Panera Bread 2011 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2011 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

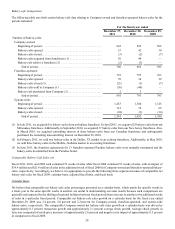

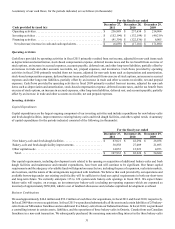

Share Repurchases

On November 17, 2009, our Board of Directors approved a three year share repurchase authorization of up to $600.0 million of

our Class A common stock, pursuant to which share repurchases may be effected from time to time on the open market or in

privately negotiated transactions and which may be made under a Rule 10b5-1 plan. Repurchased shares may be retired immediately

and will resume the status of authorized but unissued shares or they may be held by us as treasury stock. The repurchase authorization

may be modified, suspended, or discontinued by our Board of Directors at any time. Under the share repurchase authorization,

we repurchased a total of 877,100 shares of our Class A common stock at a weighted-average price of $103.55 per share for an

aggregate purchase price of $90.8 million in fiscal 2011. During fiscal 2010, we repurchased a total of 1,905,540 shares of our

Class A common stock at a weighted-average price of $78.72 per share for an aggregate purchase price of $150.0 million. During

fiscal 2009, we repurchased a total of 27,429 shares of our Class A common stock at a weighted-average price of $62.98 per share

for an aggregate purchase price of $1.7 million. As of the date of this report, under the share repurchase authorization, we repurchased

a total of 2,810,069 shares of our Class A common stock at a weighted-average price of $86.33 per share for an aggregate purchase

price of approximately $242.6 million. We have approximately $357.4 million available under the existing $600.0 million

repurchase authorization.

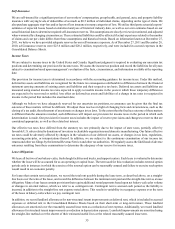

We have historically repurchased shares of our Class A common stock through a share repurchase authorization approved by our

Board of Directors from participants of the Panera Bread 1992 Stock Incentive Plan and the Panera Bread 2006 Stock Incentive

Plan, as amended, or collectively, the Plans. Repurchased shares are netted and surrendered as payment for applicable tax

withholding on the vesting of participants’ restricted stock. During fiscal 2011, we repurchased 52,146 shares of Class A common

stock surrendered by participants of the Plans at a weighted-average price of $109.33 per share for an aggregate purchase price

of approximately $5.7 million pursuant to the terms of the Plans and the applicable award agreements. During fiscal 2010, we

repurchased 44,002 shares of Class A common stock surrendered by participants of the Plans at a weighted-average price of $77.99

per share for an aggregate purchase price of $3.5 million pursuant to the terms of the Plans and the applicable award agreements.

During fiscal 2009, we repurchased 32,135 shares of Class A common stock surrendered by participants in the Plans at a weighted-

average price of $53.66 per share for an aggregate purchase price of $1.7 million pursuant to the terms of the Plans and the

applicable award agreements.

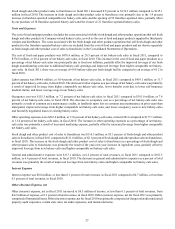

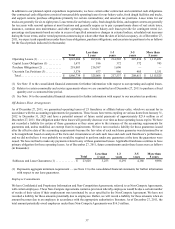

Credit Facility

On March 7, 2008, we and certain of our direct and indirect subsidiaries, as guarantors, entered into an amended and restated

credit agreement, referred to as the Amended and Restated Credit Agreement, with Bank of America, N.A., and other lenders party

thereto to amend and restate in its entirety our Credit Agreement, dated as of November 27, 2007, by and among us, Bank of

America, N.A., and the lenders party thereto, referred to as the Original Credit Agreement. Pursuant to our request under the terms

of the Original Credit Agreement, the Amended and Restated Credit Agreement increased the size of our secured revolving credit

facility from $75.0 million to $250.0 million. We may select interest rates equal to (a) the Base Rate (which is defined as the higher

of Bank of America prime rate and the Federal Funds Rate plus 0.50 percent), or (b) LIBOR plus an Applicable Rate, ranging

from 0.75 percent to 1.50 percent, based on our Consolidated Leverage Ratio, as each term is defined in the Amended and Restated

Credit Agreement. The Amended and Restated Credit Agreement allows us from time to time to request that the credit facility be

further increased by an amount not to exceed, in the aggregate, $150.0 million, subject to receipt of lender commitments and other

conditions precedent. The Amended and Restated Credit Agreement contains financial covenants that, among other things, require

the maintenance of certain leverage and fixed charges coverage ratios. The credit facility, which is secured by the capital stock of

our present and future material subsidiaries, will become due on March 7, 2013, subject to acceleration upon certain specified

events of defaults, including breaches of representations or covenants, failure to pay other material indebtedness or a change of

control of our Company, as defined in the Amended and Restated Credit Agreement. The proceeds from the credit facility will be

used for general corporate purposes, including working capital, capital expenditures, permitted acquisitions, and share repurchases.

As of December 27, 2011 and December 28, 2010, we had no balance outstanding and was in compliance with all covenants under

the Amended and Restated Credit Agreement.

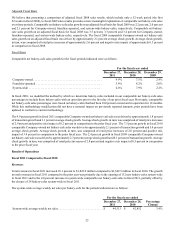

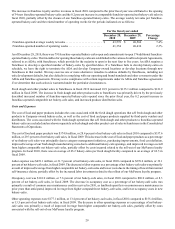

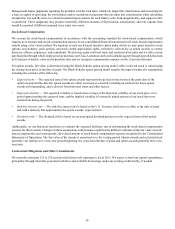

Critical Accounting Policies & Estimates

Our discussion and analysis of our consolidated financial condition and results of operations is based upon the consolidated

financial statements and notes to the consolidated financial statements, which have been prepared in accordance with GAAP. The

preparation of the consolidated financial statements requires us to make estimates, judgments and assumptions, which we believe

to be reasonable, based on the information available. These estimates and assumptions affect the reported amounts of assets,

liabilities, revenues and expenses, and related disclosures of contingent assets and liabilities. Variances in the estimates or

assumptions used to actual experience could yield materially different accounting results. On an ongoing basis, we evaluate the

continued appropriateness of our accounting policies and resulting estimates to make adjustments we consider appropriate under

the facts and circumstances.