Pizza Hut 2004 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YGRAcquisition OnMay7,2002,theCompanycompleted

itsacquisitionofYGR,theparentcompanyofLJSandA&W.

SeeNote4foradiscussionoftheacquisition.

Asofthedateoftheacquisition,YGRconsistedof742

and496companyandfranchiseLJSunits,respectively,and

127and 742 company and franchise A&W units,respec-

tively.Inaddition,133multibrandedLJS/A&Wrestaurants

were includedintheLJSunittotals.Exceptasdiscussed

incertainsectionsoftheMD&A,theimpactoftheacquisi-

tiononourresultsofoperationsin2003wasnotsignificant

relativeto2002.

AmendmentofSale-LeasebackAgreements Asdiscussed

in Note 14, on August 15, 2003 we amended two sale-

leasebackagreementsassumedinour2002acquisitionof

YGRsuchthattheagreementsnowqualifyforsale-leaseback

accounting.Restaurantprofitdecreasedby$5millionand

by$3millionin2004and2003,respectively,asaresultof

thetwoamendedagreementsbeingaccountedforasoper-

atingleasessubsequenttotheamendment.Thedecrease

inrestaurantprofitwaslargelyoffsetbyasimilardecreasein

interestexpense.

CanadaUnconsolidatedAffiliateDissolution OnNovember

10,2003,wedissolvedourunconsolidatedaffiliatethatprevi-

ouslyoperated733restaurantsinCanada.Weowned50%

ofthisunconsolidatedaffiliatepriorto itsdissolutionand

accountedforourinterestundertheequitymethod.Ofthe

restaurantspreviouslyoperatedbytheunconsolidatedaffil-

iate,wenowoperatethevastmajorityofPizzaHutsandTaco

Bells,whilealmostallKFCsareoperatedbyfranchisees.As

aresultofoperatingcertainrestaurantsthatwerepreviously

operatedbytheunconsolidatedaffiliate,ourCompanysales,

restaurantprofitandgeneralandadministrativeexpenses

increased and our franchise fees decreased. Additionally,

onafullyearbasisotherincomeincreasedaswerecorded

alossfromourinvestmentintheCanadianunconsolidated

affiliatein2003.

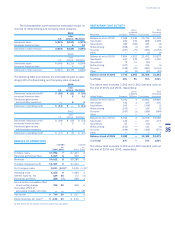

Asaresultofthe dissolutionofour Canadian uncon-

solidatedaffiliate,Companysalesincreased$147million,

franchise fees decreased $9million, restaurant profit

increased$8million,generalandadministrativeexpenses

increased$11millionandotherincomeincreased$4million

fortheyearendedDecember25,2004comparedtotheyear

endedDecember27,2003.Theimpacton2004netincome

wasnotsignificant.Theimpactofthedissolutiononour2003

resultswasalsonotsignificant.

SaleofPuertoRicoBusiness OurPuertoRicobusinesswas

heldforsalesincethefourthquarterof2002andwassold

onOctober4,2004for anamountapproximatingitsthen

carryingvalue.Companysalesandrestaurantprofitdecreased

$27million and $4million, respectively, franchise fees

increased$1millionandgeneralandadministrativeexpenses

decreased$1millionfortheyearendedDecember25,2004

ascomparedtotheyearendedDecember27,2003.

CommodityInflation Theincreasedcostofcertaincommod-

itiesnegativelyimpactedourU.S.marginsfortheyearended

December25,2004.Highercommoditycosts,particularlyin

cheeseandmeatprices,negativelyimpactedU.S.restaurant

marginsasapercentageofsalesbyapproximately160basis

pointsfortheyearendedDecember25,2004.

WrenchLitigation Werecorded income of $14million in

2004andexpenseof$42millionin2003.SeeNote24fora

discussionoftheWrenchlitigation.

AmeriServe and Other Charges (Credits) We recorded

income of $16million in 2004, $26million in 2003 and

$27millionin2002.SeeNote7foradetaileddiscussionof

AmeriServeandothercharges(credits).

StorePortfolioStrategy FromtimetotimewesellCompany

restaurantstoexistingandnewfranchiseeswheregeographic

synergies can be obtained or where their expertise can

generallybeleveragedtoimproveouroveralloperatingperfor-

mance,whileretainingCompanyownershipofkeyU.S.and

Internationalmarkets.Suchrefranchisingsreduceourreported

revenuesandrestaurantprofitsandincreasetheimportance

ofsystemsalesgrowthasakeyperformancemeasure.

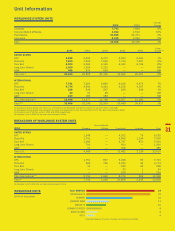

The following table summarizes our refranchising

activities:

2004 2003 2002

Numberofunitsrefranchised 317 228 174

Refranchisingproceeds,pre-tax $140 $92 $81

Refranchisingnetgains,pre-tax(a)$ 12 $ 4 $19

(a)RefranchisingnetgainsfortheyearendedDecember25,2004includecharges

towritedownourPuertoRicobusinesstoourthenestimateofitsfairvalueand

chargestowritedown certainU.S. restaurantswe currentlyownbut wehave

offeredtosellatamountslowerthantheircarryingvalues.Refranchisingnetgains

fortheyearendedDecember27,2003alsoincludechargestowritedownour

PuertoRicobusinesstoourthenestimateofitsfairvalue.Aspreviouslynoted,

wesoldourPuertoRicobusinesseffectiveOctober4,2004foranamountapproxi-

matingitsthencarryingvalue.

Inadditiontoourrefranchisingprogram,fromtimetotime

wecloserestaurantsthatarepoorperforming,werelocate

restaurantstoanewsitewithinthesametradeareaorwe

consolidatetwoormoreofourexistingunitsintoasingleunit

(collectively“storeclosures”).

ThefollowingtablesummarizesCompanystoreclosure

activities:

2004 2003 2002

Numberofunitsclosed 319 287 224

Storeclosurecosts(income)(a)$(3) $ 6 $15

Impairmentchargesforstores

tobeclosed $ 5 $12 $ 9

(a)Storeclosureincomein2004isprimarilytheresultofgainsfromthesaleof

propertiesonwhichweformerlyoperatedrestaurants.

The impact on operating profit arising from refranchising

andCompanystoreclosuresisthenetof(a)theestimated

reductionsinrestaurantprofit,whichreflectsthedecreasein

Companysales,andgeneralandadministrativeexpensesand

(b)theestimatedincreaseinfranchisefeesfromthestores

refranchised.Theamountspresentedbelowreflecttheesti-

matedimpactfromstoresthatwereoperatedbyusforall

orsomeportionoftherespectivepreviousyearandwereno

longeroperatedbyusasofthelastdayoftherespectiveyear.

Theamountsdonotincluderesultsfromnewrestaurantsthat

weopenedinconnectionwitharelocationofanexistingunit

oranyincrementalimpactuponconsolidationoftwoormore

ofourexistingunitsintoasingleunit.

34