Pizza Hut 2004 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2004 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

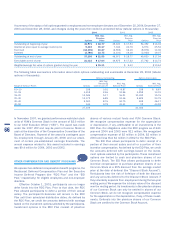

GUARANTEES,COMMITMENTSANDCONTINGENCIES

NOTE24

LeaseGuaranteesand Contingencies As a result of (a)

assigningourinterestinobligationsunderrealestateleasesas

aconditiontotherefranchisingofcertainCompanyrestaurants;

(b) contributing certain Company restaurants to unconsoli-

datedaffiliates;and(c)guaranteeingcertainotherleases,we

arefrequentlycontingentlyliableonleaseagreements.These

leaseshavevaryingterms,thelatestofwhichexpiresin2031.

AsofDecember25,2004andDecember27,2003,thepoten-

tialamountofundiscountedpaymentswecouldberequired

tomakeintheeventofnon-paymentbytheprimarylessee

was$365millionand$393million,respectively.Thepresent

valuesofthesepotentialpaymentsdiscountedatourpre-tax

costofdebtatDecember25,2004andDecember27,2003

were$306millionand$312million,respectively.Ourfranchi-

seesaretheprimarylesseesunderthevastmajorityofthese

leases.Wegenerallyhavecross-defaultprovisionswiththese

franchiseesthatwouldputthemindefaultoftheirfranchise

agreementintheeventofnon-paymentunderthelease.We

believethesecross-defaultprovisionssignificantlyreducethe

riskthatwewillberequiredtomakepaymentsunderthese

leases. Accordingly, the liability recorded for our exposure

undersuchleasesatDecember25,2004andDecember27,

2003wasnotmaterial.

Includedinthepotentialpaymentsdescribedaboveare

contingentliabilitiesrelatedtoourguaranteesofleaseagree-

ments of certain former non-core businesses of PepsiCo

whichweresoldpriortoSpin-off.Twoofthesebusinesses,

ChevysMexicanRestaurantandHot‘nNowfiledforbank-

ruptcy protection in October 2003 and January2004,

respectively.Webelievethatwehaveappropriatelyprovided

forourestimatedprobableexposureundertheseguarantees

andwedonotexpectanynecessary,futureadjustmentsto

recordedreservestohaveamaterialimpactonourFinancial

Statements.Anyrelated expenseshavebeen recordedas

AmeriServeandothercharges(credits)inourConsolidated

IncomeStatement.

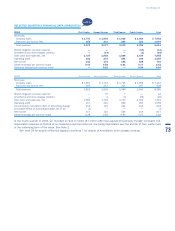

GuaranteesSupportingFinancialArrangementsofFranchisees,

UnconsolidatedAffiliatesandOtherThirdParties Wehad

providedapproximately$16millionand$32millionofpartial

guaranteesoftwofranchiseeloanpoolsrelatedprimarilyto

theCompany’shistoricalrefranchisingprograms and,to a

lesserextent,franchiseedevelopmentofnewrestaurants,at

December25,2004andDecember27,2003,respectively.

Insupportoftheseguarantees,wepostedlettersofcredit

of $4million and $32million at December25, 2004 and

December27,2003,respectively.Wealsoprovidedastandby

letterofcreditof$18millionand$23millionatDecember25,

2004andDecember27,2003,respectively,underwhichwe

couldpotentiallyberequiredtofundaportionofoneofthe

franchiseeloanpools.Thetotalloansoutstandingunderthese

loanpoolswereapproximately$90millionatDecember25,

2004. In 2004, approximately $26million of loans were

soldfromoneoftheloanpoolstotheotherresultingina

reductionofourrelatedguaranteesandlettersofcreditby

$16million.Additionally,in2004a$12millionletterofcredit

relatedtoourguaranteeofoneoftheloanpoolswaselimi-

natedbasedonourimprovedcreditratingandathirdparty

assumedaportionoftheriskassociatedwithoneoftheloan

poolsresultingina$5millionreductionofourstandbyletter

ofcredit.Thesechangesresultedina$21milliondecreasein

ourmaximumexposurerelatedtothefranchiseeloanpools.

Any funding under the guarantees or letters of credit

wouldbesecuredbythefranchiseeloansandanyrelated

collateral.Webelievethatwehaveappropriatelyprovidedfor

ourestimatedprobableexposuresunderthesecontingent

liabilities.Theseprovisionswereprimarilycharged to net

refranchisingloss(gain).Newloansarenotcurrentlybeing

addedtoeitherloanpool.

Wehaveguaranteedcertainlinesofcreditandloansof

unconsolidatedaffiliatestotaling$34millionand$28million

at December25, 2004 and December27, 2003, respec-

tively.Ourunconsolidatedaffiliateshadtotal revenuesof

over $1.7billion for the year ended December25, 2004

and assets and debt of approximately $884million and

$49million,respectively,atDecember25,2004.

Wehavealsoguaranteedcertainlinesofcredit,loansand

lettersofcreditofthirdpartiestotaling$9millionand$8million

atDecember25,2004andDecember27,2003,respectively.

Ifallsuchlinesofcreditandlettersofcreditwerefullydrawn

themaximumcontingentliabilityunderthesearrangements

wouldbeapproximately$26millionasofDecember25,2004

and$25millionasofDecember27,2003.

Wehavevaryinglevelsofrecourseprovisionsandcollat-

eralthatmitigatetheriskoflossrelatedtoourguarantees

ofthesefinancialarrangementsofunconsolidatedaffiliates

andotherthird parties.Accordingly, ourrecorded liability

asofDecember25,2004andDecember27,2003isnot

significant.

InsurancePrograms Weareself-insuredforasubstantial

portion of our currentandprior years’ coverageincluding

workers’ compensation, employment practices liability,

general liability, automobile liability and property losses

(collectively, “property and casualty losses”). To mitigate

thecostofourexposuresforcertainpropertyandcasualty

losses,wemakeannualdecisionstoself-insuretherisksof

lossuptodefinedmaximumperoccurrenceretentionsona

linebylinebasisortocombinecertainlinesofcoverageinto

onelosspoolwithasingleself-insuredaggregateretention.

TheCompanythenpurchasesinsurancecoverage,uptoa

certainlimit,forlossesthatexceedtheself-insuranceper

occurrenceoraggregateretention.Theinsurers’maximum

aggregatelosslimitsaresignificantlyaboveouractuarially

determinedprobablelosses;therefore,webelievethelikeli-

hoodoflossesexceedingtheinsurers’maximumaggregate

losslimitsisremote.

IntheU.S.andincertainothercountries,wearealso

self-insuredforhealthcareclaimsforeligibleparticipating

employeessubjecttocertaindeductiblesandlimitations.We

70