Panera Bread 2011 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2011 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.14

• profitability of new bakery-cafes, especially in new markets;

• delays in new bakery-cafe openings;

• fluctuations in supply costs, shortages, or interruptions; and

• natural disasters and other calamities.

Increased advertising and marketing costs could adversely affect our consolidated results of operations.

We expect our advertising expenses to continue to increase and to dedicate greater resources to advertising and marketing than in

previous years. If new advertising and other marketing programs, including our national television advertising, do not drive

increased net bakery-cafe sales or if the costs of advertising, media, or marketing increase greater than expected, our consolidated

financial results could be materially adversely affected.

Our federal, state, and local tax returns have been and may in the future be selected for audit by the taxing authorities,

which may result in tax assessments or penalties that could have a material adverse impact on our consolidated financial

position and results of operations.

We are subject to federal, state, and local taxes in the United States and Canada, including sales, use, and other applicable taxes.

Significant judgment is required in determining the provision for taxes. Although we believe our tax estimates are reasonable, if

the Internal Revenue Service or another taxing authority disagrees with the positions we have taken on our tax returns, we could

have additional tax liability, including interest and penalties. If material, payment of such additional amounts upon final adjudication

of any disputes could have a material impact on our consolidated financial position and results of operations.

A regional or global health pandemic could severely affect our business.

A health pandemic is a disease outbreak that spreads rapidly and widely by infection and affects many individuals in an area or

population at the same time. If a regional or global health pandemic occurs, depending upon its duration, location, and severity,

our business could be severely affected. Generally, we are viewed by our customers as an “everyday oasis”, a friendly, all day

destination where people can gather with friends and business colleagues. Customers might avoid public gathering places in the

event of a health pandemic, and local, regional, or national governments might limit or ban public gatherings to halt or delay the

spread of disease. A regional or global health pandemic might also adversely impact our business by disrupting or delaying

production and delivery of ingredients and products in our supply chain and by causing staffing shortages in our bakery-cafes.

The impact of a health pandemic might be disproportionately greater on us than on other companies that depend less on the

gathering of people for the sale of their products.

Regional factors could negatively impact our consolidated results of operations.

There are several states in which we, our franchisees, or both own and operate a significant number of bakery-cafes. As a result,

the economic conditions, state and local laws, government regulations, and weather conditions affecting those particular states,

or a geographic region generally, may have a material impact upon our consolidated results of operations.

Failure to meet market expectations for our financial performance would likely adversely affect the market price of our

stock.

The public trading of our stock is based in large part on market expectations that our business would continue to grow and that

we would achieve certain levels of financial performance. Should we fail to meet market expectations going forward, particularly

with respect to comparable net bakery-cafe sales revenues, operating margins, and diluted earnings per share, the market price of

our stock would likely decline.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

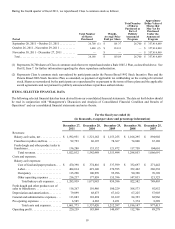

ITEM 2. PROPERTIES

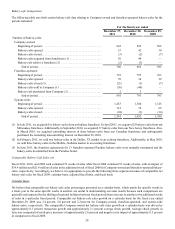

The average size of a Company-owned bakery-cafe as of December 27, 2011 was approximately 4,600 square feet. The square

footage of each of our fresh dough facilities is provided below. We lease all but two of our bakery-cafe locations, all fresh dough

facilities, and all of our support centers. Lease terms for our bakery-cafes, fresh dough facilities, and support centers are generally

10 years with renewal options at most locations and our leases generally require us to pay a proportionate share of real estate taxes,