North Face 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VF CORPORATION

Notes to Consolidated Financial Statements

December 2015

Concentration of Risks

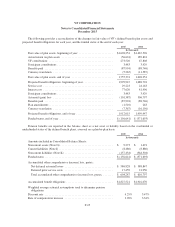

VF markets products to a broad customer base throughout the world. Products are sold at a range of price

points through multiple wholesale and direct-to-consumer channels. VF’s ten largest customers, all U.S.-based

retailers, accounted for 22% of 2015 total revenues, and sales to VF’s largest customer accounted for 8% of 2015

total revenues. Sales are generally made on an unsecured basis under customary terms that may vary by product,

channel of distribution or geographic region. VF continuously monitors the creditworthiness of its customers and

has established internal policies regarding customer credit limits. The breadth of product offerings, combined

with the large number and geographic diversity of its customers, limits VF’s concentration of risks.

Legal and Other Contingencies

Management periodically assesses liabilities and contingencies in connection with legal proceedings and

other claims that may arise from time to time. When it is probable that a loss has been or will be incurred, an

estimate of the loss is recorded in the consolidated financial statements. Estimates of losses are adjusted when

additional information becomes available or circumstances change. A contingent liability is disclosed when there

is at least a reasonable possibility that a material loss may have been incurred. Management believes that the

outcome of any outstanding or pending matters, individually and in the aggregate, will not have a material

adverse effect on the consolidated financial statements.

Reclassifications

Certain prior year amounts have been reclassified to conform with the 2015 presentation, as discussed below

in Recently Adopted Accounting Standards.

Recently Adopted Accounting Standards

In April 2014, the Financial Accounting Standards Board (“FASB”) changed the definition and disclosure

requirements for discontinued operations. This guidance became effective in the first quarter of 2015, but did not

have an impact on VF’s consolidated financial statements.

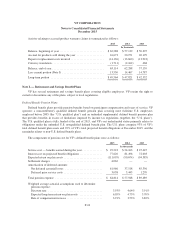

In April 2015, the FASB issued an update to their accounting guidance related to retirement benefits that

provides a practical expedient permitting companies to measure defined benefit plan assets and obligations using

the month-end that is closest to an entity’s fiscal year-end. The Company early adopted this guidance as of

December 2015, and measured plan assets and obligations as of December 31, 2015. This change in

measurement date did not have a significant impact on VF’s consolidated financial statements.

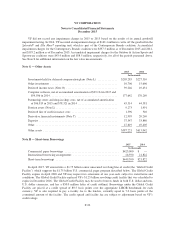

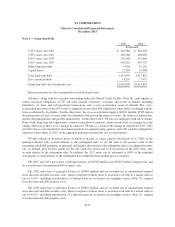

In April 2015, the FASB issued an update to their accounting guidance related to debt issuance costs. The

guidance requires that debt issuance costs related to a recognized debt liability be presented in the balance sheet

as a direct deduction from the carrying amount of that debt liability, consistent with the presentation of debt

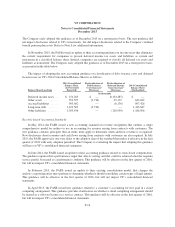

discounts. The Company early adopted this guidance as of December 2015 on a retrospective basis, as presented

in the table below.

In May 2015, the FASB issued an update to their accounting guidance related to fair value measurements.

The guidance removes the requirement to categorize within the fair value hierarchy all investments for which fair

value is measured using the net asset value per share practical expedient, and requires separate disclosure instead.

F-15