Pizza Hut 2004 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Federal income tax receivables of $59million were

includedinprepaidexpensesandothercurrentassetsat

December25,2004.

We have previously not provided deferred tax on the

undistributedearningsfromourforeigninvestments,except

foramountstoberepatriatedasaresultoftheAct,aswe

believedtheywerepermanentinnature.Weestimatethat

our total net undistributed earnings upon which we have

notprovideddeferredtaxtotalapproximately$300million

atDecember25,2004.Adeterminationofthedeferredtax

liabilityonsuchearningsisnotpracticable.

Wehaveavailablenetoperatinglossandtaxcreditcarry-

forwardstotalingapproximately$1.7billionatDecember25,

2004toreducefuturetaxofYUMandcertainsubsidiaries.

Thecarryforwardsarerelatedtoanumberofforeignandstate

jurisdictions. Ofthesecarryforwards,$30millionexpirein

2005and$1.3billionexpireatvarioustimesbetween2006

and 2023. The remaining carryforwards of approximately

$400milliondonotexpire.

REPORTABLEOPERATINGSEGMENTS

NOTE23

We are principally engaged in developing, operating, fran-

chisingandlicensingtheworldwideKFC,PizzaHutandTaco

Bell concepts, and since May 7, 2002, the LJS and A&W

concepts,whichwere addedwhenweacquiredYGR.KFC,

PizzaHut,TacoBell,LJSandA&WoperatethroughouttheU.S.

andin88,85,10,3and12countriesandterritoriesoutside

theU.S.,respectively.Ourfivelargestinternationalmarkets

basedonoperatingprofitin2004areChina,UnitedKingdom,

Australia,AsiaFranchiseandKorea.AtDecember25,2004,

wehadinvestmentsinnineunconsolidatedaffiliatesoutside

the U.S. which operate principally KFC and/or Pizza Hut

restaurants.TheseunconsolidatedaffiliatesoperateinChina,

Japan,PolandandtheUnitedKingdom.

Weidentifyouroperatingsegmentsbasedonmanagement

responsibilitywithintheU.S.andInternational.Forpurposes

ofapplying SFASNo.131,“Disclosure AboutSegments of

AnEnterpriseandRelatedInformation”(“SFAS131”)inthe

U.S.,weconsiderLJSandA&Wtobeasinglesegment.We

considerourKFC,PizzaHut,TacoBellandLJS/A&Woperating

segmentsintheU.S.tobesimilarandthereforehaveaggre-

gatedthemintoasinglereportableoperatingsegment.

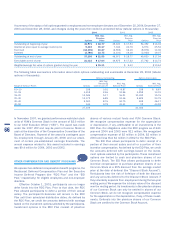

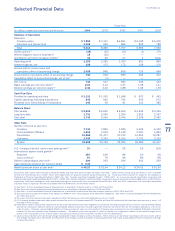

Revenues2004 2003 2002

UnitedStates $5,763 $5,655 $5,347

International(a)3,248 2,725 2,410

$9,011 $8,380 $7,757

OperatingProfit;

InterestExpense,Net;

andIncomeBeforeIncomeTaxes2004 2003 2002

UnitedStates $ 777 $ 812 $ 802

International(b) 542 441 361

Unallocatedandcorporateexpenses (204) (179) (178)

Unallocatedotherincome(expense) (2) (3) (1)

Unallocatedfacilityactions(c) 12 4 19

Wrenchlitigationincome(expense)(d) 14 (42) —

AmeriServeandother

(charges)credits(d) 16 26 27

Totaloperatingprofit 1,155 1,059 1,030

Interestexpense,net (129) (173) (172)

Incomebeforeincometaxesand

cumulativeeffectof

accountingchange $1,026 $ 886 $ 858

DepreciationandAmortization2004 2003 2002

UnitedStates $ 267 $ 240 $ 228

International 168 146 122

Corporate 13 15 20

$ 448 $ 401 $ 370

CapitalSpending2004 2003 2002

UnitedStates $ 365 $ 395 $ 453

International 239 246 295

Corporate 41 22 12

$ 645 $ 663 $ 760

IdentifiableAssets2004 2003 2002

UnitedStates $3,316 $3,279 $3,285

International(e)2,054 1,880 1,732

Corporate(f) 326 461 383

$5,696 $5,620 $5,400

Long-LivedAssets(g)2004 2003 2002

UnitedStates $2,900 $2,880 $2,805

International 1,340 1,206 1,021

Corporate 99 72 60

$4,339 $4,158 $3,886

(a)Includesrevenuesof$903million,$703millionand$531millioninMainland

Chinafor2004,2003and2002,respectively.

(b)Includesequityincomeofunconsolidatedaffiliatesof$57million,$44millionand

$31millionin2004,2003and2002,respectively.

(c)Unallocated facility actions comprises refranchising gains (losses) which are

notallocatedtotheU.S.orInternationalsegments forperformancereporting

purposes.

(d)SeeNote7foradiscussionofAmeriServeandother(charges)creditsandNote24

foradiscussionofWrenchlitigation.

(e)Includesinvestment inunconsolidatedaffiliatesof$194million,$182million

and $225million for 2004, 2003 and 2002, respectively. On November 10,

2003,wedissolvedourunconsolidatedaffiliateinCanada.SeeNote8forfurther

discussion.

(f) Primarilyincludesdeferredtaxassets,property,plantandequipment,net,related

toourofficefacilities,taxesreceivableandfairvalueofderivativeinstruments.

(g)Includesproperty,plantandequipment,net;goodwill;andintangibleassets,net.

SeeNote7foradditionaloperating segment disclosures

relatedtoimpairment,storeclosurecostsandthecarrying

amountofassetsheldforsale.

69

Yum!Brands,Inc.