Pizza Hut 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

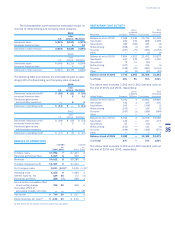

Income Tax Valuation Allowances and Tax Reserves At

December25, 2004, we have a valuation allowance of

$351million primarily to reduce our net operating loss

andtaxcreditcarryforwardsof$231millionandourother

deferred tax assetsto amountsthat willmore likelythan

notberealized.Thenetoperatinglossandtaxcreditcarry-

forwardsexistinmanystateandforeignjurisdictionsand

havevaryingcarryforwardperiodsandrestrictionsonusage.

Theestimationoffuturetaxableincomeinthesestateand

foreignjurisdictionsandourresultingability to utilizenet

operatinglossandtaxcreditcarryforwardscansignificantly

changebasedonfutureevents,includingourdeterminations

astothefeasibilityofcertaintaxplanningstrategies.Thus,

recordedvaluationallowancesmaybesubjecttomaterial

futurechanges.

As a matter of course, we are regularly audited by

federal,stateandforeigntaxauthorities.Weprovidereserves

forpotentialexposureswhenweconsideritprobablethat

a taxing authority may take a sustainable position on a

mattercontrarytoourposition.Weevaluatethesereserves,

includinginterestthereon,onaquarterlybasistoinsurethat

theyhavebeenappropriatelyadjustedforevents,including

auditsettlements,thatmayimpactourultimatepaymentfor

suchexposures.

SeeNote22forafurtherdiscussionofourincometaxes.

QUANTITATIVEANDQUALITATIVE

DISCLOSURESABOUTMARKETRISK

TheCompanyisexposed tofinancialmarketrisksassoci-

atedwithinterestrates,foreigncurrencyexchangeratesand

commodityprices.Inthenormalcourseofbusinessandin

accordancewithourpolicies,wemanagetheserisksthrough

avarietyofstrategies,whichmayincludetheuseofderivative

financialandcommodityinstrumentstohedgeourunderlying

exposures.Ourpoliciesprohibittheuseofderivativeinstru-

mentsfortradingpurposes,andwehaveproceduresinplace

tomonitorandcontroltheiruse.

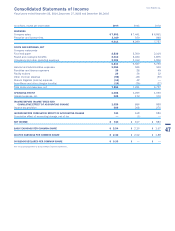

Interest Rate Risk We have a market risk exposure to

changesininterestrates,principallyintheUnitedStates.

We attempt to minimize this risk and lower our overall

borrowingcoststhroughtheutilizationofderivativefinancial

instruments,primarilyinterestrateswaps.Theseswapsare

enteredintowithfinancialinstitutionsandhaveresetdates

andcriticaltermsthatmatchthoseoftheunderlyingdebt.

Accordingly, any change in market value associated with

interestrateswapsisoffsetbytheoppositemarketimpact

ontherelateddebt.

At December25, 2004 and December27, 2003, a

hypothetical100basispointincreaseinshort-terminterest

rateswouldresult,overthefollowingtwelve-monthperiod,

ina reductionofapproximately$6millionand $3million,

respectively,inincomebeforeincometaxes.Theestimated

reductionsarebaseduponthelevel of variable ratedebt

andassume no changesinthevolume or compositionof

debt.Inaddition,thefairvalueofourderivativefinancial

instrumentsatDecember25,2004andDecember27,2003

woulddecreaseapproximately$51millionand$5million,

respectively.ThefairvalueofourSeniorUnsecuredNotes

at December25, 2004 and December27, 2003 would

decreaseapproximately$76millionand$87million,respec-

tively.Fairvaluewasdeterminedbydiscountingtheprojected

cashflows.

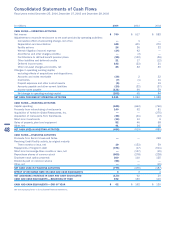

ForeignCurrencyExchangeRateRisk Internationaloper-

atingprofitconstitutesapproximately41%ofouroperating

profitin2004,excludingunallocatedincome(expenses).

In addition, the Company’s net asset exposure (defined

asforeigncurrencyassetslessforeigncurrencyliabilities)

totaledapproximately$1.5billionasofDecember25,2004.

Operatingininternational marketsexposestheCompany

to movements in foreign currency exchange rates. The

Company’sprimaryexposuresresultfromouroperationsin

Asia-Pacific,theAmericas andEurope.Changesinforeign

currencyexchangerateswouldimpactthetranslationofour

investmentsinforeignoperations,thefairvalueofourforeign

currencydenominatedfinancialinstrumentsandourreported

foreigncurrencydenominatedearningsandcashflows.For

thefiscalyearendedDecember25,2004,operatingprofit

wouldhavedecreased$59millionifallforeigncurrencieshad

uniformlyweakened10%relativetotheU.S.dollar.Theesti-

matedreductionassumesnochangesinsalesvolumesor

localcurrencysalesorinputprices.

Weattempttominimizetheexposurerelatedtoour

investmentsinforeignoperationsbyfinancingthoseinvest-

mentswithlocalcurrencydebtwhenpracticalandholding

cash in local currencies when possible. In addition, we

attempttominimizetheexposurerelatedtoforeigncurrency

denominatedfinancialinstrumentsbypurchasinggoodsand

services fromthirdpartiesinlocal currencieswhen prac-

tical.Consequently,foreigncurrencydenominatedfinancial

instruments consist primarily of intercompany short-term

receivables and payables. At times, we utilize forward

contracts to reduce our exposure related to these inter-

companyshort-termreceivablesandpayables.Thenotional

amountandmaturitydatesofthesecontractsmatchthose

of the underlying receivables or payables such that our

foreigncurrencyexchangeriskrelatedtotheseinstruments

iseliminated.

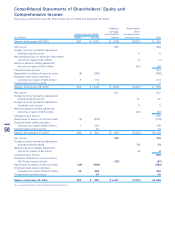

CommodityPriceRisk Wearesubjecttovolatilityinfood

costsasaresultofmarketriskassociatedwithcommodity

prices.Ourabilitytorecoverincreasedcoststhroughhigher

pricingis,attimes,limitedbythecompetitiveenvironment

inwhichweoperate.Wemanageourexposuretothisrisk

primarilythroughpricingagreementsaswellas,onalimited

basis,commodityfutureand option contracts. Commodity

futureandoptioncontractsenteredintoforthefiscalyears

endedDecember25,2004,andDecember27,2003,didnot

significantlyimpactourfinancialposition,resultsofopera-

tionsorcashflows.

45

Yum!Brands,Inc.