Panera Bread 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

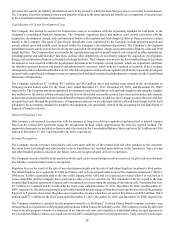

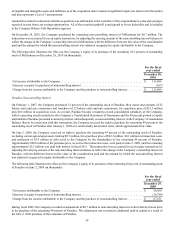

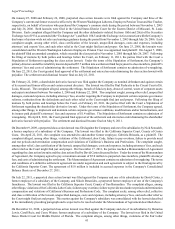

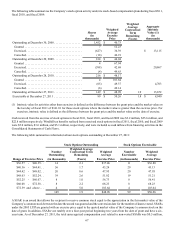

10. Accrued Expenses

Accrued expenses consisted of the following (in thousands):

Unredeemed gift cards, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Compensation and related employment taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Insurance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Capital expenditures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Taxes, other than income tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Fresh dough and other product operations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Rent . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Loyalty program . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Litigation settlement (Note 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Utilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Deferred acquisition purchase price . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Deferred revenue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

December 27,

2011

$ 58,321

41,491

23,629

19,116

18,512

7,101

5,958

5,916

5,334

5,000

4,170

2,565

2,236

23,101

$ 222,450

December 28,

2010

$ 47,716

43,788

20,212

13,057

16,281

5,071

7,084

4,280

9,866

7,125

3,547

5,040

1,962

19,141

$ 204,170

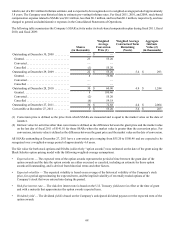

11. Credit Facility

On March 7, 2008, the Company and certain of its direct and indirect subsidiaries, as guarantors, entered into an amended and

restated credit agreement (the “Amended and Restated Credit Agreement”) with Bank of America, N.A., and other lenders party

thereto to amend and restate in its entirety the Company’s Credit Agreement, dated as of November 27, 2007, by and among the

Company, Bank of America, N.A., and the lenders party thereto (the “Original Credit Agreement”). The Amended and Restated

Credit Agreement provides for a secured revolving credit facility of $250.0 million. The borrowings under the Amended and

Restated Credit Agreement bear interest, at the Company’s option at the time each loan is made, at either (a) the Base Rate

determined by reference to the higher of (1) the prime rate of Bank of America, N.A., as administrative agent, or (2) the Federal

Funds Rate plus 0.50 percent, or (b) LIBOR plus an Applicable Rate, ranging from 0.75 percent to 1.50 percent, based on the

Company’s Consolidated Leverage Ratio, as each term is defined in the Amended and Restated Credit Agreement. The Company

also pays commitment fees for the unused portion of the credit facility on a quarterly basis equal to the Applicable Rate for

commitment fees times the actual daily unused commitment for that calendar quarter. The Applicable Rate for commitment fees

is between 0.15 percent and 0.30 percent based on the Company’s Consolidated Leverage Ratio.

The Amended and Restated Credit Agreement includes usual and customary covenants for a credit facility of this type, including

covenants limiting liens, dispositions, fundamental changes, investments, indebtedness, and certain transactions and payments.

In addition, the Amended and Restated Credit Agreement also requires the Company satisfy two financial covenants at the end of

each fiscal quarter for the previous four consecutive fiscal quarters: (1) a consolidated leverage ratio less than or equal to 3.25 to

1.00, and (2) a consolidated fixed charge coverage ratio of greater than or equal to 2.00 to 1.00. The credit facility, which is

collateralized by the capital stock of the Company’s present and future material subsidiaries, will become due on March 7, 2013,

subject to acceleration upon certain specified events of default, including breaches of representations or covenants, failure to pay

other material indebtedness or a change of control of the Company, as defined in the Amended and Restated Credit Agreement.

The Amended and Restated Credit Agreement allows the Company from time to time to request that the credit facility be further

increased by an amount not to exceed, in the aggregate, $150.0 million, subject to receipt of lender commitments and other

conditions precedent. The Company has not exercised these requests for increases in available borrowings as of December 27,

2011. The proceeds from the credit facility will be used for general corporate purposes, including working capital, capital

expenditures, permitted acquisitions, and share repurchases.