Panera Bread 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

of tangible and intangible assets and liabilities as of the acquisition date is based on significant inputs not observed in the market

and thus represents a Level 3 measurement.

Goodwill recorded in connection with this acquisition was attributable to the workforce of the acquired bakery-cafes and synergies

expected to arise from cost savings opportunities. All of the recorded goodwill is anticipated to be tax deductible and is included

in the Company Bakery-Cafe Operations segment.

On December 28, 2010, the Company purchased the remaining non-controlling interest of Millennium for $0.7 million. The

transaction was accounted for as an equity transaction, by adjusting the carrying amount of the noncontrolling interest balance to

reflect the change in the Company’s ownership interest in Millennium, with the difference between fair value of the consideration

paid and the amount by which the noncontrolling interest was adjusted recognized in equity attributable to the Company.

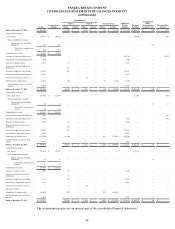

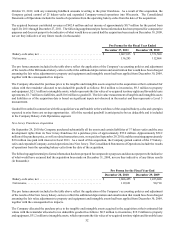

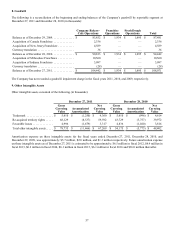

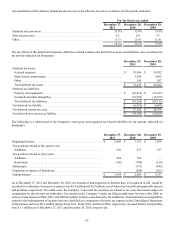

The following table illustrates the effect on the Company’s equity of its purchase of the remaining 28.5 percent of outstanding

stock of Millennium on December 28, 2010 (in thousands):

Net income attributable to the Company . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Decrease in equity for purchase of noncontrolling interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Change from net income attributable to the Company and the purchase of noncontrolling interest. . . . . . . . . . .

For the fiscal

year ended

December 28,

2010

$ 111,866

(367)

$ 111,499

Paradise Noncontrolling Interest

On February 1, 2007, the Company purchased 51 percent of the outstanding stock of Paradise, then owner and operator of 22

bakery-cafes and one commissary and franchisor of 22 bakery-cafes and one commissary, for a purchase price of $21.1 million

plus $0.5 million in acquisition costs. As a result, Paradise became a majority-owned consolidated subsidiary of the Company,

with its operating results included in the Company’s Consolidated Statements of Operations and the 49 percent portion of equity

attributable to Paradise presented as minority interest, and subsequently as noncontrolling interest, in the Company’s Consolidated

Balance Sheets. In connection with this transaction, the Company received the right to purchase the remaining 49 percent of the

outstanding stock of Paradise after January 1, 2009 at a contractually determined value, which approximated fair value.

On June 2, 2009, the Company exercised its right to purchase the remaining 49 percent of the outstanding stock of Paradise,

excluding certain agreed upon assets totaling $0.7 million, for a purchase price of $22.3 million, $0.1 million in transaction costs,

and settlement of $3.4 million of debt owed to the Company by the shareholders of the remaining 49 percent of Paradise.

Approximately $20.0 million of the purchase price, as well as the transaction costs, were paid on June 2, 2009, and the remaining

approximately $2.3 million was paid with interest in fiscal 2011. The transaction was accounted for as an equity transaction, by

adjusting the carrying amount of the noncontrolling interest balance to reflect the change in the Company’s ownership interest in

Paradise, with the difference between fair value of the consideration paid and the amount by which the noncontrolling interest

was adjusted recognized in equity attributable to the Company.

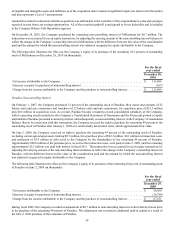

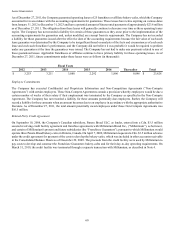

The following table illustrates the effect on the Company’s equity of its purchase of the remaining 49 percent of outstanding stock

of Paradise on June 2, 2009 (in thousands):

Net income attributable to the Company . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Decrease in equity for purchase of noncontrolling interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Change from net income attributable to the Company and the purchase of noncontrolling interest. . . . . . . . . . .

For the fiscal

year ended

December 29,

2009

$ 86,050

(18,799)

$ 67,251

During fiscal 2009, the Company recorded an adjustment of $0.7 million to noncontrolling interest to reflect deferred taxes prior

to the purchase of the remaining 49 percent of Paradise. This adjustment was recorded to additional paid-in capital as a result of

the June 2, 2009 purchase of the remainder of Paradise.