Panera Bread 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38

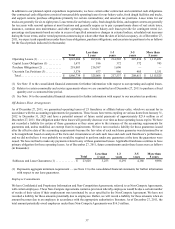

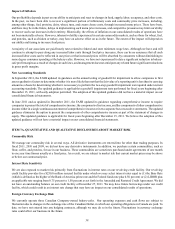

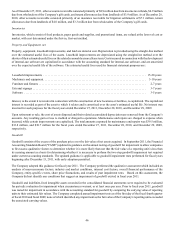

Impact of Inflation

Our profitability depends in part on our ability to anticipate and react to changes in food, supply, labor, occupancy, and other costs.

In the past, we have been able to recover a significant portion of inflationary costs and commodity price increases, including,

among other things, fuel, proteins, dairy, wheat, tuna, and cream cheese costs, through increased menu prices. There have been,

and there may be in the future, delays in implementing such menu price increases, and competitive pressures may limit our ability

to recover such cost increases in their entirety. Historically, the effects of inflation on our consolidated results of operations have

not been materially adverse. However, inherent volatility experienced in certain commodity markets, such as those for wheat, fuel,

and proteins, such as chicken or turkey, may have an adverse effect on us in the future. The extent of the impact will depend on

our ability and timing to increase food prices.

A majority of our associates are paid hourly rates related to federal and state minimum wage laws. Although we have and will

continue to attempt to pass along any increased labor costs through food price increases, there can be no assurance that all such

increased labor costs can be reflected in our prices or that increased prices will be absorbed by consumers without diminishing to

some degree consumer spending at the bakery-cafes. However, we have not experienced to date a significant reduction in bakery-

cafe profit margins as a result of changes in such laws, and management does not anticipate any related future significant reductions

in gross profit margins.

New Accounting Standards

In September 2011, the FASB updated its guidance on the annual testing of goodwill for impairment to allow companies to first

assess qualitative factors to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying

amount as a basis for determining whether it is necessary to perform the two-step goodwill impairment test required under current

accounting standards. The updated guidance is applicable to goodwill impairment tests performed for fiscal years beginning after

December 15, 2011, with early adoption permitted. The adoption of this updated guidance did not have a material impact on our

consolidated financial statements.

In June 2011 and as updated in December 2011, the FASB updated its guidance regarding comprehensive income to require

companies to present the total of comprehensive income, the components of net income, and the components of other comprehensive

income either in a single continuous statement of comprehensive income or in two separate but consecutive statements. The updated

guidance eliminates the option to present the components of other comprehensive income as part of the statement of changes in

equity. This updated guidance is applicable for fiscal years beginning after December 15, 2011. We believe the adoption of this

updated guidance will not have a material impact on our consolidated financial statements.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Commodity Risk

We manage our commodity risk in several ways. All derivative instruments are entered into for other than trading purposes. In

fiscal 2011, 2010 and 2009, we did not have any derivative instruments. In addition, we purchase certain commodities, such as

flour, coffee, and proteins, for use in our business. These commodities are sometimes purchased under agreements of one month

to one year time frames usually at a fixed price. As a result, we are subject to market risk that current market prices may be above

or below our contractual price.

Interest Rate Sensitivity

We are also exposed to market risk primarily from fluctuations in interest rates on our revolving credit facility. Our revolving

credit facility provides for a $250.0 million secured facility under which we may select interest rates equal to (1) the Base Rate

(which is defined as the higher of the Bank of America prime rate and the Federal funds rate plus 0.50 percent) or (2) LIBOR plus

an applicable rate ranging from 0.75 percent to 1.50 percent as set forth in the Amended and Restated Credit Agreement. We did

not have an outstanding balance on our credit facility at December 27, 2011. We may have future borrowings under our credit

facility, which could result in an interest rate change that may have an impact on our consolidated results of operations.

Foreign Currency Exchange Risk

We currently operate three Canadian Company-owned bakery-cafes. Our operating expenses and cash flows are subject to

fluctuation due to changes in the exchange rate of the Canadian Dollar, in which our operating obligations in Canada are paid. To

date, we have not entered into any hedging contracts, although we may do so in the future. Fluctuations in currency exchange

rates could affect our business in the future.