North Face 2015 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2015 North Face annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

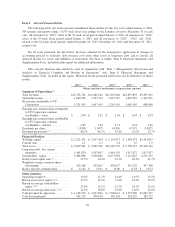

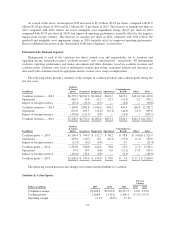

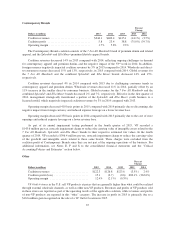

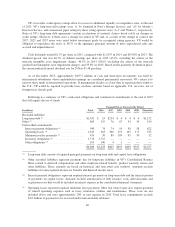

Contemporary Brands

Percent

Change

Dollars in millions 2015 2014 2013 2015 2014

Coalition revenues ............................ $344.1 $400.4 $415.1 (14.1%) (3.5%)

Coalition profit .............................. 5.8 23.4 38.8 (75.0%) (39.7%)

Operating margin ............................. 1.7% 5.8% 9.3%

The Contemporary Brands coalition consists of the 7 For All Mankind®brand of premium denim and related

apparel, and the Splendid®and Ella Moss®premium lifestyle apparel brands.

Coalition revenues decreased 14% in 2015 compared with 2014, reflecting ongoing challenges in demand

for contemporary apparel and premium denim, and the negative impact of the 53rd week in 2014. In addition,

foreign currency negatively impacted coalition revenues by 3% in 2015 compared to 2014. Wholesale and direct-

to-consumer revenues decreased 15% and 13%, respectively, in 2015 compared with 2014. Global revenues for

the 7 For All Mankind®and the combined Splendid®and Ella Moss®brands decreased 14% and 15%,

respectively.

Coalition revenues decreased 4% in 2014 compared with 2013 due to challenging consumer trends in

contemporary apparel and premium denim. Wholesale revenues decreased 11% in 2014, partially offset by an

11% increase in the smaller direct-to-consumer business. Global revenues for the 7 For All Mankind®and the

combined Splendid®and Ella Moss®brands decreased 2% and 7%, respectively. Effective in the first quarter of

2014, management strategically transitioned a portion of the Splendid®and Ella Moss®youth business to a

licensed model, which negatively impacted coalition revenues by 3% in 2014 compared with 2013.

Operating margin decreased 410 basis points in 2015 compared with 2014 primarily due to discounting, the

negative impact from foreign currency and reduced expense leverage on a lower revenue base.

Operating margin decreased 350 basis points in 2014 compared with 2013 primarily due to the cost of store

openings and reduced expense leverage on a lower revenue base.

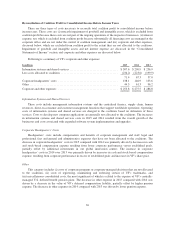

As part of its annual impairment testing performed in the fourth quarter of 2015, VF recorded a

$143.6 million pre-tax, noncash impairment charge to reduce the carrying value of intangible assets related to the

7 For All Mankind®,Splendid®and Ella Moss®brands to their respective estimated fair values. In the fourth

quarter of 2014, VF recorded a $396.4 million pre-tax, noncash impairment charge to reduce the carrying value

of the goodwill and intangible assets related to these same brands. These charges were excluded from the

coalition profit of Contemporary Brands since they are not part of the ongoing operations of the business. For

additional information, see Notes E, F and S to the consolidated financial statements and the “Critical

Accounting Policies and Estimates” section below.

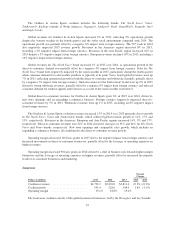

Other

Percent

Change

Dollars in millions 2015 2014 2013 2015 2014

Coalition revenues .......................... $122.3 $126.8 $123.6 (3.5%) 2.4%

Coalition profit (loss) ........................ 15.1 (2.7) (0.6) 682.1% (362.6%)

Operating margin ........................... 12.4% (2.1%) (0.5%)

VF Outlet®stores in the U.S. sell VF products at prices that are generally higher than what could be realized

through external wholesale channels, as well as other non-VF products. Revenues and profits of VF products sold

in these stores are reported as part of the operating results of the applicable coalition, while revenues and profits

of non-VF products are reported in this “other” category. The increase in profit in 2015 is primarily due to a

$16.6 million gain recognized on the sale of a VF Outlet®location in 2015.

35