Panera Bread 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

Standards Act. The complaint seeks, among other relief, collective, and class certification of the lawsuit, unspecified damages,

costs and expenses, including attorneys’ fees and such other relief as the Court might find just and proper. The Company believes

it and the other defendant have meritorious defenses to each of the claims in this lawsuit and the Company is prepared to vigorously

defend the lawsuit. There can be no assurance, however, that the Company will be successful, and an adverse resolution of the

lawsuit could have a material adverse effect on the Company’s consolidated financial statements in the period in which the lawsuit

is resolved.

In addition, the Company is subject to other routine legal proceedings, claims, and litigation in the ordinary course of its business.

Defending lawsuits requires significant management attention and financial resources and the outcome of any litigation, including

the matters described above, is inherently uncertain. The Company does not, however, currently expect that the costs to resolve

these matters individually or in the aggregate will have a material adverse effect on its consolidated financial position, results of

operations, or cash flows.

Other

The Company is subject to on-going federal and state income tax audits and sales tax audits and any unfavorable rulings could

materially and adversely affect its consolidated financial condition or results of operations. The Company believes reserves for

these matters are adequately provided for in its consolidated financial statements.

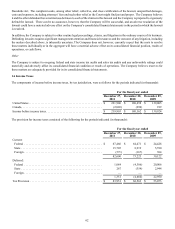

14. Income Taxes

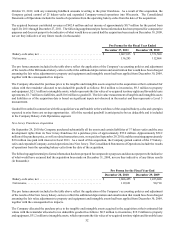

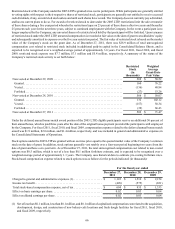

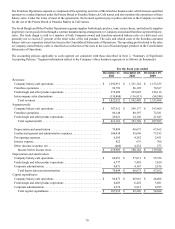

The components of income before income taxes, by tax jurisdiction, were as follows for the periods indicated (in thousands):

United States . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Canada. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Income before income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

For the fiscal year ended

December 27,

2011

$ 221,906

(2,003)

$ 219,903

December 28,

2010

$ 180,458

(296)

$ 180,162

December 29,

2009

$ 139,005

919

$ 139,924

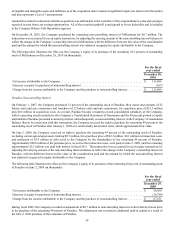

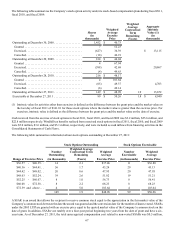

The provision for income taxes consisted of the following for the periods indicated (in thousands):

Current:

Federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Foreign . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Deferred:

Federal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Foreign . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Tax Provision . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

For the fiscal year ended

December 27,

2011

$ 67,466

15,705

(571)

82,600

1,084

267

—

1,351

$ 83,951

December 28,

2010

$ 64,471

8,919

(167)

73,223

(4,306)

(354)

—

(4,660)

$ 68,563

December 29,

2009

$ 24,428

5,390

304

30,122

20,006

2,944

—

22,950

$ 53,073