Panera Bread 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

5. Fair Value Measurements

On December 30, 2009, the Company adopted the updated guidance issued by the FASB related to fair value measurements and

disclosures, which requires a reporting entity to separately disclose the amounts of significant transfers in and out of Level 1 and

Level 2 fair value measurements and to describe the reasons for the transfers. The updated guidance also requires that an entity

provide fair value measurement disclosures for each class of assets and liabilities and disclosures about the valuation techniques

and inputs used to measure fair value for both recurring and non-recurring Level 2 and Level 3 fair value measurements. The

adoption of this updated guidance did not have an impact on the Company’s consolidated results of operations or financial condition.

The Company’s $27.5 million and $44.5 million in cash equivalents at December 27, 2011 and December 28, 2010, respectively,

were carried at fair value in the Consolidated Balance Sheets based on quoted market prices for identical securities (Level 1 inputs).

The Company’s remaining cash balance in the Consolidated Balance Sheets was held in FDIC insured accounts. As of December 27,

2011 and December 28, 2010, the Company held municipal industrial revenue bonds in the amount of $1.7 million and $1.5

million, respectively, and valued these bonds using Level 2 inputs as they can be corroborated by market data.

Historically, the Company invested a portion of its cash balances on hand in a private placement of units of beneficial interest in

the Columbia Strategic Cash Portfolio, which was an enhanced cash fund previously sold as an alternative to traditional money-

market funds. Prior to the fourth quarter of fiscal 2007, the amounts were appropriately classified as trading securities in cash and

cash equivalents in the Consolidated Balance Sheets as the fund was considered both short-term and highly liquid in nature. The

Columbia Strategic Cash Portfolio included investments in certain asset backed securities and structured investment vehicles that

were collateralized by sub-prime mortgage securities or related to mortgage securities, among other assets. As a result of adverse

market conditions that unfavorably affected the fair value and liquidity availability of collateral underlying the Columbia Strategic

Cash Portfolio, it was overwhelmed with withdrawal requests from investors and the Columbia Strategic Cash Portfolio was closed

with a restriction placed upon the cash redemption ability of its holders in the fourth quarter of fiscal 2007. As such, the Company

classified the Columbia Strategic Cash Portfolio units in short-term and long-term investments rather than cash and cash equivalents

in the Consolidated Balance Sheets and carried the investments at fair value.

As the Columbia Strategic Cash Portfolio units were no longer trading and, therefore, had little or no price transparency, the

Company assessed the fair value of the underlying collateral for the Columbia Strategic Cash Portfolio through review of current

investment ratings, as available, coupled with the evaluation of the liquidation value of assets held by each investment and their

subsequent distribution of cash. The Company then utilized this assessment of the underlying collateral from multiple indicators

of fair value, which were then adjusted to reflect the expected timing of disposition and market risks to arrive at an estimated fair

value of the Columbia Strategic Cash Portfolio units. During fiscal 2009, the Company received $5.5 million of cash redemptions,

which fully redeemed the Company’s remaining units in the Columbia Strategic Cash Portfolio. Based on the valuation methodology

used to determine the fair value, the Columbia Strategic Cash Portfolio was classified within Level 3 of the fair value hierarchy.

Realized and unrealized gains/(losses) relating to the Columbia Strategic Cash Portfolio were classified in other (income) expense,

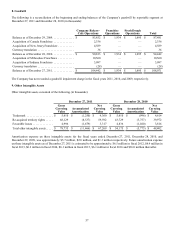

net in the Consolidated Statements of Operations. The following table sets forth a summary of the changes in the fair value of the

Company’s Level 3 financial asset for the period indicated (in thousands):

Beginning balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Net realized and unrealized gains. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Redemptions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Ending balance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

December 29,

2009

$ 4,126

1,339

(5,465)

$—