Panera Bread 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

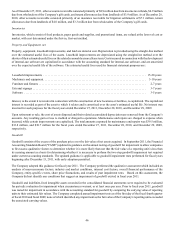

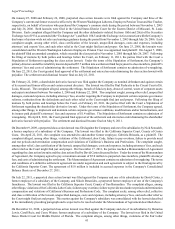

October 19, 2012, with any remaining holdback amounts reverting to the prior franchisee. As a result of this acquisition, the

Company gained control of 25 bakery-cafes and expanded Company-owned operations into Wisconsin. The Consolidated

Statements of Operations include the results of operations from the operating bakery-cafes from the date of the acquisition.

The acquired business contributed revenues of $42.4 million and net income of approximately $0.7 million for the period from

April 20, 2011 through December 27, 2011. The following supplemental pro forma information has been prepared for comparative

purposes and does not purport to be indicative of what would have occurred had the acquisition been made on December 30, 2009,

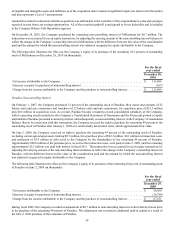

nor are they indicative of any future results (in thousands):

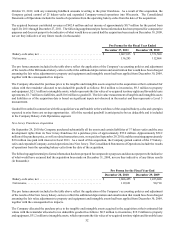

Bakery-cafe sales, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Net income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Pro Forma for the Fiscal Year Ended

December 27, 2011

$ 1,607,633

136,243

December 28, 2010

$ 1,371,500

112,864

The pro forma amounts included in the table above reflect the application of the Company’s accounting policies and adjustment

of the results of the Milwaukee bakery-cafes to reflect the additional depreciation and amortization that would have been charged

assuming the fair value adjustments to property and equipment and intangible assets had been applied from December 30, 2009,

together with the consequential tax impacts.

The Company allocated the purchase price to the tangible and intangible assets acquired in the acquisition at their estimated fair

values with the remainder allocated to tax deductible goodwill as follows: $0.4 million to inventories, $9.3 million to property

and equipment, $23.3 million to intangible assets, which represents the fair value of re-acquired territory rights and favorable lease

agreements, $1.7 million to liabilities, and $10.6 million to goodwill. The fair value measurement of tangible and intangible assets

and liabilities as of the acquisition date is based on significant inputs not observed in the market and thus represents a Level 3

measurement.

Goodwill recorded in connection with this acquisition was attributable to the workforce of the acquired bakery-cafes and synergies

expected to arise from cost savings opportunities. All of the recorded goodwill is anticipated to be tax deductible and is included

in the Company Bakery-Cafe Operations segment.

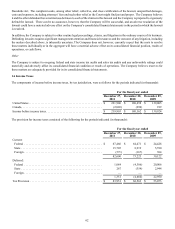

New Jersey Franchisee Acquisition

On September 29, 2010 the Company purchased substantially all the assets and certain liabilities of 37 bakery-cafes and the area

development rights from its New Jersey franchisee for a purchase price of approximately $55.0 million. Approximately $52.2

million of the purchase price, as well as related transaction costs, were paid on September 29, 2010, and the remaining approximately

$2.8 million was paid with interest in fiscal 2011. As a result of this acquisition, the Company gained control of the 37 bakery-

cafes and expanded Company-owned operations into New Jersey. The Consolidated Statements of Operations include the results

of operations from the operating bakery-cafes from the date of the acquisition.

The following supplemental pro forma information has been prepared for comparative purposes and does not purport to be indicative

of what would have occurred had the acquisition been made on December 31, 2008, nor are they indicative of any future results

(in thousands):

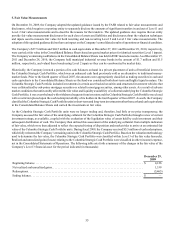

Bakery-cafe sales, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Net income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Pro Forma for the Fiscal Year End

December 28, 2010

$ 1,606,455

119,621

December 29, 2009

$ 1,433,686

90,710

The pro forma amounts included in the table above reflect the application of the Company’s accounting policies and adjustment

of the results of the New Jersey bakery-cafes to reflect the additional depreciation and amortization that would have been charged

assuming the fair value adjustments to property and equipment and intangible assets had been applied from December 30, 2009,

together with the consequential tax impacts.

The Company allocated the purchase price to the tangible and intangible assets acquired in the acquisition at their estimated fair

values with the remainder allocated to tax deductible goodwill as follows: $0.5 million to inventories, $19.9 million to property

and equipment, $31.2 million to intangible assets, which represents the fair value of re-acquired territory rights and favorable lease