissuedonlystockoptionsunderthe1999LTIP.

We may grant stock options under the 1999 LTIP to

purchasesharesatapriceequaltoorgreaterthantheaver-

agemarketpriceofthestockonthedateofgrant.Newoption

grantsunderthe1999LTIPcanhavevaryingvestingprovisions

andexerciseperiods.Previouslygrantedoptionsunderthe

1997LTIPand1999LTIPvestinperiodsrangingfromimmedi-

ateto2008andexpiretentofifteenyearsaftergrant.

Wemaygrantoptionsto purchaseupto 15.0million

sharesofstockundertheRGMPlanatapriceequaltoor

greaterthantheaveragemarketpriceofthestockonthedate

ofgrant.RGMPlanoptionsgrantedhaveafour-yearvesting

periodandexpiretenyearsaftergrant.Wemaygrantoptions

topurchase up to 14.0millionsharesof stockat aprice

equaltoorgreaterthantheaveragemarketpriceofthestock

onthedateofgrantunderSharePower.Previouslygranted

SharePoweroptionshaveexpirationsthrough2014.

AttheSpin-offDate,weconvertedcertainoftheunvested

options to purchase PepsiCo stock that were held by our

employeestoYUMstockoptionsundereitherthe1997LTIP

orSharePower.Weconverted theoptionsat amountsand

exercisepricesthat maintainedtheamountofunrealized

stockappreciationthatexistedimmediatelypriortotheSpin-

off.Thevestingdatesandexerciseperiodsoftheoptions

werenotaffectedbytheconversion.Basedontheiroriginal

PepsiCograntdate,theseconvertedoptionsvestinperiods

rangingfromonetotenyearsandexpiretentofifteenyears

aftergrant.

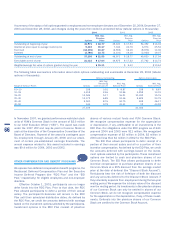

Weestimatedthefairvalueofeachoptiongrantmade

during2004,2003and2002asofthedateofgrantusing

theBlack-Scholes option-pricing model withthe following

weighted-averageassumptions:

2004 2003 2002

Risk-freeinterestrate 3.2% 3.0% 4.3%

Expectedlife(years) 6.0 6.0 6.0

Expectedvolatility 40.0% 33.6% 33.9%

Expecteddividendyield 0.1%(a) 0.0% 0.0%

(a)Theweighted-averageassumption for theexpected dividend yieldreflects an

assumptionof0%forstockoptionsgrantedpriortotheinitiationofourquarterly

stockdividendin2004and1%thereafter.

65

Yum!Brands,Inc.