Panera Bread 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.49

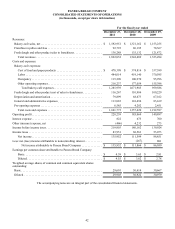

if unredeemed after 60 days. The accrued liability related to the Company’s loyalty program, which is included as a reduction of

bakery-cafe sales in the Consolidated Statement of Operations, was $5.9 million and $4.3 million as of December 27, 2011 and

December 28, 2010, respectively.

The Company sells gift cards that do not have an expiration date and from which does not deduct non-usage fees from outstanding

gift card balances. The Company recognizes revenue from gift cards when: (i) the gift card is redeemed by the customer; or (ii) the

Company determines the likelihood of the gift card being redeemed by the customer is remote ("gift card breakage") and there is

no longer a legal obligation to remit the unredeemed gift cards to the relevant jurisdiction. The determination of gift card breakage

is based upon Company-specific historical redemption patterns. When the likelihood of further redemptions becomes remote,

breakage is recorded as a reduction of general and administrative expenses in the Consolidated Statements of Operations; however,

such gift cards will continue to be honored. In the fiscal year ended December 27, 2011, the Company completed an initial analysis

of unredeemed gift card liabilities and recognized a reduction of $1.9 million of general and administrative expenses.

Advertising Costs

National advertising fund and marketing administration contributions received from franchise-operated bakery-cafes are

consolidated with those from the Company in the Company’s consolidated financial statements. Liabilities for unexpended funds

received from franchisees are included in accrued expenses in the Consolidated Balance Sheets. The Company’s contributions to

the national advertising and marketing administration funds are recorded as part of general and administrative expenses in the

Consolidated Statements of Operations, while the Company’s own local bakery-cafe media costs are recorded as part of other

operating expenses in the Consolidated Statements of Operations. The Company’s policy is to record advertising costs as expense

in the period in which the costs are incurred. The Company’s advertising costs include national, regional, and local expenditures

utilizing primarily radio, billboards, social networking, television, and print. The total amounts recorded as advertising expense

were $33.2 million, $27.4 million, and $15.3 million for the fiscal years ended December 27, 2011, December 28, 2010, and

December 29, 2009, respectively.

Pre-Opening Expenses

All pre-opening expenses directly associated with the opening of new bakery-cafe locations, which consists primarily of pre-

opening rent expense, labor, and food costs incurred during in-store training and preparation for opening, but exclude manager

training costs which are included in labor expense in the Consolidated Statements of Operations, are expensed when incurred.

Rent Expense

The Company recognizes rent expense on a straight-line basis over the reasonably assured lease term as defined in the accounting

standard for leases. The reasonably assured lease term for most bakery-cafe leases is the initial non-cancelable lease term plus

one renewal option period, which generally equates to 15 years. The reasonably assured lease term on most fresh dough facility

leases is the initial non-cancelable lease term plus one to two renewal option periods, which generally equates to 20 years. In

addition, certain of the Company’s lease agreements provide for scheduled rent increases during the lease terms or for rental

payments commencing at a date other than the date of initial occupancy. The Company includes any rent escalations and construction

period and other rent holidays in its determination of straight-line rent expense. Therefore, rent expense for new locations is charged

to expense beginning with the start of the construction period.

The Company records landlord allowances and incentives received which are not related to structural building improvements as

deferred rent in the Consolidated Balance Sheets based on their short-term or long-term nature. This deferred rent is amortized

on a straight-line basis over the reasonably assured lease term as a reduction of rent expense. Additionally, the Company records

landlord allowances for structural tenant improvements as a reduction of property and equipment, net in the Consolidated Balance

Sheets, resulting in decreased depreciation expense over the reasonably assured lease term.

Earnings Per Share

The Company accounts for earnings per common share in accordance with the relevant accounting guidance, which requires

companies to present basic earnings per share and diluted earnings per share. Basic earnings per share is computed by dividing

net income attributable to the Company by the weighted-average number of shares of common stock outstanding during the fiscal

year. Diluted earnings per common share is computed by dividing net income attributable to the Company by the weighted-average

number of shares of common stock outstanding and dilutive securities outstanding during the year.

Foreign Currency Translation

The Company has three Company-owned bakery-cafes in Canada which use the Canadian Dollar as their functional currency.

Assets and liabilities are translated into U.S. dollars using the current exchange rate in effect at the balance sheet date, while