Panera Bread 2011 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2011 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

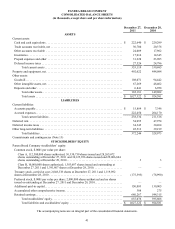

on December 28, 2010 for $0.7 million. Additionally, in fiscal 2010 we purchased substantially all the assets and certain liabilities

of 37 bakery-cafes from our New Jersey franchisee. Within our Consolidated Balance Sheets as of December 27, 2011 and

December 28, 2010, $2.6 million and $5.0 million respectively, were included for contingent or accrued purchase price remaining

from previously completed acquisitions. See Note 3 to the consolidated financial statements for further information with respect

to our acquisition activity in fiscal 2011 and 2010.

Investments

Historically, we invested a portion of our cash balances on hand in a private placement of units of beneficial interest in the Columbia

Strategic Cash Portfolio, which was an enhanced cash fund previously sold as an alternative to traditional money-market funds.

The Columbia Strategic Cash Portfolio included investments in certain asset-backed securities and structured investment vehicles

that were collateralized by sub-prime mortgage securities or related to mortgage securities, among other assets. As a result of

adverse market conditions that unfavorably affected the fair value and liquidity availability of collateral underlying the Columbia

Strategic Cash Cash Portfolio was closed with a restriction placed upon the cash redemption ability of its holders in the fourth

quarter of fiscal 2007.

During fiscal 2009, we received $5.5 million of cash redemptions at an average net asset value of $0.861 per unit, which fully

redeemed our remaining units in the Columbia Strategic Cash Portfolio, and we classified the redemptions as investment maturity

proceeds provided by investing activities. In total, we recognized a net realized and unrealized gain on the Columbia Strategic

Cash Portfolio units of $1.3 million in fiscal 2009 related to the fair value measurements and redemptions received and included

the net gain in net cash provided by operating activities.

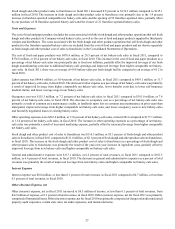

Financing Activities

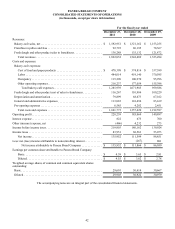

Financing activities in fiscal 2011 included $96.6 million used to repurchase shares of our Class A common stock and $5.0 million

used on the payment of deferred acquisition holdbacks, offset by $5.0 million received from the tax benefit from exercise of stock

options, $3.2 million received from the exercise of employee stock options, and $2.0 million received from the issuance of common

stock. Financing activities in fiscal 2010 included $153.5 million used to repurchase shares of our Class A common stock offset

by $25.6 million received from the exercise of employee stock options, $3.6 million received from the tax benefit from exercise

of stock options, and $1.8 million received from the issuance of common stock. Financing activities in fiscal 2009 included $22.8

million received from the exercise of employee stock options, $5.1 million received from the tax benefit from the exercise of stock

options, and $1.6 million received from the issuance of common stock, partially offset by $20.1 million used to purchase the

remaining interest of Paradise and approximately $3.5 million to repurchase shares of our Class A common stock.

Purchase of Noncontrolling Interest

On June 2, 2009, we purchased the remaining 49 percent of the outstanding stock of Paradise, excluding certain agreed upon assets

totaling $0.7 million, for a purchase price of $22.3 million, $0.1 million in transaction costs, and settlement of $3.4 million of debt

owed to us by the former shareholders of the remaining 49 percent of Paradise, whom we refer to as the Prior Shareholders.

Approximately $20.0 million of the purchase price, as well as the transaction costs, were paid on June 2, 2009, with $2.3 million

retained by us for certain holdbacks. The holdbacks were primarily for certain indemnifications and expired on June 2, 2011, at

which time the remaining holdback amounts reverted to the Prior Shareholders. The transaction was accounted for as an equity

transaction, by adjusting the carrying amount of the noncontrolling interest balance to reflect the change in our ownership interest

in Paradise, with the difference between fair value of the consideration paid and the amount by which the noncontrolling interest

was adjusted recognized in equity attributable to us.