Pizza Hut 2004 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Theimpactoftheacquisition,includinginterestexpenseon

debtincurredtofinancetheacquisition,onnetincomeand

dilutedearningspersharewouldnothavebeensignificant

in2002.Theproformainformationisnotnecessarilyindica-

tiveoftheresultsofoperationshadtheacquisitionactually

occurredatthebeginningofthisperiod.

As of the date of acquisition, we recorded approxi-

mately$49millionofreserves(“exitliabilities”)relatedto

ourplanstoconsolidatecertainsupportfunctions,andexit

certainmarketsthroughstorerefranchisingsandclosures.

Theconsolidationofcertainsupportfunctionsincludedthe

terminationofapproximately100employees.Theremaining

exitliabilities,whichtotaledapproximately$17millionand

$27millionatDecember25,2004andDecember27,2003,

respectively,consistofreservesrelatedtotheleaseofthe

formerYGRheadquartersandcertainreservesassociated

withstorerefranchisingandclosures.Withtheexceptionof

theseremainingexitliabilities,thevastmajorityoftheother

reservesestablishedatthedateofacquisitionhavebeen

extinguishedthroughcashpayments.

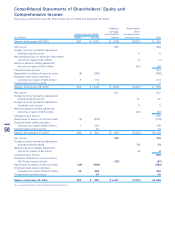

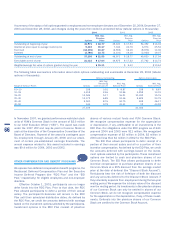

ACCUMULATEDOTHER

COMPREHENSIVEINCOME(LOSS)

NOTE5

Accumulatedothercomprehensiveincome(loss)includes:

2004 2003

Foreigncurrencytranslationadjustment $ (34) $(107)

Minimumpensionliabilityadjustment,netoftax (95) (101)

Unrealizedlossesonderivativeinstruments,

netoftax (2) (2)

Totalaccumulatedothercomprehensiveloss $(131) $(210)

EARNINGSPERCOMMONSHARE(“EPS”)

NOTE6

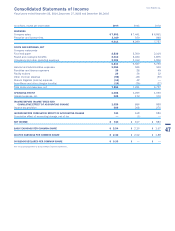

2004 2003 2002

Netincome $ 740 $ 617 $ 583

BasicEPS:

Weighted-averagecommonshares

outstanding 291 293 296

BasicEPS $2.54 $2.10 $1.97

DilutedEPS:

Weighted-averagecommonshares

outstanding 291 293 296

Sharesassumedissuedonexercise

ofdilutiveshareequivalents 47 52 56

Sharesassumedpurchasedwith

proceedsofdilutiveshareequivalents (33) (39) (42)

Sharesapplicabletodilutedearnings 305 306 310

DilutedEPS $2.42 $2.02 $1.88

Unexercised employee stock options to purchase approxi-

mately 0.4million,4million and 1.4million shares ofour

Common Stock for the years ended December25, 2004,

December27,2003andDecember28,2002,respectively,

werenotincludedinthecomputationofdilutedEPSbecause

theirexercisepricesweregreaterthantheaveragemarket

priceofourCommonStockduringtheyear.

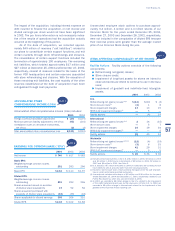

ITEMSAFFECTINGCOMPARABILITYOFNETINCOME

NOTE7

Facility Actions Facility actions consistsofthefollowing

components:

Refranchisingnet(gains)losses;

Storeclosurecosts;

Impairmentoflong-livedassetsforstoresweintendto

closeandstoresweintendtocontinuetouseinthebusi-

ness;

Impairment of goodwill and indefinite-lived intangible

assets.

2004 2003 2002

U.S.

Refranchisingnet(gains)losses(a)(b)$(14) $(20) $ (4)

Storeclosurecosts(c) (3) 1 8

Storeimpairmentcharges 17 10 15

SFAS142impairmentcharges(d) — 5 —

Facilityactions — (4) 19

International

Refranchisingnet(gains)losses(a)(d) 2 16 (15)

Storeclosurecosts — 5 7

Storeimpairmentcharges 24 19 16

SFAS142impairmentcharges(e) — — 5

Facilityactions 26 40 13

Worldwide

Refranchisingnet(gains)losses(a)(b)(d) (12) (4) (19)

Storeclosurecosts(c) (3) 6 15

Storeimpairmentcharges 41 29 31

SFAS142impairmentcharges(e) — 5 5

Facilityactions $ 26 $ 36 $ 32

(a)IncludesinitialfranchisefeesintheU.S.of$2millionin2004,$3millionin2003

and$1millionin2002andinInternationalof$8millionin2004,$2millionin

2003and$5millionin2002.SeeNote9.

(b)U.S.includesa$7millionwritedownin2004onrestaurantswecurrentlyownbut

haveofferedtosellatamountslowerthantheircarryingamounts.

(c)Incomeinstoreclosurecostsresultsprimarilyfromgainsfromthesaleofproper-

tiesonwhichweformerlyoperatedrestaurants.

(d)Internationalincludeswritedownsof$6millionand$16millionfortheyears

endedDecember25,2004andDecember27,2003,respectively,relatedtoour

PuertoRicobusiness,whichwassoldonOctober4,2004.

(e)In2003,werecordeda$5millionchargeintheU.S.relatedtotheimpairment

oftheA&Wtrademark/brand(seefurtherdiscussionatNote12).In2002,we

recordeda$5millionchargein Internationalrelatedtotheimpairmentofthe

goodwillofthePizzaHutFrancereportingunit.

57

Yum!Brands,Inc.