Pizza Hut 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

anannualbasis,theCompanyistargetingapayoutratioof

15%to20%ofnetincome.

On September 7, 2004, the Company executed an

amendedandrestatedfive-yearseniorunsecuredRevolving

CreditFacility(the“CreditFacility”)totaling$1.0billionwhich

replaced a$1.0billionseniorunsecured Revolving Credit

Facility(the“OldFacility”)withamaturitydateofJune25,

2005.UnderthetermsoftheCreditFacility,theCompanymay

borrowuptothemaximumborrowinglimitlessoutstanding

lettersofcredit.AtDecember25,2004,ourunusedCredit

Facility totaled $776million,net of outstanding lettersof

creditof$205million.Therewereborrowingsof$19million

outstandingundertheCreditFacilityatDecember25,2004.

TheinterestrateforborrowingsundertheCreditFacilityranges

from0.35%to1.625%overtheLondonInterbankOfferedRate

(“LIBOR”)or0.00%to0.20%overanAlternateBaseRate,

whichisthegreaterofthePrimeRateortheFederalFunds

EffectiveRateplus0.50%.TheexactspreadoverLIBORor

theAlternateBaseRate,asapplicable,willdependuponour

performanceunderspecifiedfinancialcriteria.Interestonany

outstandingborrowingsundertheCreditFacilityispayableat

leastquarterly.

TheCreditFacilityisunconditionallyguaranteedbyour

principaldomesticsubsidiariesandcontainsfinancialcove-

nantsrelatingtomaintenanceofleverageandfixedcharge

coverageratios.TheCreditFacilityalsocontainsaffirmative

andnegativecovenantsincluding,amongotherthings,limi-

tations oncertain additionalindebtedness,guaranteesof

indebtedness,levelofcashdividends,aggregate non-U.S.

investmentandcertainothertransactionsasdefinedinthe

agreement. These covenants are substantially similar to

thosecontainedintheOldFacility.Wewereincompliance

withallcovenantsatDecember25,2004,anddonotantici-

patethatthecovenantswillimpactourabilitytoborrowunder

ourCreditFacilityforitsremainingterm.

Theremainderofourlong-termdebtprimarilycomprises

SeniorUnsecuredNotes.AmountsoutstandingunderSenior

UnsecuredNoteswere$1.5billionatDecember25,2004.

On November 15, 2004, we voluntarily redeemed all of

our7.45%SeniorUnsecuredNotesdueinMay2005(the

“2005Notes”)inaccordancewiththeiroriginalterms.The

2005Notes,whichhadafacevalueof$350million,were

redeemedforanamountofapproximately$358millionusing

primarilycashonhandas well assomeborrowingsunder

ourCreditFacility.Theredemptionamountapproximatedthe

carryingvalueofthe2005Notesresultinginnosignificant

impactonnetincome.

Weestimatethatin2005 capitalspending,including

acquisitions of our restaurants from franchisees, will be

approximately$780million.Wealsoestimatethatin2005

refranchisingproceeds,priortotaxes,willbeapproximately

$100million,employeestockoptionsproceeds,priortotaxes,

willbeapproximately$150millionandsalesofproperty,plant

and equipmentwillbeapproximately $80million.A share

repurchaseprogramauthorizedbyourBoardofDirectorsin

May2004isexpectedtobecompletedduringthefirsthalf

of2005.AtDecember25,2004,wehadremainingcapacity

torepurchase,throughNovember2005,uptoapproximately

$25millionofouroutstandingCommonStock(excludingappli-

cabletransactionfees)underthisprogram.InJanuary2005,

theBoardofDirectorsauthorizedanewsharerepurchase

programforupto$500millionoftheCompany’soutstanding

commonstocktobepurchasedthroughJanuary2006.

Inadditiontoanydiscretionaryspendingwemaychoose

tomake,significantcontractualobligationsandpaymentsas

ofDecember25,2004included:

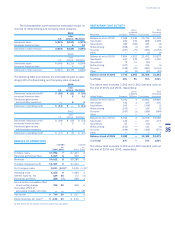

Less More

than 1–3 3–5 than

Total 1Year Years Years 5Years

Long-termdebt(a) $1,598 $ 1 $204 $275 $1,118

Capitalleases(b) 184 18 32 28 106

Operatingleases(b) 2,511 342 564 442 1,163

Purchaseobligations(c) 233 138 39 30 26

Otherlong-term

liabilitiesreflected

onourConsolidated

BalanceSheet

underGAAP 30 — 18 4 8

Totalcontractual

obligations $4,556 $499 $857 $779 $2,421

(a)Excludesafairvalueadjustmentof$21millionincludedindebtrelatedtointerest

rateswapsthathedgethefairvalueofaportionofourdebt.SeeNote14.

(b)Theseobligations,whichareshownonanominalbasis,relatetoapproximately

5,500restaurants.SeeNote15.

(c)Purchaseobligationsinclude agreementstopurchasegoodsor servicesthat

areenforceableandlegallybindingonusandthatspecifyallsignificantterms,

including:fixedorminimumquantitiestobepurchased;fixed,minimumorvariable

priceprovisions;andtheapproximatetimingofthetransaction.Wehaveexcluded

agreements that are cancelable without penalty. Purchase obligations relate

primarilytoinformationtechnology and commodity agreements,purchases of

property,plantandequipmentaswellasmarketing,maintenance,consultingand

otheragreements.

Wehavenotincludedobligationsunder our pensionand

postretirementmedicalbenefitplansinthecontractualobli-

gationstable.Ourfundingpolicyregardingourfundedpension

planistocontributeamountsnecessarytosatisfyminimum

pensionfundingrequirementsplussuchadditionalamounts

fromtimetotimeas aredetermined to be appropriateto

improvetheplan’sfundedstatus.Thepensionplan’sfunded

statusisaffectedbymanyfactorsincludingdiscountrates

and the performanceofplan assets.Wearenot required

tomakeminimumpensionfundingpaymentsin2005,but

we may make discretionary contributions during the year

basedonourestimateoftheplan’sexpectedSeptember30,

2005fundedstatus.During2004,wemadea$50million

discretionarycontributiontoourfundedplan,noneofwhich

representedminimumfundingrequirements.Ourpostretire-

mentplanisnotrequiredtobefundedinadvance,butis

payasyougo.Wemadepostretirementbenefitpaymentsof

$4millionin2004.

Alsoexcludedfromthecontractualobligationstableare

paymentswemaymakeforworkers’compensation,employ-

mentpracticesliability,generalliability,automobileliability

and property losses (collectively “property and casualty

losses”)aswellasemployeehealthcareclaimsforwhichwe

41

Yum!Brands,Inc.