Pizza Hut 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

determined to have a finite useful life, we amortize the

intangibleassetprospectivelyoveritsestimatedremaining

usefullife.Amortizableintangibleassetsareamortizedon

astraight-linebasisover3to40years.Asdiscussedabove,

wesuspendamortizationonthoseintangibleassetswitha

definedlifethatareallocatedtorestaurantsthatareheld

forsale.

InaccordancewiththerequirementsofSFAS142,goodwill

hasbeenassignedtoreportingunitsforpurposesofimpair-

menttesting.Ourreportingunitsareouroperatingsegments

intheU.S.(seeNote23)andourbusinessmanagementunits

internationally(typicallyindividualcountries).Goodwillimpair-

menttestsconsistofacomparisonofeachreportingunit’s

fairvaluewithitscarryingvalue.Thefairvalueofareporting

unitisanestimate of theamountforwhichtheunitasa

wholecouldbesoldinacurrenttransactionbetweenwilling

parties.Wegenerallyestimatefairvaluebasedondiscounted

cashflows.Ifthecarryingvalueofareportingunitexceeds

itsfairvalue,goodwilliswrittendowntoitsimpliedfairvalue.

Wehaveselectedthebeginningofourfourthquarterasthe

dateonwhichtoperformourongoingannualimpairmenttest

forgoodwill.For2004and2003,therewasnoimpairment

ofgoodwillidentifiedduringourannualimpairmenttesting.

For2002,goodwillassignedtothePizzaHutFrancereporting

unit was deemed impaired and written off. The charge of

$5millionwasrecordedinfacilityactions.

Forindefinite-livedintangibleassets,ourimpairmenttest

consistsofacomparisonofthefairvalueofanintangible

assetwithitscarryingamount.Fairvalueisanestimateof

thepriceawillingbuyerwouldpayfortheintangibleasset

andisgenerallyestimatedbydiscountingtheexpectedfuture

cash flows associated with the intangible asset. We also

performourannualtestforimpairmentofourindefinite-lived

intangibleassetsatthebeginningofourfourthquarter.Our

indefinite-livedintangibleassetsconsistofvaluesassigned

tocertaintrademarks/brandswehaveacquired.Whendeter-

miningthefairvalue,welimitassumptionsaboutimportant

factorssuchassalesgrowthtothosethataresupportable

basedonourplansforthetrademark/brand.Asdiscussedin

Note12,werecordeda$5millionchargein2003asaresult

oftheimpairmentofanindefinite-livedintangibleasset.This

charge was recorded infacilityactions. No impairment of

indefinite-livedintangibleswasrecordedin2004or2002.

Stock-Based Employee Compensation At December25,

2004,theCompanyhadfourstock-basedemployeecompen-

sationplansineffect,whicharedescribedmorefullyinNote

18.TheCompanyaccountsforthoseplansundertherecog-

nitionandmeasurementprinciplesofAccountingPrinciples

Board Opinion No.25, “Accounting for Stock Issued to

Employees”(“APB25”),andrelatedInterpretations.Nostock-

basedemployeecompensationcostisreflectedinnetincome

foroptionsgrantedundertheseplans,asallsuchoptions

hadanexercisepriceequaltothemarketvalueoftheunder-

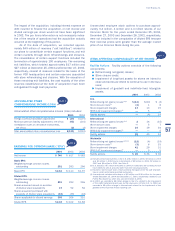

lyingcommonstockonthedateofgrant.Thefollowingtable

illustratestheeffectonnetincomeandearningspershareif

theCompanyhadappliedthefairvaluerecognitionprovisions

ofSFASNo.123,“AccountingforStock-BasedCompensation”

(“SFAS123”),tostock-basedemployeecompensation.

2004 2003 2002

NetIncome,asreported $ 740 $ 617 $ 583

Deduct:Totalstock-basedemployee

compensationexpensedetermined

underfairvaluebasedmethodfor

allawards,netofrelatedtaxeffects (34) (36) (39)

Netincome,proforma 706 581 544

BasicEarningsperCommonShare

Asreported $2.54 $2.10 $1.97

Proforma 2.42 1.98 1.84

DilutedEarningsperCommonShare

Asreported $2.42 $2.02 $1.88

Proforma 2.31 1.91 1.76

DerivativeFinancialInstruments Wedonotusederivative

instrumentsfortradingpurposesandwehaveproceduresin

placetomonitorandcontroltheiruse.Ouruseofderivative

instrumentshas included interest rate swaps andcollars,

treasury locks and foreign currency forward contracts. In

addition,onalimitedbasisweutilizecommodityfuturesand

optionscontracts.Ourinterestrateandforeigncurrencyderiv-

ativecontractsareenteredintowithfinancialinstitutionswhile

ourcommodityderivativecontractsareexchangetraded.

Weaccountforthesederivativefinancialinstruments

inaccordancewithSFASNo.133,“AccountingforDerivative

Instruments and Hedging Activities” (“SFAS133”) as

amendedbySFASNo.149,“AmendmentofStatement133on

DerivativeInstrumentsandHedgingActivities”(“SFAS149”).

SFAS133requiresthatallderivativeinstrumentsberecorded

ontheConsolidatedBalanceSheetatfairvalue.Theaccount-

ingforchangesinthefairvalue(i.e.,gainsorlosses)ofa

derivativeinstrumentisdependentuponwhetherthederiva-

tivehasbeendesignatedandqualifiesaspartofahedging

relationshipandfurther,onthetypeofhedgingrelationship.

Forderivativeinstrumentsthataredesignatedandqualifyas

afairvaluehedge,thegainorlossonthederivativeinstru-

mentaswellastheoffsettinggainorlossonthehedgeditem

attributabletothehedgedriskarerecognizedintheresults

ofoperations.Forderivativeinstrumentsthataredesignated

andqualifyasacashflowhedge,theeffectiveportionofthe

gainorlossonthederivativeinstrumentisreportedasacom-

ponentofothercomprehensiveincome(loss)andreclassified

intoearningsinthesameperiodorperiodsduringwhichthe

hedgedtransactionaffectsearnings.Anyineffectiveportionof

thegainorlossonthederivativeinstrumentisrecordedinthe

resultsofoperationsimmediately.Forderivativeinstruments

notdesignatedashedginginstruments,thegainorlossis

recognizedintheresultsofoperationsimmediately.SeeNote

16foradiscussionofouruseofderivativeinstruments,man-

agementofcreditriskinherentinderivativeinstrumentsand

fairvalueinformation.

New Accounting Pronouncements Not Yet Adopted In

October 2004, the FASB ratified the consensus reached

bytheEmergingIssues TaskForce(“EITF”) onIssue04-1

“AccountingforPreexistingRelationshipsbetweentheParties

55

Yum!Brands,Inc.