Panera Bread 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.34

We have chosen accounting policies we believe are appropriate to report accurately and fairly our consolidated operating results

and financial position, and we apply those accounting policies in a consistent manner. We consider our policies on accounting for

revenue recognition, valuation of goodwill, self-insurance, income taxes, lease obligations, and stock-based compensation to be

the most critical in the preparation of the consolidated financial statements because they involve the most difficult, subjective, or

complex judgments about the effect of matters that are inherently uncertain. There have been no material changes to our application

of critical accounting policies and significant judgments and estimates that occurred during the fiscal year ended December 27,

2011.

Revenue Recognition

We recognize revenues from net bakery-cafe sales upon delivery of the related food and other products to the customer. Revenues

from fresh dough and other product sales to franchisees are recorded upon delivery of the fresh dough and other products to

franchisees. Also, a liability is recorded in the period in which a gift card is issued and proceeds are received. As gift cards are

redeemed, this liability is reduced and revenue is recognized. Sales of soup and other branded products sold outside our bakery-

cafes are generally recognized upon delivery to customers. Further, franchise fees are the result of the sale of area development

rights and the sale of individual franchise locations to third parties. The initial franchise fee is generally $35,000 per bakery-cafe

to be developed under the Area Development Agreement, or ADA. Of this fee, $5,000 is generally paid at the time of signing of

the ADA and is recognized as revenue when it is received as it is non-refundable and we have to perform no other service to earn

this fee. The remainder of the fee is paid at the time an individual franchise agreement is signed and is recognized as revenue upon

the opening of the corresponding bakery-cafe. Royalties are generally paid weekly based on a percentage of net franchisee sales

specified in each ADA (generally 4 percent to 5 percent of net sales). Royalties are recognized as revenue when they are earned.

We maintain a customer loyalty program in which customers earn rewards based on registration in the program and purchases

within our bakery-cafes. We record the full retail value of loyalty program rewards as a reduction of net bakery-cafe sales and a

liability is established within accrued expenses as rewards are earned while considering historical redemption rates. Fully earned

rewards expire if unredeemed after 60 days.

We sell gift cards which do not have an expiration date and from which we do not deduct non-usage fees from outstanding gift

card balances. We recognize revenue from gift cards when: (i) the gift card is redeemed by the customer; or (ii) we determine the

likelihood of the gift card being redeemed by the customer is remote ("gift card breakage") and there is no longer a legal obligation

to remit the unredeemed gift cards in the relevant jurisdiction. The determination of gift card breakage is based upon our specific

historical redemption patterns. When the likelihood of further redemptions becomes remote, breakage is recorded as a reduction

of general and administrative expenses in the Consolidated Statements of Operations; however, such gift cards will continue to

be honored. In the fiscal year ended December 27, 2011, we completed an initial analysis of unredeemed gift card liabilities and

recognized a reduction of $1.9 million of general and administrative expenses.

Valuation of Goodwill

Goodwill consists of the excess of the purchase price over the fair value of net assets acquired. In September 2011, the FASB

updated its guidance on the annual testing of goodwill for impairment to allow companies to first assess qualitative factors to

determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount as a basis for

determining whether it is necessary to perform the two-step goodwill impairment test required under current accounting standards.

The updated guidance is applicable to goodwill impairment tests performed for fiscal years beginning after December 15, 2011,

with early adoption permitted.

We have adopted this updated guidance for the fiscal year 2011. We performed the qualitative assessment, which included an

analysis of macroeconomic factors, industry and market conditions, internal cost factors, our overall financial performance, entity-

specific events, share price fluctuations, and results of past impairment tests. Based on this assessment, we have not identified

any conditions that would suggest an impairment of goodwill exists in fiscal year 2011.

Goodwill and indefinite-lived intangible assets recorded in the consolidated financial statements are required to be evaluated for

periodic evaluation for impairment when circumstances warrant, or at least once per year. Prior to fiscal year 2011, goodwill was

tested for impairment in accordance with the accounting standard for goodwill by comparing the carrying value of reporting units

to their estimated fair values. We completed annual impairment tests as of the first day of the fiscal fourth quarter for each of fiscal

2010 and fiscal 2009, none of which identified any impairment as the fair value of our reporting units exceeded the associated

carrying values.

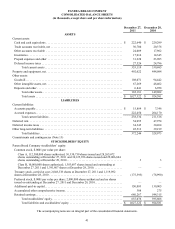

At December 27, 2011 and December 28, 2010, our goodwill balance was $108.1 million and $94.4 million, respectively. As we

did not become aware of any impairment indicators subsequent to the date of the annual assessment, we determined there was no

impairment as of December 27, 2011.