North Face 2015 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2015 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VF CORPORATION

Notes to Consolidated Financial Statements

December 2015

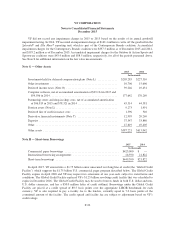

The Global Credit Facility contains certain restrictive covenants, which include maintenance of a

consolidated indebtedness to consolidated capitalization ratio, as defined therein, equal to or below 60%. If VF

fails in the performance of any covenants, the lenders may terminate their obligation to make advances and

declare any outstanding obligations to be immediately due and payable. At the end of 2015, VF was in

compliance with all covenants.

VF has a commercial paper program that allows for borrowings of up to $1.75 billion to the extent that it has

borrowing capacity under the Global Credit Facility. As of December 2015 and 2014, outstanding commercial

paper borrowings totaled $423.0 million and $0, respectively. The Global Credit Facility also had $17.3 million

of outstanding standby letters of credit issued on behalf of VF, leaving $1,309.7 million available for borrowing

against this facility as of December 2015.

VF has $110.1 million of international lines of credit with various banks, which are uncommitted and may

be terminated at any time by either VF or the banks. Borrowings under these arrangements had a weighted

average interest rate of 6.0% and 5.3% at December 2015 and 2014, respectively, excluding accepted letters of

credit which are non-interest bearing to VF. Total outstanding balances under these arrangements were

$26.6 million and $21.8 million at December 2015 and 2014, respectively.

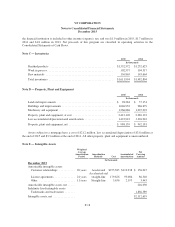

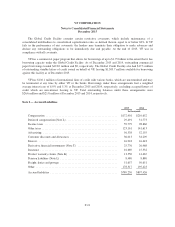

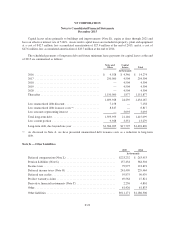

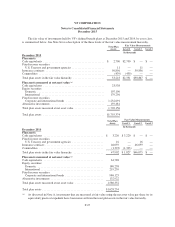

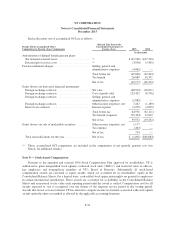

Note I — Accrued Liabilities

2015 2014

In thousands

Compensation .................................................. $172,901 $210,652

Deferred compensation (Note L) .................................... 29,491 31,773

Income taxes ................................................... 59,779 98,860

Other taxes ..................................................... 123,161 141,613

Advertising .................................................... 56,338 52,155

Customer discounts and allowances ................................. 36,013 34,209

Interest ........................................................ 16,918 16,443

Derivative financial instruments (Note T) ............................ 25,776 26,968

Insurance ...................................................... 16,669 15,332

Product warranty claims (Note K) .................................. 13,550 14,467

Pension liabilities (Note L) ........................................ 8,480 8,880

Freight, duties and postage ........................................ 51,657 50,651

Other ......................................................... 178,517 195,423

Accrued liabilities ............................................... $789,250 $897,426

F-21