Panera Bread 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

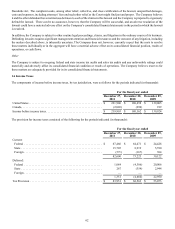

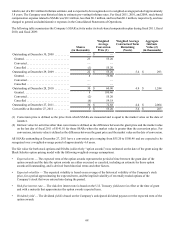

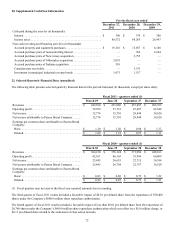

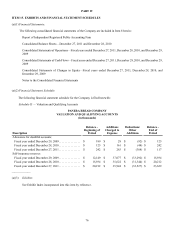

20. Supplemental Cash Flow Information

Cash paid during the year for (in thousands):

Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Non-cash investing and financing activities (in thousands):

Accrued property and equipment purchases . . . . . . . . . . . . . . . . . . . . . . . .

Accrued purchase price of noncontrolling interest . . . . . . . . . . . . . . . . . . .

Accrued purchase price of New Jersey acquisition. . . . . . . . . . . . . . . . . . .

Accrued purchase price of Milwaukee acquisition . . . . . . . . . . . . . . . . . . .

Accrued purchase price of Indiana acquisition . . . . . . . . . . . . . . . . . . . . . .

Canadian note receivable. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Investment in municipal industrial revenue bonds . . . . . . . . . . . . . . . . . . .

For the fiscal year ended

December 27,

2011

$ 390

80,572

$ 19,116

—

—

2,055

510

—

1,673

December 28,

2010

$ 379

68,263

$ 13,057

764

2,755

—

—

3,333

1,517

December 29,

2009

$ 380

26,947

$ 6,108

2,264

—

—

—

—

—

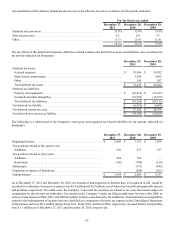

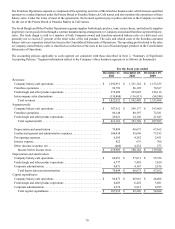

21. Selected Quarterly Financial Data (unaudited)

The following table presents selected quarterly financial data for the periods indicated (in thousands, except per share data):

Revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Operating profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Net income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Net income attributable to Panera Bread Company . . . . . .

Earnings per common share attributable to Panera Bread

Company:

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Diluted. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Fiscal 2011 - quarters ended (1)

March 29

$ 422,100

52,974

32,774

32,774

$ 1.10

$ 1.09

June 28

$ 451,080

57,132

35,710

35,710

$ 1.20

$ 1.18

September 27

$ 453,087

47,607

28,848

28,848

$ 0.98

$ 0.97

December 27

$ 495,765

62,546

38,620

38,620

$ 1.33

$ 1.31

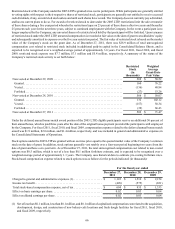

Revenues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Operating profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Net income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Net income attributable to Panera Bread Company . . . . . .

Earnings per common share attributable to Panera Bread

Company:

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Diluted. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Fiscal 2010 - quarters ended (1)

March 30

$ 364,210

42,161

25,845

25,845

$ 0.83

$ 0.82

June 29

$ 378,124

46,103

26,655

26,704

$ 0.86

$ 0.85

September 28

$ 371,994

35,996

22,715

22,797

$ 0.75

$ 0.75

December 28

$ 428,161

60,809

36,384

36,520

$ 1.22

$ 1.21

(1) Fiscal quarters may not sum to the fiscal year reported amounts due to rounding.

The third quarter of fiscal 2011 results included a favorable impact of $0.01 per diluted share from the repurchase of 850,400

shares under the Company’s $600.0 million share repurchase authorization.

The fourth quarter of fiscal 2011 results included a favorable impact of less than $0.01 per diluted share from the repurchase of

26,700 shares under the Company’s $600.0 million share repurchase authorization which was offset by a $5.0 million charge, or

$0.11 per diluted share related to the settlement of class action lawsuits.