North Face 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VF CORPORATION

Notes to Consolidated Financial Statements

December 2015

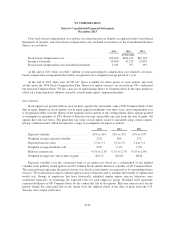

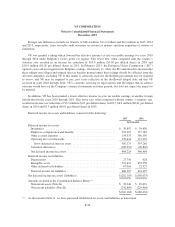

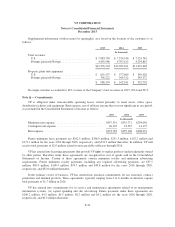

Foreign rate differences include tax benefits of $28.4 million, $11.2 million and $6.9 million in 2015, 2014

and 2013, respectively, from favorable audit outcomes on certain tax matters and from expiration of statutes of

limitations.

VF was granted a ruling which lowered the effective income tax rate on taxable earnings for years 2010

through 2014 under Belgium’s excess profit tax regime. This lower rate, when compared with the country’s

statutory rate, resulted in an income tax reduction of $14.9 million ($0.03 per diluted share) in 2014 and

$10.4 million ($0.02 per diluted share) in 2013. In February 2015, the European Union Commission (“EU”)

opened a state aid investigation into Belgium’s rulings. On January 11, 2016, the EU announced its decision that

these rulings were illegal and ordered that tax benefits granted under these rulings should be collected from the

affected companies, including VF. If this matter is adversely resolved, the Belgian government may be required

to assess, and VF may be required to pay, past taxes reflective of the disallowed alleged state aid that VF

received in years 2010 through 2014. VF is currently assessing its legal options and the impact that an adverse

outcome would have on the Company’s financial statements in future periods, but does not expect the impact to

be material.

In addition, VF has been granted a lower effective income tax rate on taxable earnings in another foreign

jurisdiction for the years 2010 through 2019. This lower rate, when compared with the country’s statutory rate,

resulted in income tax reductions of $3.2 million ($.01 per diluted share) in 2015, $6.0 million ($0.01 per diluted

share) in 2014 and $3.3 million ($0.01 per diluted share) in 2013.

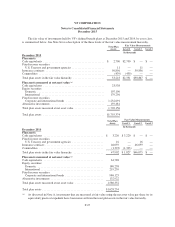

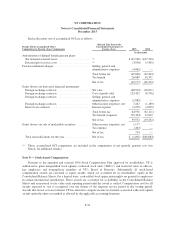

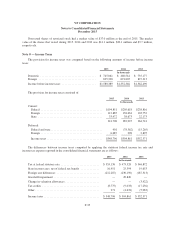

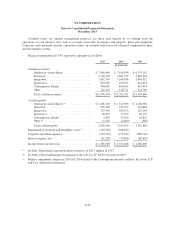

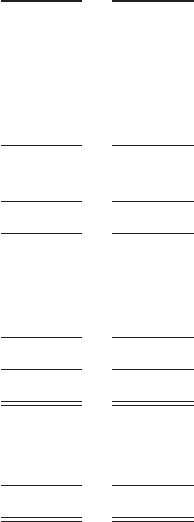

Deferred income tax assets and liabilities consisted of the following:

2015 2014

In thousands

Deferred income tax assets:

Inventories ................................................. $ 38,897 $ 34,430

Employee compensation and benefits ............................ 252,307 257,187

Other accrued expenses ....................................... 154,337 186,390

Operating loss carryforwards ................................... 139,634 115,259

Gross deferred income tax assets .............................. 585,175 593,266

Valuation allowances ......................................... (100,951) (96,802)

Net deferred income tax assets .................................. 484,224 496,464

Deferred income tax liabilities:

Depreciation ................................................ 27,756 624

Intangible assets ............................................. 591,615 652,950

Other deferred tax liabilities .................................... 67,016 22,923

Deferred income tax liabilities .................................. 686,387 676,497

Net deferred income tax assets (liabilities) .......................... $(202,163) $(180,033)

Amounts included in the Consolidated Balance Sheets (a):

Noncurrent assets (Note G) .................................... $ 39,246 $ 49,431

Noncurrent liabilities (Note K) .................................. (241,409) (229,464)

$(202,163) $(180,033)

(a) As discussed in Note A , we have presented all deferred tax assets and liabilities as noncurrent.

F-36